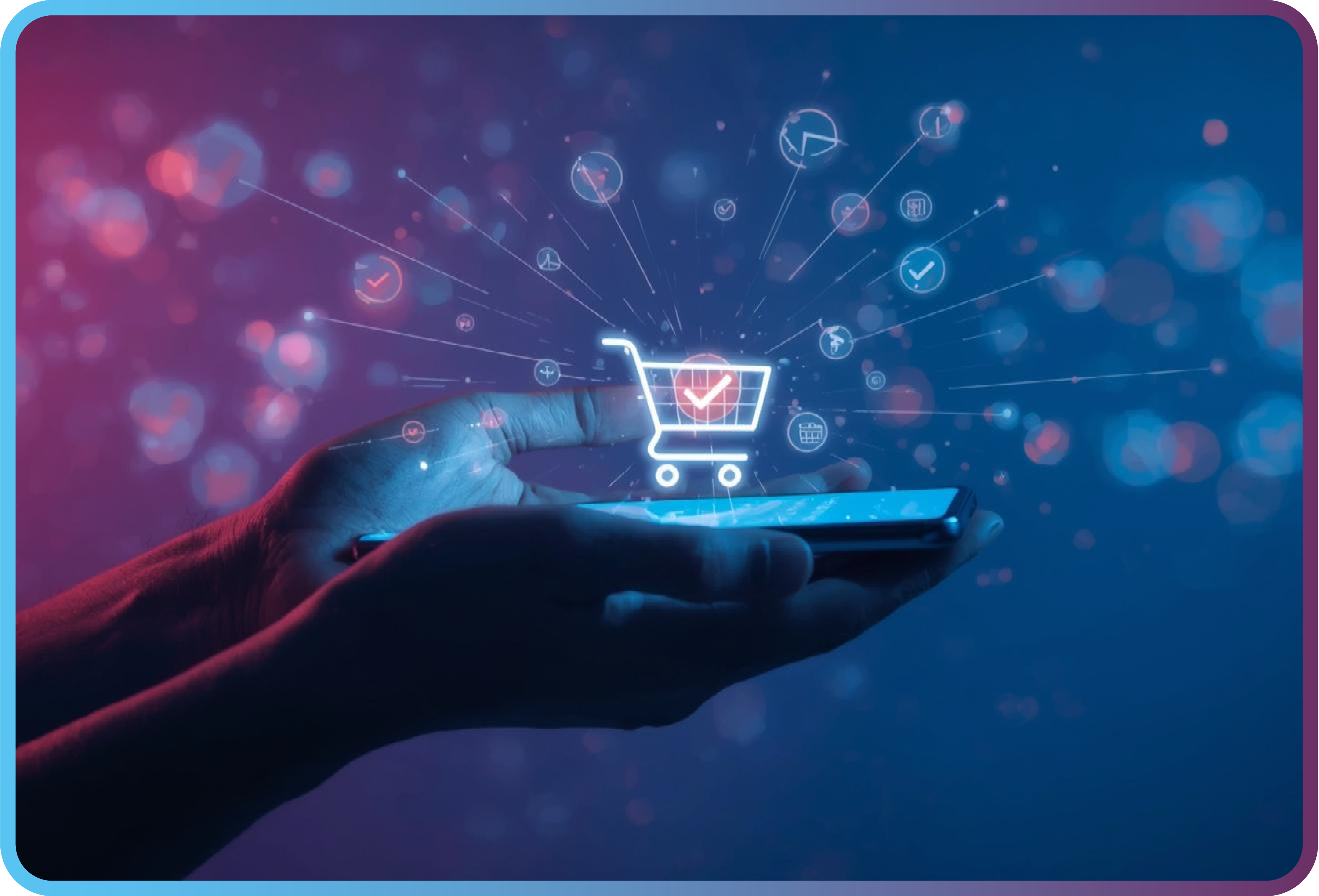

The rapid advancement of technology today is fundamentally changing access to and usage of financial services. Remote account opening refers to the process of opening a bank account or financial service account with a bank or financial institution online or through a mobile application without physically visiting a branch. In this article, we will examine what remote account opening is, how it works, and what it promises for the future.

What is Remote Account Opening?

