Before embarking on the journey of establishing a new bank, it is beneficial to examine the latest developments in the banking sector.

After the financial crisis in Turkey in 2000, the establishment of new banks experienced a calm period for approximately 15 years. However, this changed with the public sector's entry into the market in 2015. Between 2015 and 2020, the Turkish banking sector experienced the establishment of new banks such as Ziraat Katılım, Vakıf Katılım, and Emlak Katılım. After 2020, private sector investments in banking have gained attention. The search for more boutique services by companies, the publication of service and digital banking regulations, and the inflow of foreign capital have contributed to this dynamism. Since 2015, we have seen that the Banking Regulation and Supervision Agency (BRSA) has granted establishment licenses to 23 new banks (including participation, investment, and digital banks). Of these banks, 13 have received operating licenses, 9 are awaiting operating licenses, and the establishment license of one bank has been canceled.

Out of the 13 banks that received operating licenses, 8 have chosen Architecht's BOA Banking and Technology Platform, and 2 of the 9 banks awaiting operating licenses have also selected BOA. The fact that 10 out of the 20 banks that have started banking operations in the last 9 years have chosen BOA positions Architecht as a leading player in core banking infrastructure.

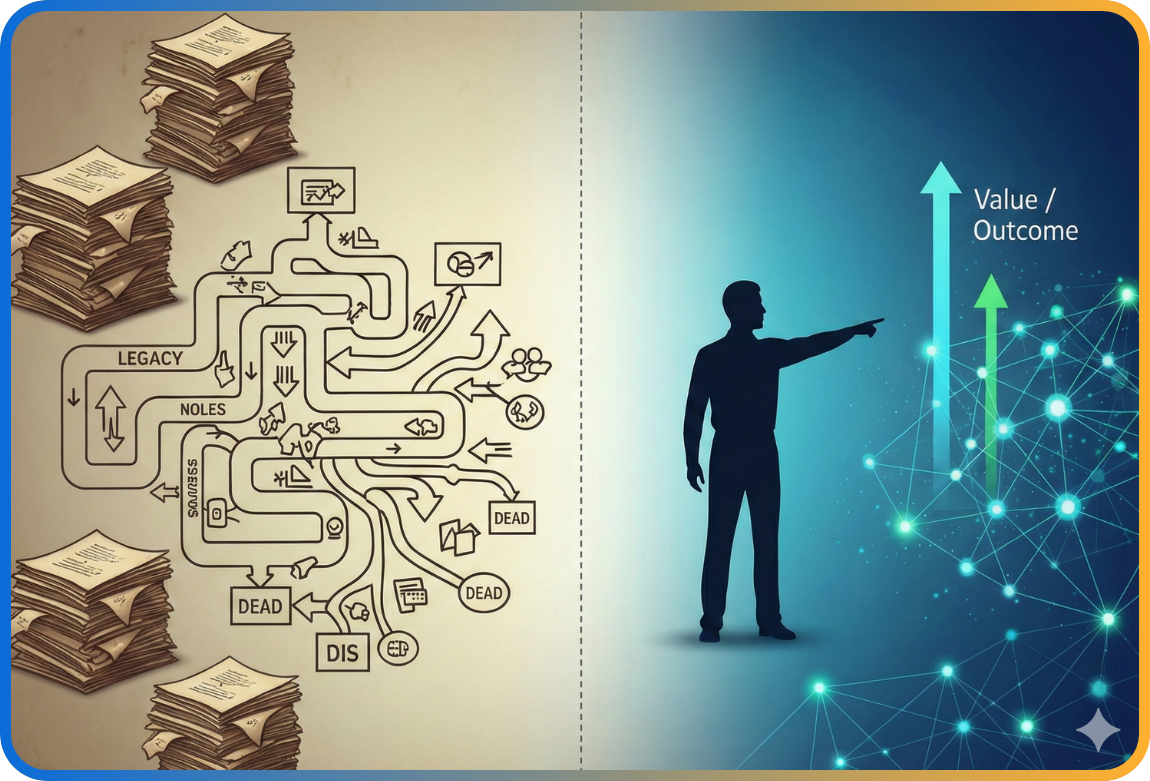

After this brief update on the sector, we will discuss the reasons behind the success Architecht has achieved and the challenges that await a new bank during its establishment journey.

