Products

Our products, developed with the most robust and up-to-date technologies, carry the financial industry into the future!

End-to-end core banking platform that enables all the functions required by banks to operate on a single platform.

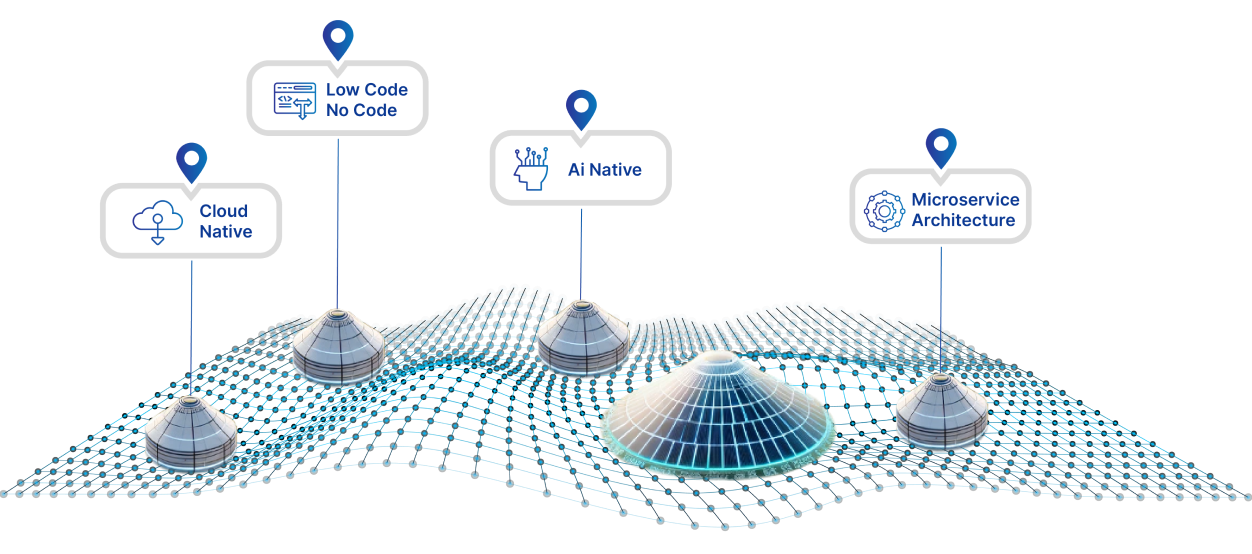

OBA Suite is a cloud-based technology platform built with microservice architecture. This technology platform offers an infrastructure to meet the software development needs of not only banks but also companies in different sectors such as insurance, fintech and telecommunications.