Remote account opening refers to the process of opening a bank account or financial service account with a bank or financial institution online or through a mobile application without physically visiting a branch. This process offers a faster and more user-friendly option compared to traditional methods.

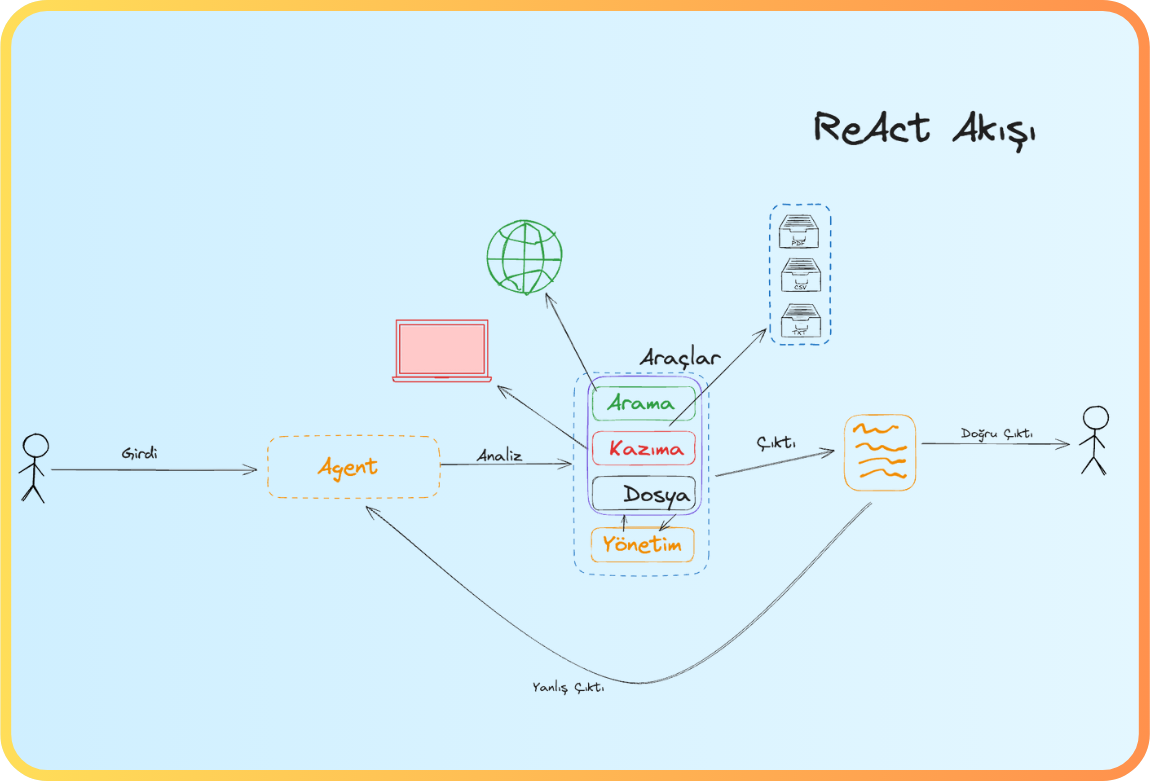

Remote account opening typically involves the following steps:

1. Online Application: You need to fill out an online application form on the bank's official website or mobile application. This form includes personal information, account type, and other required details.

2. Identity Verification: The bank may ask you to submit scans or photos of identification documents (e.g., driver's license, passport, or ID card) to verify your identity. This is important for ensuring the security of your account.

3. Application Review: The bank will review your application. This process may vary from bank to bank and can sometimes take a few business days.

4. Approval and Activation: Once your application is approved, your account becomes active. The bank will provide you with account details and information regarding account usage. Remote account opening enables banks to offer customers more access and convenience. However, security is important, so you should use strong passwords to protect your personal information and conduct transactions through reliable sources. Advantages of Remote Account Opening Remote account opening offers several advantages, providing users with greater convenience and flexibility. Here are the main advantages of remote account opening:

5. More Options: Remote account opening provides access to various account options offered by different banks and financial institutions, increasing your chances of selecting the account that best suits your needs.

6. Convenience of Online Banking: Accounts opened remotely are often integrated into online banking platforms, making it easier to manage and conduct transactions online.

