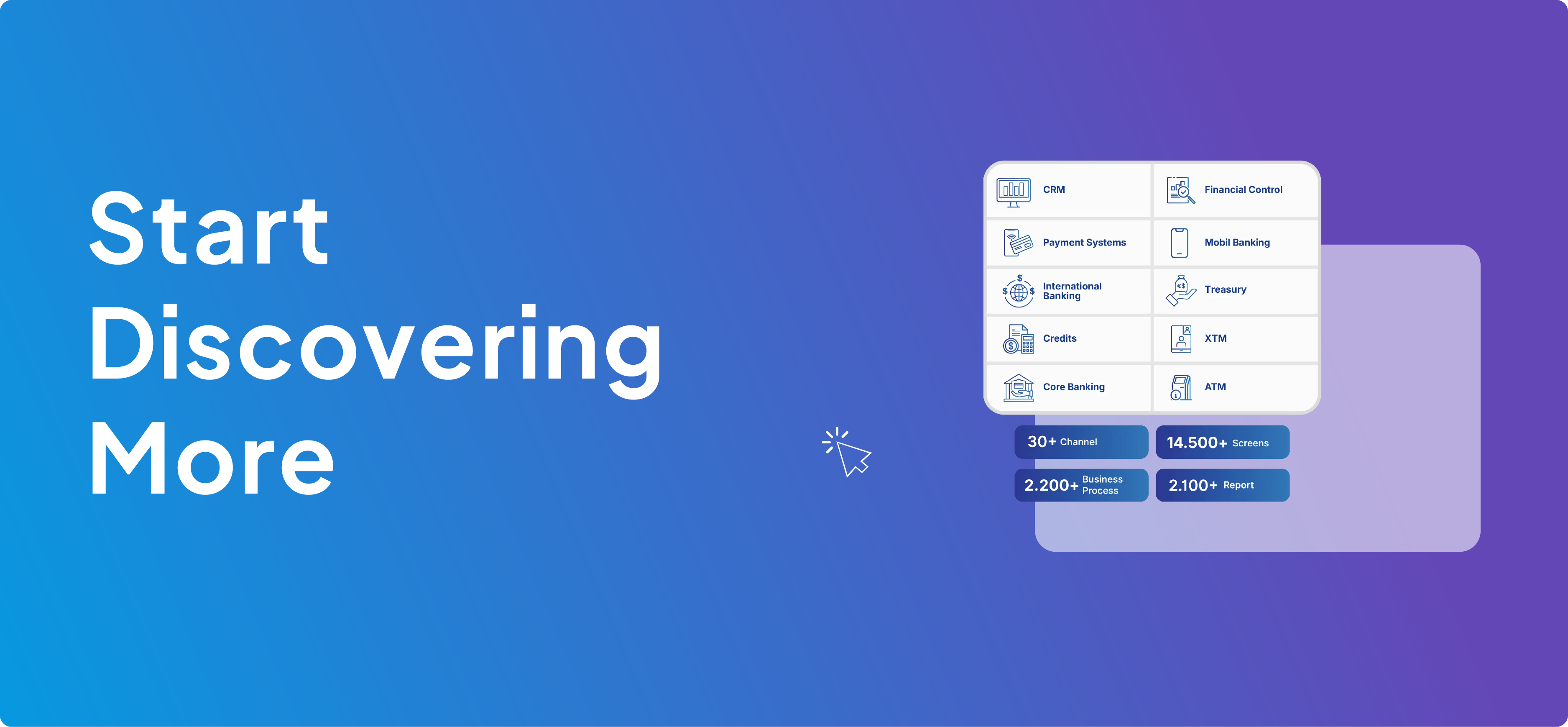

BOA Banking and Technology Platform

A Comprehensive, Stable, Secure, and Up-to-Date Core Banking and Technology Platform

Screens

Screens Reports

ReportsModules

- Core Banking

- Loans

- Treasury

- Foreign Trade

- International Banking

- Payment Systems

- CRM

- Campaign Management

- Financial Control

- Accounting

- Digital Channels

- ATM

- XTM

- Organizational Integrations

- Collection Management

- Human Resources

- Administrative Services

- Purchasing Management

- Call Center

-

CIO/CTO Perspective

- It offers a sustainable platform to banks and financial institutions with its continuously updatable technological infrastructure.

- It protects customers' financial data and transactions at the highest level with its cyber security infrastructure.

- It offers a low total cost of ownership thanks to optimized costs, creating long-term economic value.

-

Employee Perspective

- Individually adaptable with customization based on use.

- Multi-language support enables the employment of foreign staff.

- Provides the ability to run queries and reporting at a basic level.

- Facilitates process follow-up with systematic approval mechanism.

- Guides the use of BOA with help documents.

- Provides the right team communication convenience in information technologies with fast call opening system in case of error.

- Enables the management of all processes on a single platform.

- Facilitates business development processes with low code infrastructure.

-

Customer Perspective

- It offers unique customer experiences with the widest set of functions on digital platforms.

- It provides end-to-end multilingual support from call center to general banking transactions.

- It includes many applications that will increase customer loyalty.

- It provides ease of use with user-friendly interfaces.

-

Software Engineer Perspective

- Offers rapid development with Project Templates

- Offers fast design capability with dynamic screens

- Provides ease and readability with standard code writing

- Provides single point control with centralized management (logging, transaction management, authentication, etc.)

- Allows flexible design with parametric structure

- Minimizes the possibility of error with controlled code migration.

- Pipe structure that can be configured on a channel basis

-

Analyst Perspective

- Offers fast and easy design with definition-based systems (Accounting, Receipt, Commission, Workflow, Central Limit, Service Definition, Dynamic Screen, Report definition).

- Facilitates writing requirements with 5N1K questions

- Allows flexible design with parametric structure

- Facilitates error tracking with automatic calls in case the system receives an error

- Provides quick access to object owners through accountability management

Contact us for detailed information!