Why Establish a Bank with BOA?

BOA, with over 15 years of investment, encompasses all the end-to-end modules that a bank, whether branch-based or branchless, might need. BOA includes internet and mobile banking, over 17,000 screens, an EOD task structure, a document management system, automated rule engines, a data dictionary, centrally managed business services, a fraud infrastructure, a definition-based workflow designer and rule trees, a definition-based authorization infrastructure, web-based interfaces, and critical modules like customer, account, accounting, treasury, foreign trade, and loans. It offers its clients a robust banking infrastructure that operates seamlessly and independently of third parties.

From the perspective of firms that have received a banking establishment license, the fact that BOA has previously undergone audits and obtained licenses 10 times strengthens the position of newly established banks significantly in the eyes of the regulatory authority.

On the other hand, with the newly developed centralized code approach in BOA, changes made in one bank can be quickly applied to other banks, providing a centralized infrastructure. This approach also allows for the centralized management of a new bank's personal information, such as its name and logo, during the establishment process.

BOA Modernization

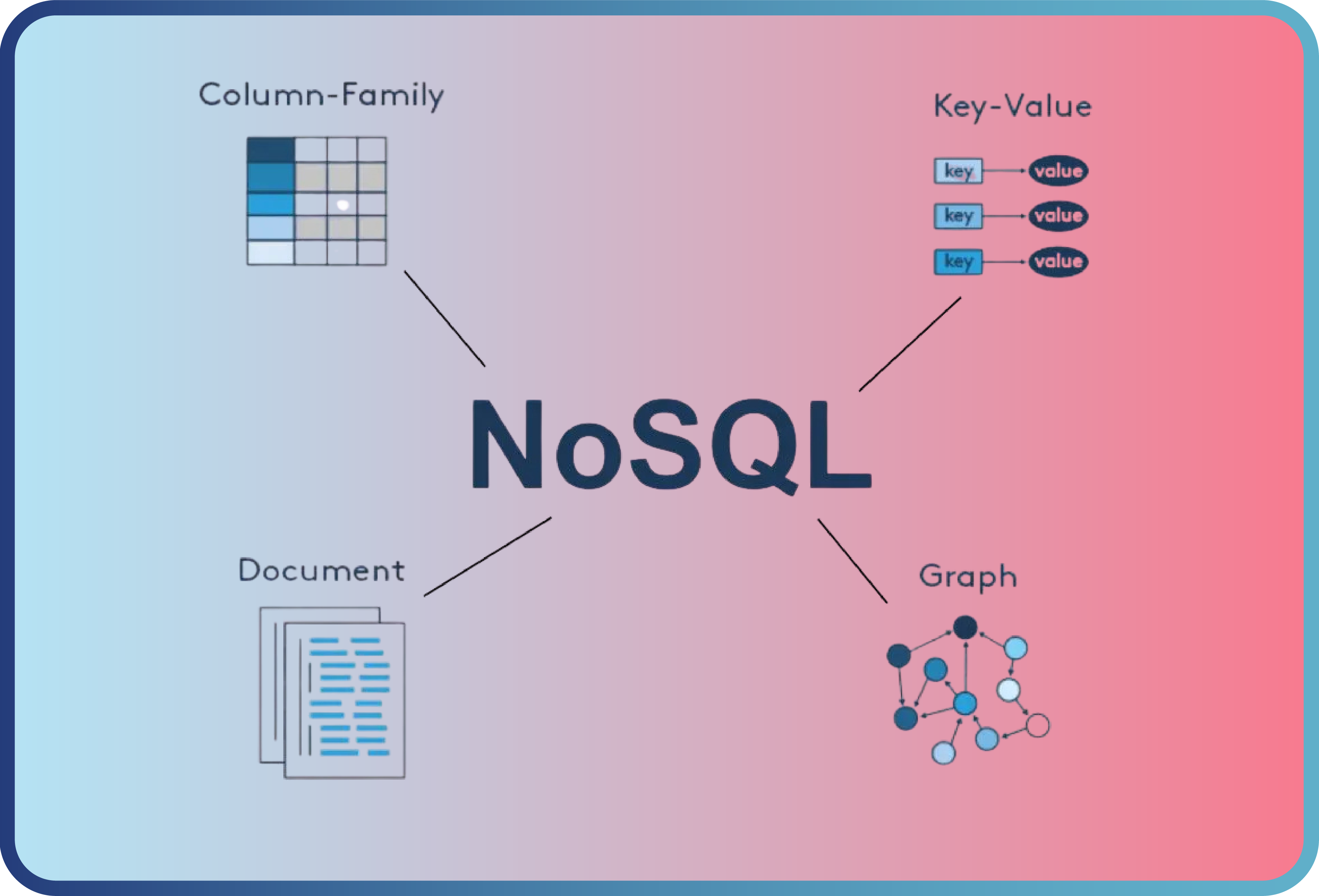

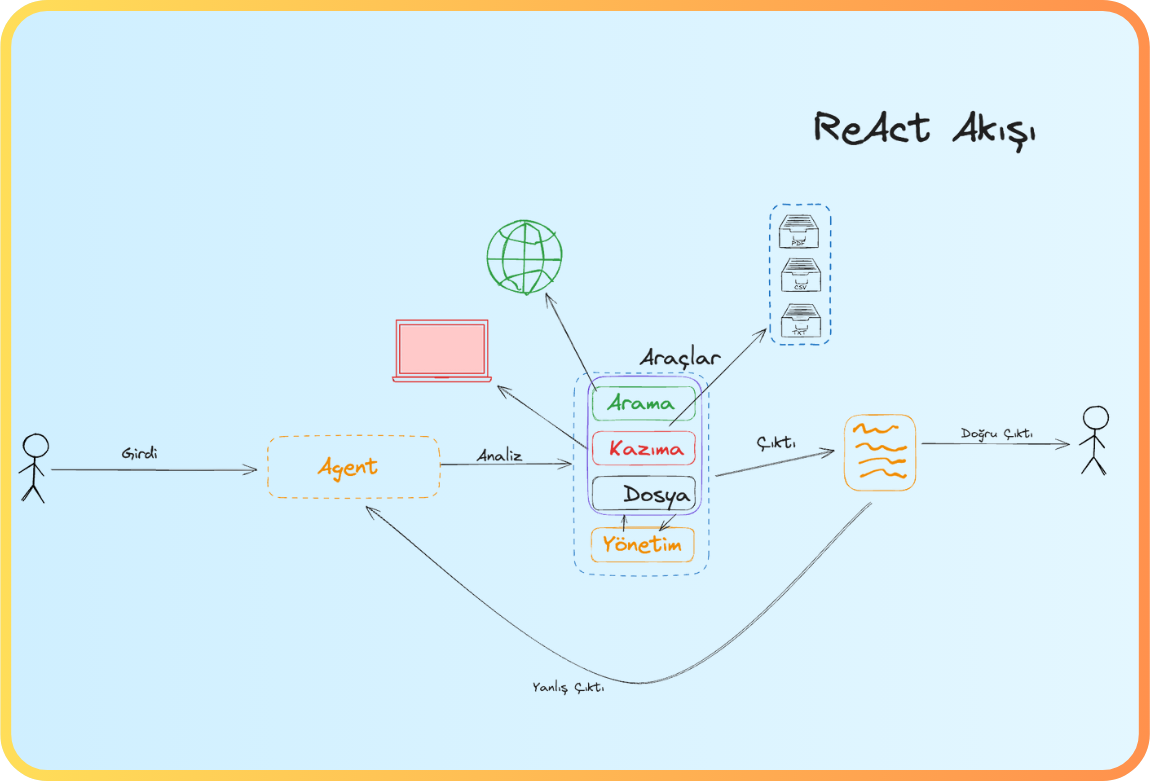

The infrastructure of the BOA Core Banking and Technology Platform is being modernized with .NET Core technology, which will provide a more modern and independent structure. Due to changing technological needs, Architecht's investments in banking infrastructure are ongoing. The initial announcement of the OBA Suite, a Cloud Native Microservices Technology Platform, was made in January 2024 in collaboration with Microsoft. The LowCode - NoCode features of OBA, integrated with advanced technologies such as Artificial Intelligence, OpenAI ChatGPT, LLM, and Microsoft Github Copilot, further optimize the software development processes. The OBA Suite Platform is designed to be suitable for developing banking applications with its LowCode - NoCode structure. Modular development processes on the OBA Suite are ongoing.

