Channel

Channel Product Type

Product Type Screens

Screens Reports

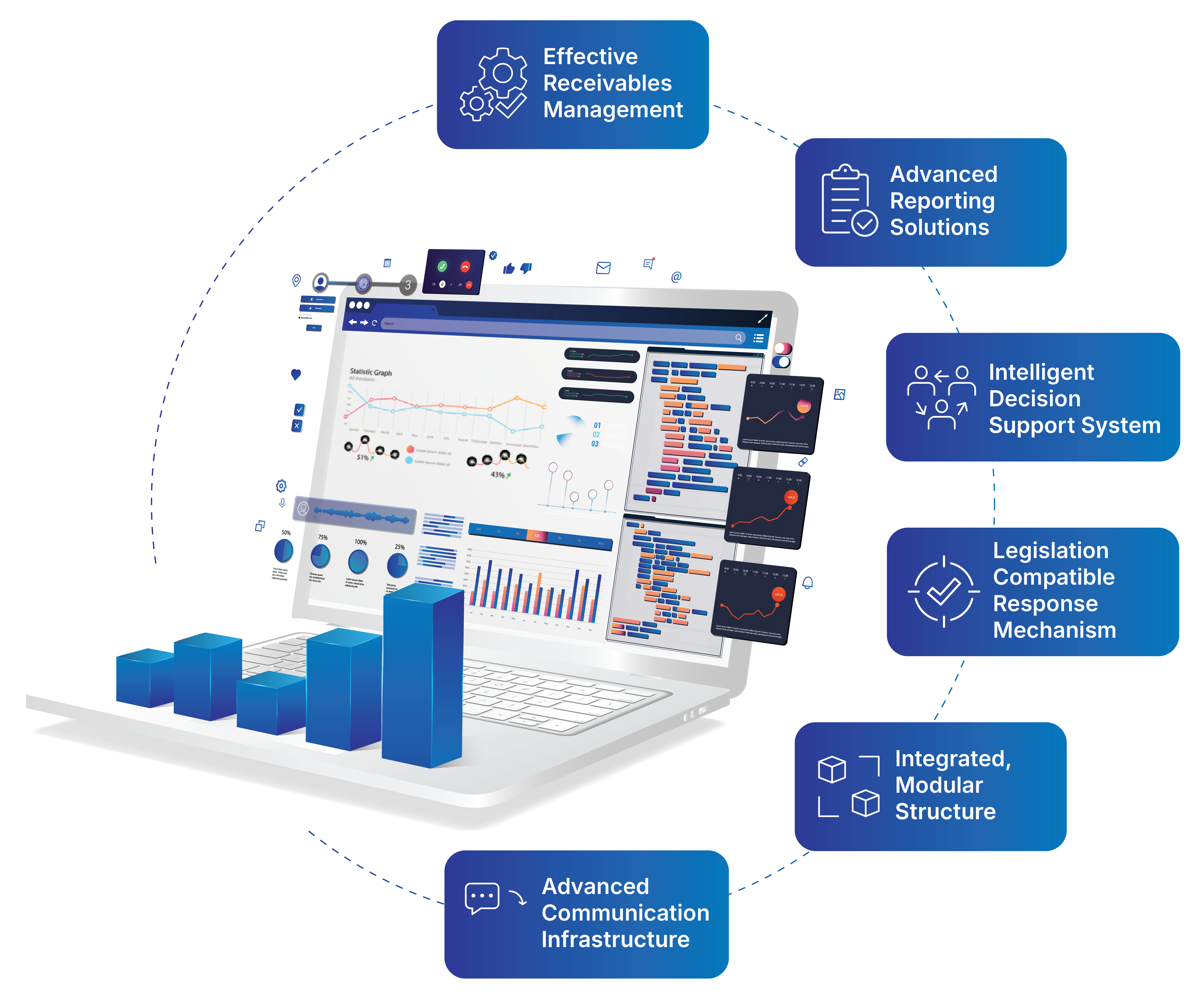

ReportsModules

- Customer Management

- Credit Scoring

- Allocation and Utilization

- Receivables Management

- Legal Follow-up

- Accounting

- Reporting

- Legal Integrations

- Commission and Expense Management

- Business Process Management

- Document Management

- Information Management

-

Automatic Allocation and Application Evaluation Systems

- BOA Consumer Financing System is integrated with Automatic Allocation and Application Evaluation systems. Financing applications are accepted or rejected with intelligent decision support systems, enabling fast allocation

-

Information Infrastructure

- Thanks to the notification infrastructure, SMS, e-mail, fax, notification types can be sent after the necessary situations.

-

Description Based Product Identification

- In the BOA Consumer Financing System; product definition, accounting, pool and price definitions can be made in a parametric manner. Product definitions also provide definition-based limit, collateral, installment options, commission and expense definitions.

-

Regulatory Compliant Provision Mechanism

- The system has parametrically designed provision mechanisms that comply with the legislation but can also use the institution's initiative when necessary.

-

Response Mechanism

- The system has parametrically designed provision mechanisms that comply with the legislation but can also use the institution's initiative when necessary.

-

Automatic Reporting

- Reports can be quickly transferred to the live environment by writing database queries without the need for coding. With the Report Mailer, it is possible to automatically send the desired reports to the selected users at the desired intervals

Contact us for detailed information!