7. Lower Fees: Some banks may offer special promotions to customers opening accounts remotely, which may include lower fees.

8. Ideal for Pandemics and Emergencies: Remote account opening allows for seamless financial transactions, especially during emergencies or travel restrictions such as pandemics.

Table 1. Remote and Branch Customer Acquisition Statistics in the Banks Association of Türkiye 2023-June Report

Security and Privacy Measures

To protect your security and privacy during remote account opening, you can take the following measures:

1. Use Strong Passwords: Use strong, complex, and unique passwords for your accounts. Regularly update your passwords and avoid using the same password for multiple accounts.

2. Two-Factor Authentication (2FA): Use two-factor authentication if available. This means that accessing your account requires not only your password but also a physical device or authentication code.

3. Secure Internet Connection: Conduct account opening processes over a secure internet connection. Prefer using a personal Wi-Fi or mobile data connection over public Wi-Fi networks.

4. Trustworthy Sources: Use your bank's official website or mobile application for account opening. Never click on spam emails or fake websites or share your personal information.

5. Secure Storage of Identity Documents: If you have submitted scanned or photographed identity documents, store them securely. Limit access to your computer or device.

6. Research: Carefully read your bank's security policies and user agreements. Also, inquire about the security measures applied during the account opening process.

7. Use Reliable Antivirus Software: Install reliable antivirus software on your computer or device and keep it updated regularly.

8. Report Suspicious Activities: Immediately report any suspicious access or transactions to your bank or financial institution. Also, regularly monitor your account activity and take prompt action if you notice anything abnormal.

9. Avoid Sharing Personal Information: Your bank or financial institution will never ask you to share your private information (e.g., password or PIN). Avoid sharing such information.

10. Regular Account Checks: Regularly monitor your account activity. Review details such as bill payments, transaction history, and balance regularly and promptly report any anomalies.

These measures will help you protect your security and privacy during remote account opening. Remember that banks and financial institutions typically implement strong security measures for customer information, but it's also important for users to pay attention to their personal security.

Remote Account Opening: How It Shapes the Future?

Remote account opening is significantly transforming the financial sector and could have a substantial impact on how financial services evolve in the future. Here are some key points on how remote account opening could shape the future:

1. Increased Access and Convenience: Remote account opening offers customers easier and faster access to financial services. This enables financial institutions to reach more customers and expand their services.

2. Decline of Traditional Branches: With remote account opening, the number of traditional bank branches may decrease. As customers conduct more transactions online, the need for physical branches may diminish.

3. Digital Identity Verification: In the future, identity verification methods could be further developed. The use of biometric data such as facial recognition, fingerprint scanning, and voice recognition could make identity verification processes more secure and user-friendly.

4. Enhanced Security: Security is a crucial factor during remote account opening and may become even more important in the future. Technologies such as blockchain and smart contracts could make financial transactions more secure and transparent.

5. Regulation and Security Standards: Regulations and security standards related to remote account opening may be strengthened in the future. This would help consumers feel more secure and ensure that financial transactions are safer.

6. Global Services: Remote account opening could work across borders, facilitating international transactions and providing people living in different countries with more access to financial services. It is likely that the financial sector will become more digital, accessible, and secure with remote account opening.

However, it is important to address security and data privacy issues alongside these changes.

SOURCE 1) https://www.kuveytturk.com.tr/subesiz-bankacilik/nasil-musteri-olurum (Last Access Date: 29.10.2023)

2)https://www.kuveytturk.com.tr/musteri-ol-isin-icin (Last Access Date: 29.10.2023)

3) https://testmer.com.tr/iletisim-2/ (Last Access Date: 29.10.2023)

4)https://www.tbb.org.tr/Content/Upload/istatistikiraporlar/ekler/4115/Uzaktan_ve_Subeden_Musteri_Edinimi_Istatistikleri-Haziran_2023.pdf (Last Access Date: 28.10.2023)

5) https://www.aa.com.tr/tr/bilim-teknoloji/siber-guvenlik-liderlerin-ajandasinda/2624325 (Last Access Date: 29.10.2023)

6) https://www.gmt.tc/service/ticari-danismanlik-hizmetleri-13 (Last Access Date: 03.11.2023)

Back

Back