Digital KOBİ

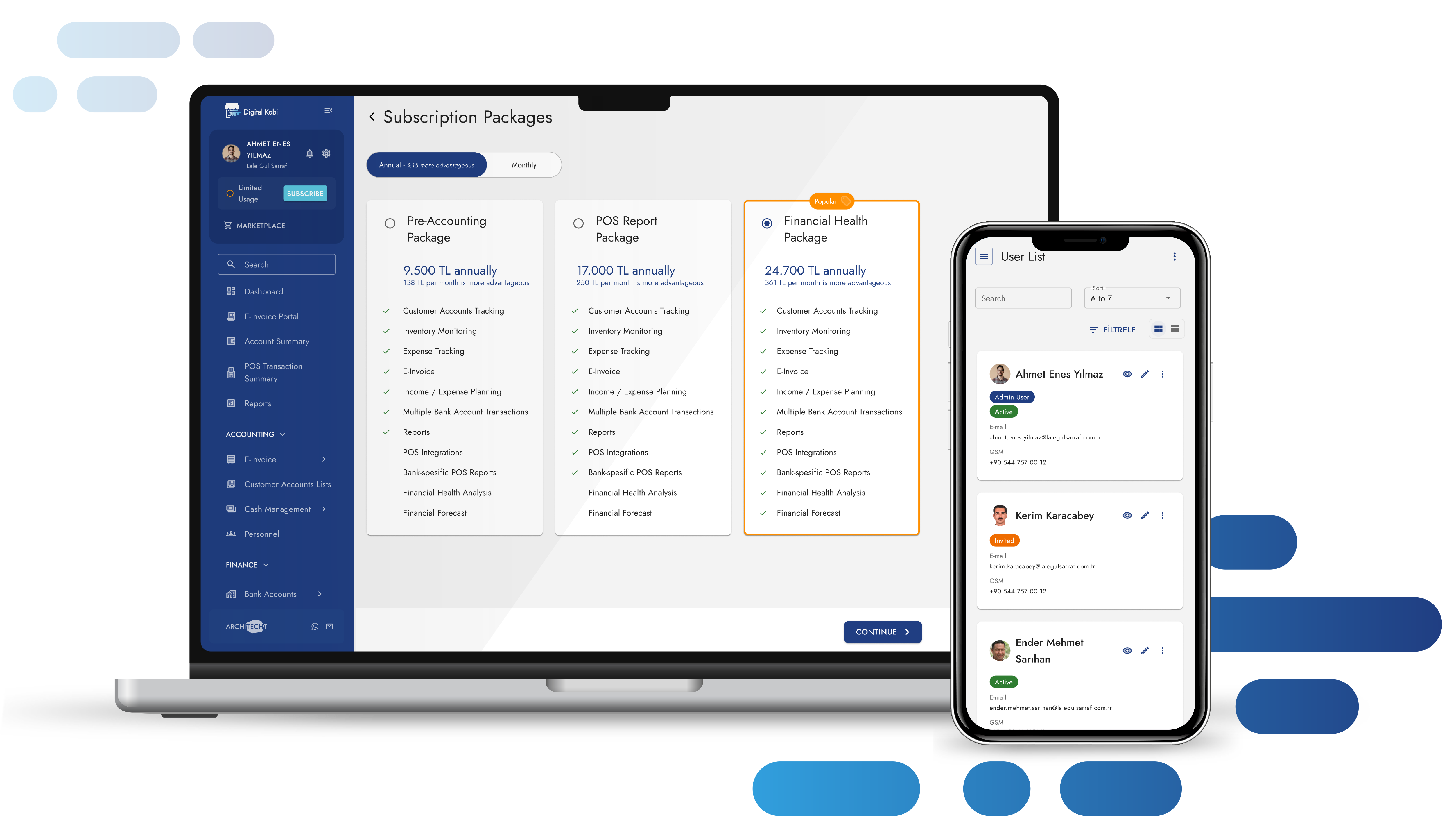

A comprehensive platform that accelerates SMEs' digital transformation processes and optimizes their financial management!

Bank Integration

Bank Integration Product and Service

Product and Service Special Integrator

Special Integrator Collaboration

CollaborationModules

- Customer Account Tracking

- Reports

- E-Commerce Integrations

- Pre-Accounting

- Bank Account Transactions

- Financial Health

- Payroll and Personnel Management

- Chatbot

- POS Integration

- Cash Management

- Marketplace

-

End-to-End Advantages

- Digital KOBİ gathers all bank accounts, checks and promissory notes on a single screen. In this way, it facilitates the cash management of SMEs.

- With e-transformation integrations, it enables e-documents to be prepared and submitted to the appropriate channels.

- Account transactions and invoices are automatically matched with current records in the system, making it possible for SMEs to track their debit/credit relationships in detail. Predictions can be made for the near future based on past payment and collection habits, which helps SMEs see the future with greater clarity.

- Measuring the financial health of SMEs and raising awareness on this issue is within the wide service area of Architecht Digital KOBİ. It offers services such as artificial intelligence-supported forecasting models and creditwothiness scoring.

- It also includes solutions with collaborations in areas such as “Human Resources Management” and “Customer Relationship Management”. All these features contribute to the digital transformation processes in SMEs and provide effective support in terms of insight.

- With e-transformation integrations, it enables businesses to create official documents such as e-invoices and e-archive invoices electronically and submit them to the relevant institutions. This enables businesses to manage their financial transactions more efficiently and error-free.

- The platform enables SMEs to make financial predictions with artificial intelligence-supported analysis. It guides businesses on issues such as stock efficiency, improvements in balance sheet items, investment recommendations and proper management of financing needs.

- It offers the ability to view and manage all POS transactions across all banks (commission definitions, turnover information, daily transactions) from a single platform.

-

Artificial Intelligence Supported Analysis

- Measuring the financial health of SMEs and raising awareness about it is within the broad service area of Digital KOBİ. It offers services such as artificial intelligence-supported forecasting models and creditworthiness scoring.

- The platform enables SMEs to make financial predictions with artificial intelligence-supported analysis. It guides businesses on issues such as stock efficiency, improvements in balance sheet items, investment recommendations and proper management of financing needs.

-

Caters to a Wide Range of Customers

- Digital KOBİ is suitable to be used by SMEs, banks, financial institutions and businesses in various sectors.

- The platform enables businesses to use their time more efficiently by facilitating their financial management processes.

- Ideal for e-commerce sites and physical stores as well.

Contact us for detailed information!