Artificial Intelligence is rapidly transforming industries worldwide, and banking is at the forefront of this transformation. The potential of AI to streamline operations, enhance customer experiences, and reduce costs is immense. However, we need to discuss a broader vision: Autonomous banking. Can we imagine a future where AI not only handles routine tasks but also assists by completing the necessary transactions and making decisions to meet the needs of customers from end to end? I truly believe so. AI-powered autonomous banking represents the next frontier in financial services, and this application could redefine the roles of both customers and employees in banking.

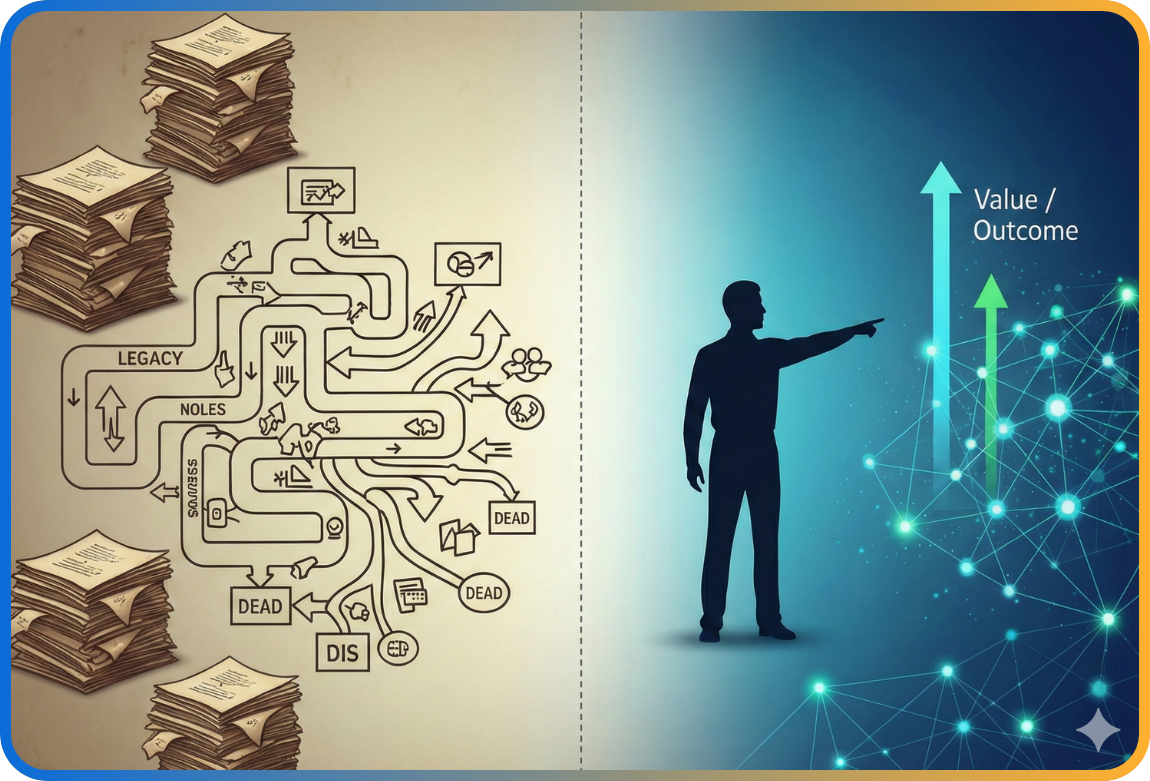

At Kuveyt Türk, we have been investing in AI for nearly a decade. We started with statistical models. Our next step was to develop models that automate decision-making processes, predict customer behaviors, automate processes, and more, using machine learning methods. Over time, these capabilities have greatly advanced in terms of human resources, processes, and technology. Now, we are entering a new phase driven by Generative AI, which offers even greater possibilities. However, before understanding how AI can guide us toward autonomous banking, we need to grasp what this journey requires and the challenges we will face.

The concept of autonomous banking is based on a fundamental question: Why should our customers or employees have to manage the banking tasks they need, when AI can handle them? Every month, millions of people spend time transferring money, paying debts, managing investments, and tracking their financial lives. If AI can learn these patterns, why should we leave these tasks to humans? Imagine an AI system automatically transferring your salary to the accounts you need every month, paying off your home loan, and investing the remaining money based on your previous behavior and economic indicators—all with minimal input. You could receive a notification for approval, and with a simple touch or voice command, the entire process would be completed. This vision is not far-fetched; today’s AI technologies can offer these capabilities, though more development and fine-tuning are required.