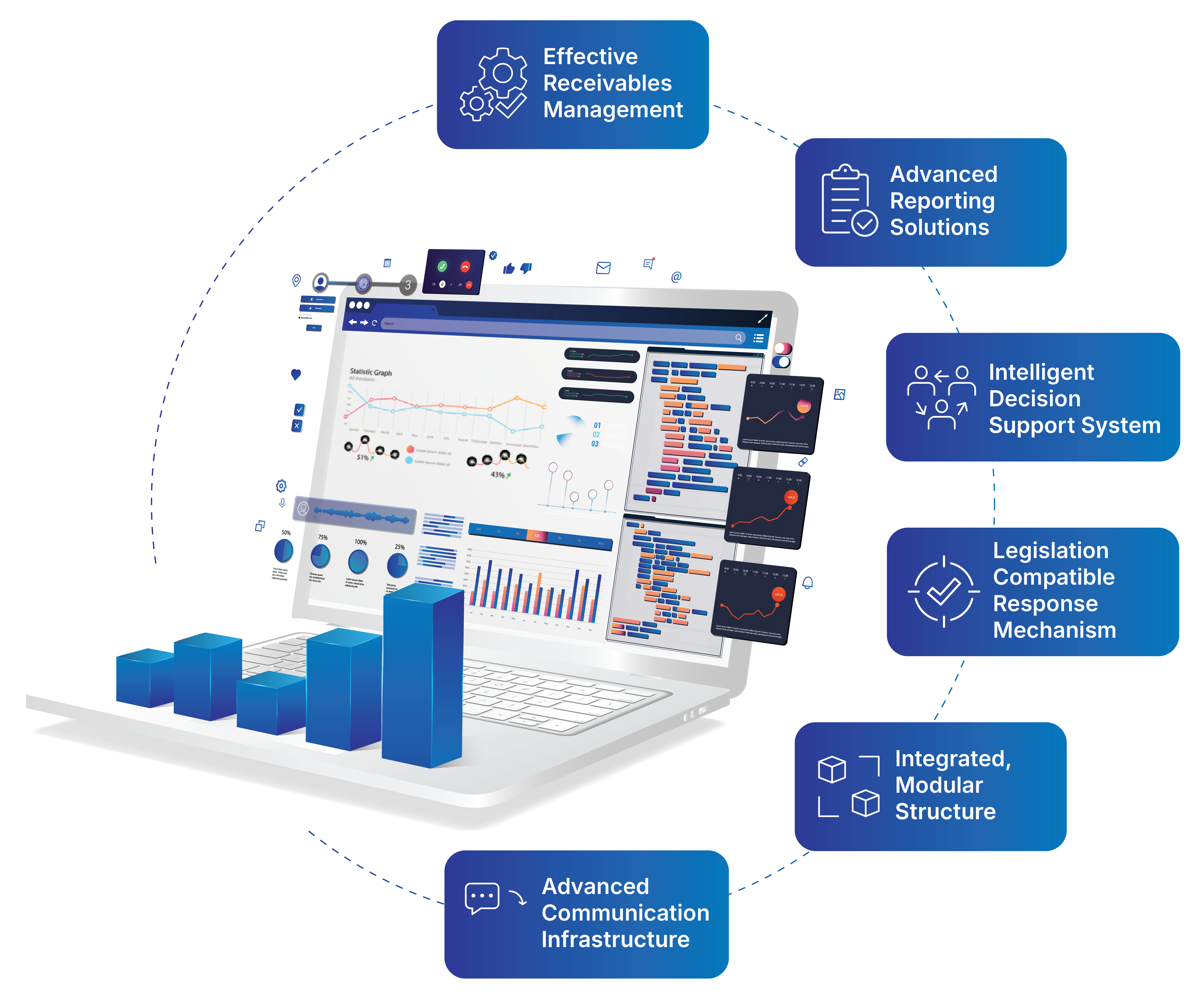

BOA Digital Banking Platform is an easy and scalable innovative solution with a modular architecture designed to perform banking transactions in a fast, secure and user-friendly structure in full compliance with regulations.

BOA Investment Banking Platform offers an end-to-end solution by incorporating all the modules required by investment banks.

BOA Consumer Financing System is a solution that enables organizations to operate all the functions they need in the field of consumer financing on a single platform.

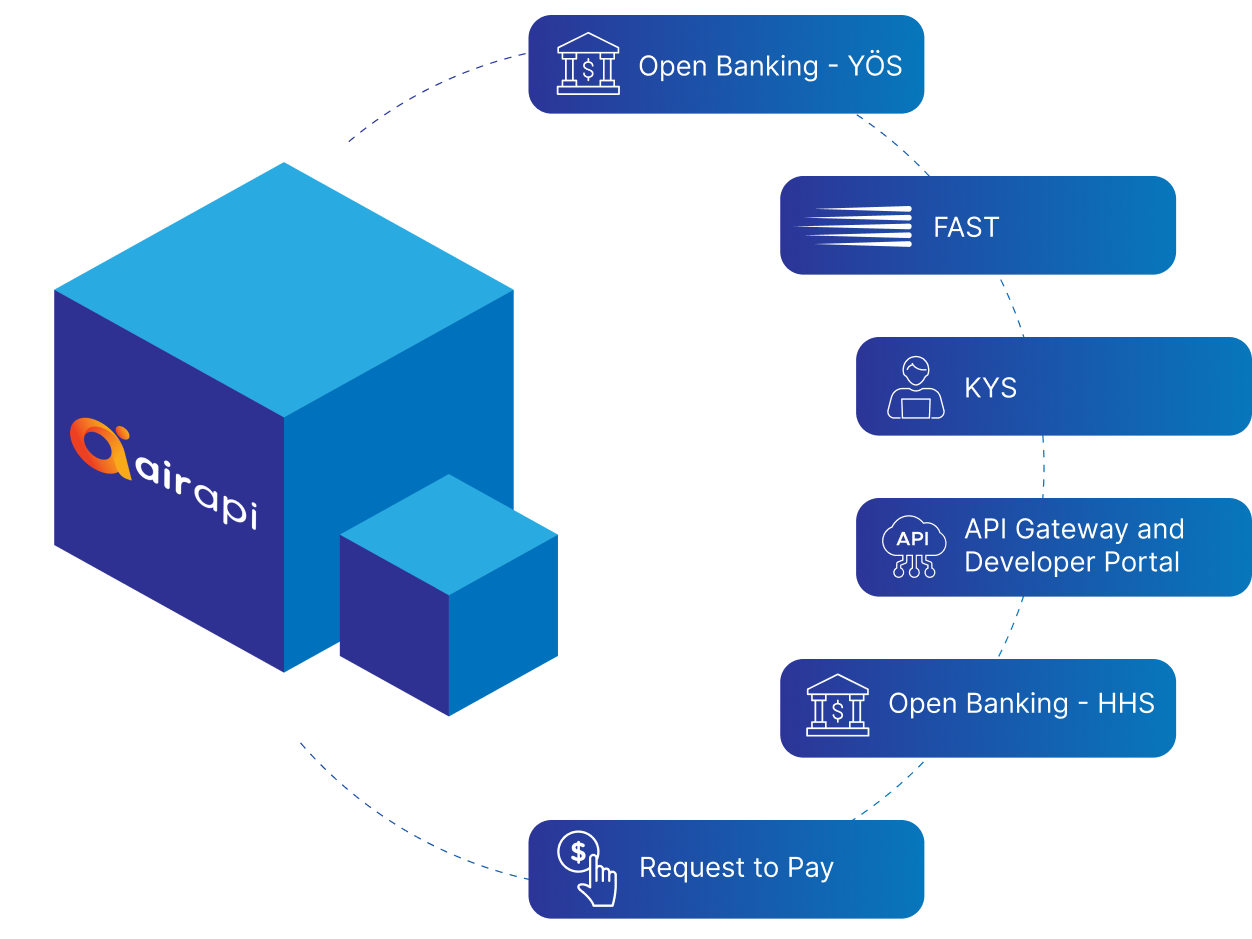

Airapi Open Banking and API Management Platform is a comprehensive and modular solution designed for banks, fintech companies and any organization that wants to open their APIs to the outside world.

PowerFactor offers comprehensive security capabilities with strong authentication, protecting companies and their customers end-to-end while enhancing customer experiences.

BOACard Payment Systems Platform is an innovative infrastructure solution that enables end-to-end management of card payment systems, merchant and POS products on a single platform.

Contact us for detailed information!