Why Architecht?

The significant impact of the digital transformation initiated with the BOA investment in 2010, and Kuveyt Türk's rise to a leading position in the sector due to this investment, has generated interest in the BOA banking software in the market. Architecht’s decision to share the developed BOA infrastructure and know-how with 10 out of the 20 newly established banks, beyond its primary partner Kuveyt Türk, demonstrates that Architecht is not merely viewing this from a competitive perspective. Instead, it shows their commitment to sharing their most valuable asset with the entire sector, growing together through collaboration, and ultimately contributing to the national economy.

Established as a product of a successful digital transformation story in banking, Architecht serves both Kuveyt Türk and other banking sector clients with its team of 750 skilled professionals. Additionally, Architecht continues to improve itself and its products with a customer-centric approach through its agile transformation process initiated in 2019. Architecht also shares its expertise with clients during new bank establishment processes, leveraging past experiences in this journey. The focus here is not just on selling a banking application but on partnering with clients in their establishment experience and challenges, overcoming difficulties together, and addressing their concerns with a proactive, customer-centered approach.

"Financial Indicators of Banks Using BOA"

The summary of the financial results published on the websites of banks using BOA is as follows.

5 Steps in the Bank Licensing and Establishment Process

1- Staffing

When establishing a bank, having a qualified and specialized team to operate the system is one of the most important factors. Expertise in critical modules significantly eases the establishment process and is crucial for achieving the bank's strategic business plans. Initial areas of need include core banking, accounting, loans, operations, payment systems, treasury, IT infrastructure, and internal systems.

2- Technology Selection

The reliability of the banking infrastructure is critical. This infrastructure should have successfully completed licensing processes through multiple audits, be backed by a strong bank, and be capable of quickly adapting to any banking regulatory changes. The maintenance service provided by strong teams with SLA (Service Level Agreement) periods is also crucial. Additionally, the technology provider must have a service quality and financial stability that does not cause concerns for its clients.

3- Data Center Management

Banks must choose a data center vendor that meets legal requirements, as they handle critical customer data. The data center should comply with Tier 3 or Tier 4 standards, offer DRC (Disaster Recovery Center) infrastructure, and provide high-quality managed services in terms of servers, database management, network, and security. These are mandatory elements for operational licensing.

4- Independent Auditing Process

The choice of an independent auditing firm that will provide consultancy during the licensing process and collaborate in the creation of all policies, procedures, and legal internal regulations is important. The process may differ depending on whether the bank is an investment bank or a digital bank. The auditing firm is expected to adapt processes accordingly, audit the banking infrastructure, and run test scenarios during the UAT (User Acceptance Testing) phase. Another critical point is the coordinated and harmonious work between the auditing firm and the banking application provider to ensure smooth progress without blockages.

5- System Integrations Before Go Live

After receiving the operational license, the BRSA (Banking Regulation and Supervision Agency) assigns a bank code to the bank. With this code, the bank initiates integration processes by applying to institutions such as the Central Bank of the Republic of Turkey (TCMB), SWIFT, Credit Bureau (KKB), Central Registry Agency (MKK), and Takasbank. The technical integration requirements of each institution may vary. Architecht has extensive experience in this area, having established all necessary integrations for 8 bank clients licensed with BOA.

References:

· https://vakifkatilim.com.tr/documents/Hazine/konsolide-finansal-tablolar-31-aralik-2023.pdf

· https://www.destekbank.com/media/gapjbx4a/destek_yatirim_bankasi_as_solo_rapor_31122023.pdf

Back

Back