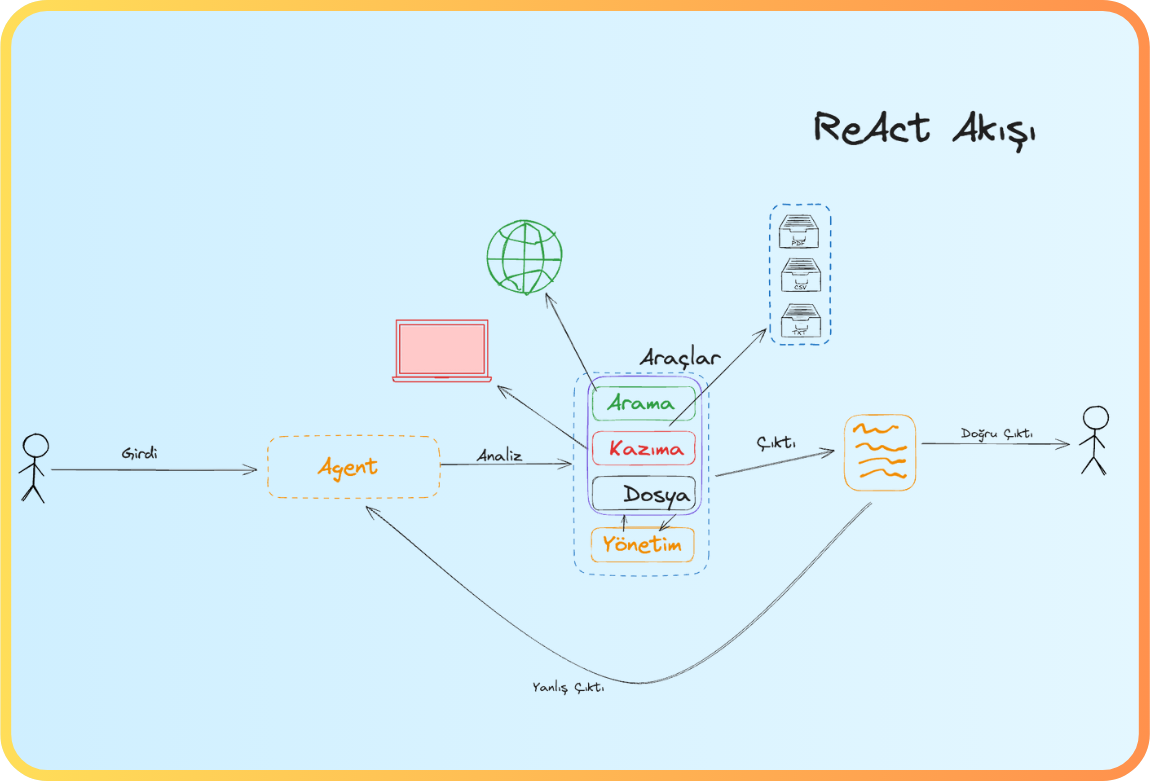

This change is part of a broader trend in the financial services sector. AI is increasingly being used to handle complex tasks, from fraud detection to personalized financial advice. In particular, generative AI is opening up new possibilities. These AI models are not only reactive but also proactive. They can learn from user interactions, predict needs, and continuously improve over time. At Kuveyt Türk, we are exploring the development of AI-powered assistants that can manage not only customer inquiries but also the transactions carried out by our employees and customers. These AI assistants could form the backbone of an autonomous banking system, interacting with customers in a natural, conversational manner while also managing back-office processes. Most importantly, it could drive customer acquisition and revenue growth without relying on human resources.

However, building an autonomous banking system is not only about technology; it also requires a shift in mindset. Banking, like many industries, is built on human relationships, trust, and a certain level of control that people want to retain. The idea of allowing AI to manage critical financial decisions may be unsettling to many. People may feel comfortable using technology for simple tasks like checking their balance or making small payments. However, the idea of a system managing their entire financial life without human involvement could be disconcerting. Overcoming this psychological barrier is one of the biggest challenges in the widespread adoption of autonomous banking.

