Today, the increasing complexity of financial sectors and the production of large amounts of data make it necessary for companies to make effective use of this data. Here, we will focus on the opportunities that data mining can bring to the banking industry by making the data produced more manageable and meaningful.

Data mining is a technique used to electronically search large volumes of data for specific data patterns and to discover hidden patterns, associations, outliers and clusters in large data sets. The process aims to improve decision making by extracting meaningful and valuable information from data sets and is supported by methods such as statistical analysis, artificial intelligence and machine learning. With the opportunities offered by evolving technology, the banking sector has become technically strong and customer-centric with online transactions, electronic transfers and ATMs.

In addition, banking systems collect large amounts of data on a daily basis, such as customer information, transaction details, risk profiles, credit card activity, limit and collateral details. It would not be an exaggeration to say that the benefit of developing data mining techniques to process and make sense of the data that accumulates daily in the banking sector is the most valuable asset of these institutions. This is because this data contains valuable information, interesting and meaningful transaction patterns that lead to the daily and rapid decisions that need to be made in the banking sector.

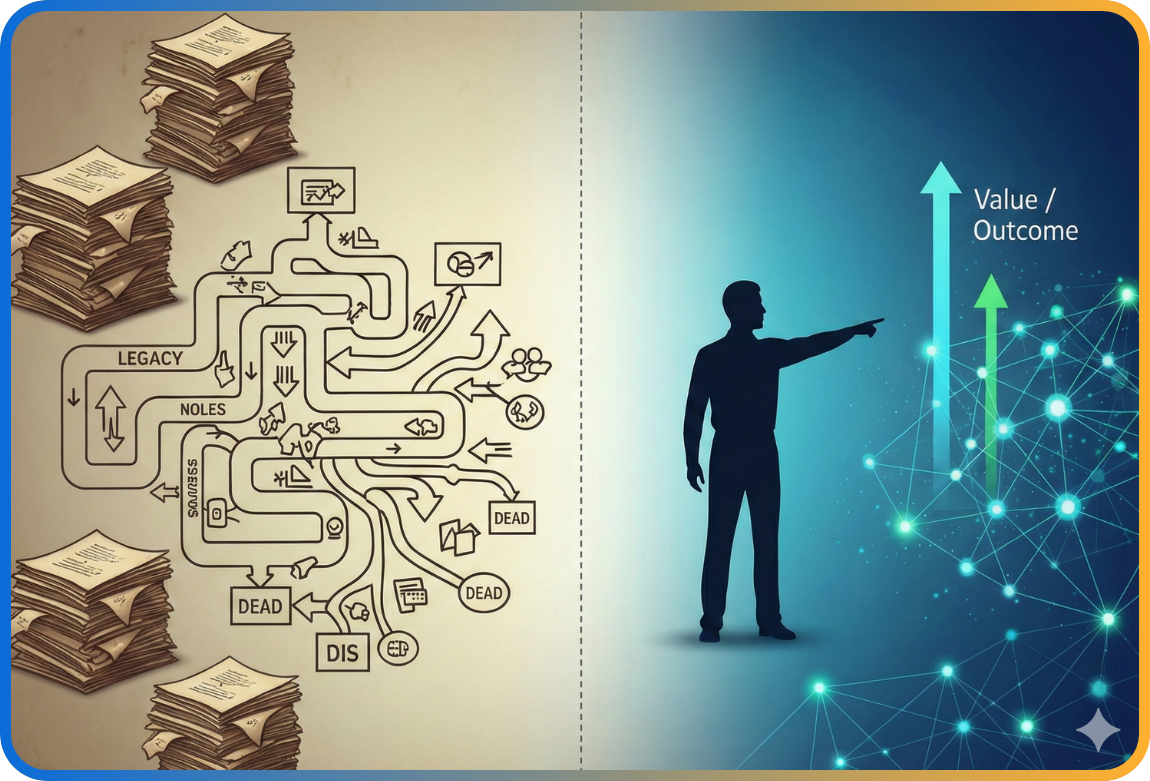

Figure 1: Traditional decision making process.

The potential for using data mining to improve banks' strategic decision making and customer experience in areas such as marketing, credit risk management, money laundering detection, liquidity management, investment banking and fraud detection is enormous.