In my view, banks have a critical role to play here. We must not only develop technology but also simplify and concretely communicate its benefits to our customers and employees. AI should not be seen as a technology replacing human judgment; rather, it should be viewed as a tool that enhances it. Just as we trust AI to guide us in traffic or recommend products, we can learn to trust it in financial matters as well. The key here is that AI must be designed to be transparent, reliable, and—most importantly—user-focused. For example, AI systems should be able to explain their decisions in simple terms, so users can understand why a certain action was taken. This transparency will build trust and make the transition to autonomous banking smoother.

One of the most exciting possibilities of autonomous banking is its potential to save time for both customers and employees. As I mentioned earlier, millions of people spend time managing income, expenses, and investments every month. This process is both repetitive and time-consuming. Why not let AI take over these tasks? By automating these processes, we can give customers more time to focus on what truly matters in their lives. Similarly, for employees, AI can take over routine operational tasks, allowing them to focus on more valuable activities, such as managing customer relationships and developing strategies.

However, the road to autonomous banking is not without challenges. One of the biggest obstacles is the technical complexity of creating secure, reliable, and scalable AI systems. Banking is a highly regulated industry, and every AI solution we implement must comply with strict regulations regarding data privacy, security, and financial transparency. This requires robust infrastructure, skilled personnel, and a deep understanding of finance and technology. At Architecht and Kuveyt Türk, we are making significant investments in these areas. We have built our AI team and are working with some of the best minds in the industry to ensure that our AI systems meet the highest standards.

Another challenge is the cultural change that will be needed within the organization. With the rise of AI, many employees may fear for the security of their jobs. However, history shows us that while technology changes the nature of work, it does not eliminate it. The advent of machines in sectors like agriculture, manufacturing, and textiles did not eliminate jobs; it transformed them. Farmers became machine operators, textile workers became designers and technicians. AI will also change the roles of employees in banking and the software industry. Employees will be able to focus their time on strategic activities, customer relationship management, and innovation instead of repetitive tasks. This shift will require investments in training and development but will ultimately lead to a more dynamic and agile workforce.

From the customer’s perspective, the challenge is somewhat different. While many people find digital banking platforms easy to use, the idea of completely autonomous systems may still seem like science fiction. However, as AI becomes an integral part of daily life, this skepticism will decrease. We are already seeing examples of AI-powered virtual assistants, chatbots, and recommendation engines in other industries, and banking is the natural next step. Imagine interacting with your bank using natural language, whether spoken or written. Instead of navigating through complex menus and screens, you could ask your AI assistant to make a money transfer, pay a bill, or invest on your behalf. The system would not only understand your request but also execute it smoothly.

The role AI can play in customer service represents a significant potential. Currently, many banks rely on call centers or digital channels to handle customer requests. While these systems are functional, they often fall short when it comes to providing personalized experiences. Generative AI, in particular, could change this. By learning from past interactions, AI systems could provide more personalized and accurate responses, improving customer satisfaction. Additionally, AI can respond to multiple inquiries at once, reducing wait times and increasing efficiency. This is especially important in a world where customers expect instant responses and seamless service.

The ultimate goal of autonomous banking is not to replace people, but to enhance their capabilities. By automating routine tasks, AI can give both customers and employees more time to focus on valuable activities. For customers, this means more time to focus on personal and professional matters. For employees, this means opportunities to take on more strategic and creative roles within the organization.

At Architecht, we are committed to leading this transformation. We have already made significant investments in AI, and we will continue to do so. Our goal is to build an autonomous banking system that not only meets today’s customer needs but also anticipates future needs. This is a long-term vision, requiring collaboration, innovation, and openness to change. But with the right strategy and mindset, I believe we can turn autonomous banking into a reality.

In conclusion, the path to autonomous banking is both a technological and cultural transformation journey. AI has the potential to radically change banking by taking over banking operations. However, for this vision to become a reality, we must overcome technical, regulatory, and psychological challenges. At Kuveyt Türk, we are investing in the infrastructure, talent, and technology necessary to build the bank of the future. Autonomous banking is not just a technological leap; it’s about reimagining what banking can be. And I believe we are ready to make that leap.

NOTE: I would like to thank dear Furkan Yunus Pamukçuoğlu and Hatice Ünal for their contributions and editorial support to my writing.

Back

Back