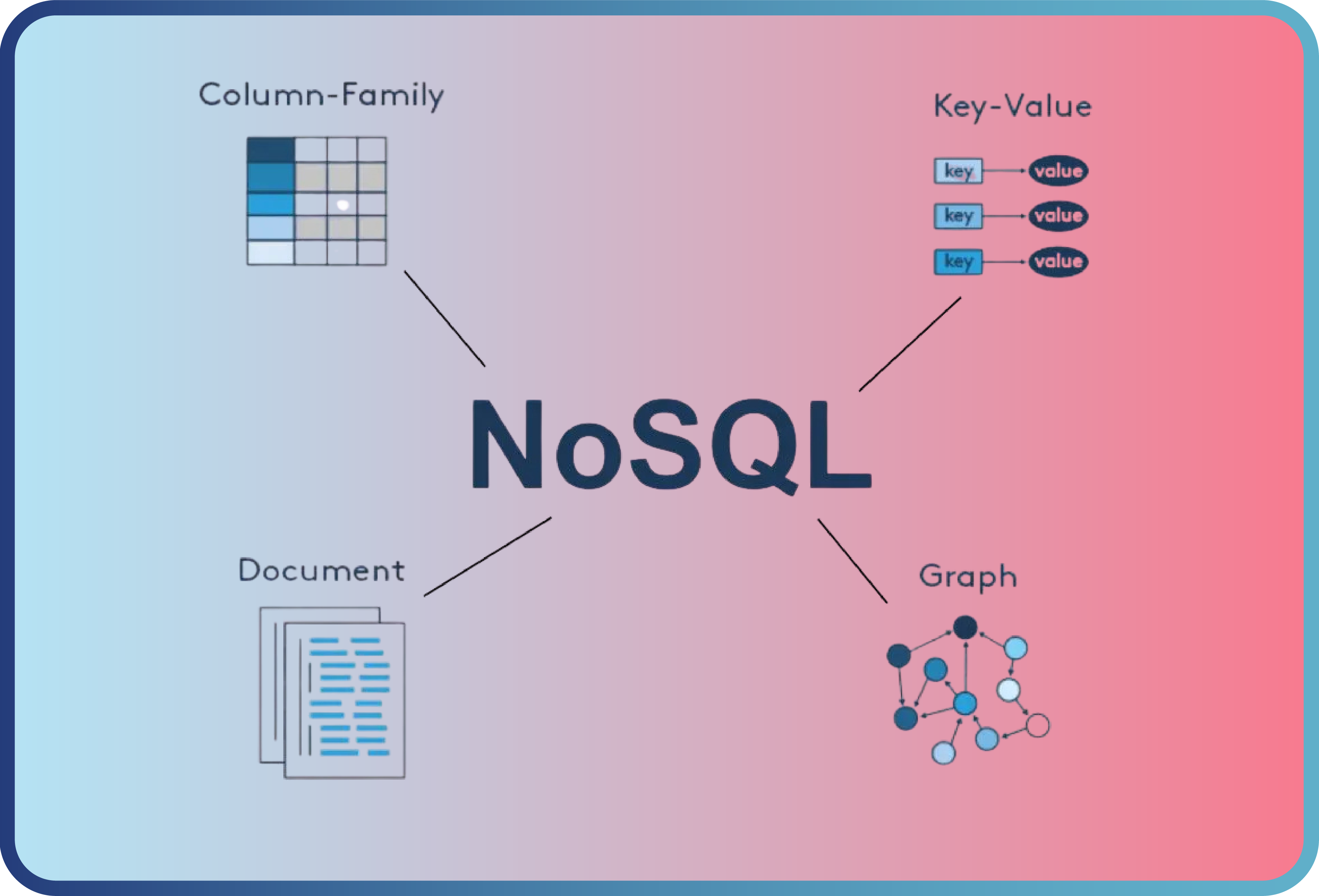

So how can large and complex data be organised in a meaningful and useful way using data mining? The following methods can be used to answer this question;

1. Classification

It is the process of assigning samples in the data set to certain categories or classes. For example, classifying a bank customer's credit risk as low, medium or high.

2. Regression

Used to understand how a dependent variable is affected by one or more independent variables. For example, to estimate the factors that determine the selling price of a house.

3. Clustering

It is the process of grouping data points with similar characteristics. For example, clustering customer profiles according to similar characteristics.

4. Neural Networks

Modelling complex relationships using artificial neural networks that mimic the structure of the brain. For example, image recognition or language understanding using deep learning.

5. Time Series Analysis

Predicting future trends by analysing time-varying data sets. For example, predicting the future value of a stock.

6. Support Vector Machines

It is a machine learning technique used for classification and regression problems. For example, approving or rejecting a customer's credit application.

These and various other methods are among the tools used in data mining to process and group data. Which method to choose can vary depending on the data set and the tasks at hand. Here we can talk about the different algorithms used in data mining. These algorithms have been developed for different purposes to analyse the data and reveal useful information. Some commonly used data mining algorithms and their purpose:

- Association Rule Learning

It finds relationships between data and identifies events that occur together. It is used in areas such as market basket analysis, cross-selling strategies and recommendation systems. Apriori algorithms and FP (Frequent Pattern Growth) algorithms are examples.

- Desicion Trees

It is used to classify data based on decision rules. Decision trees work to identify important factors in the data set and reveal paths that can be used in decision-making processes. It is used in areas such as credit risk assessment, customer segmentation and fraud detection. CART (Classification and Regression Trees) and ID3 (Iterative Dichotomiser 3) algorithms are examples.

- KNN (K-Nearest Neighbors)

It relies on nearest neighbour classification to decide which class new data belongs to. It is a simple and flexible algorithm. It is used in areas such as pattern recognition, recommender systems and fraud detection.

- Naive Bayes Algorithm

It is a probabilistic classification method. It is mainly used for text classification and document categorisation. It is used in areas such as spam detection, customer complaint classification and sentiment analysis.

- Apriori Algorithm

It is used to learn association rules. It identifies items that are often found together, especially in large data sets. Market basket analysis is used to analyse customer behaviour.

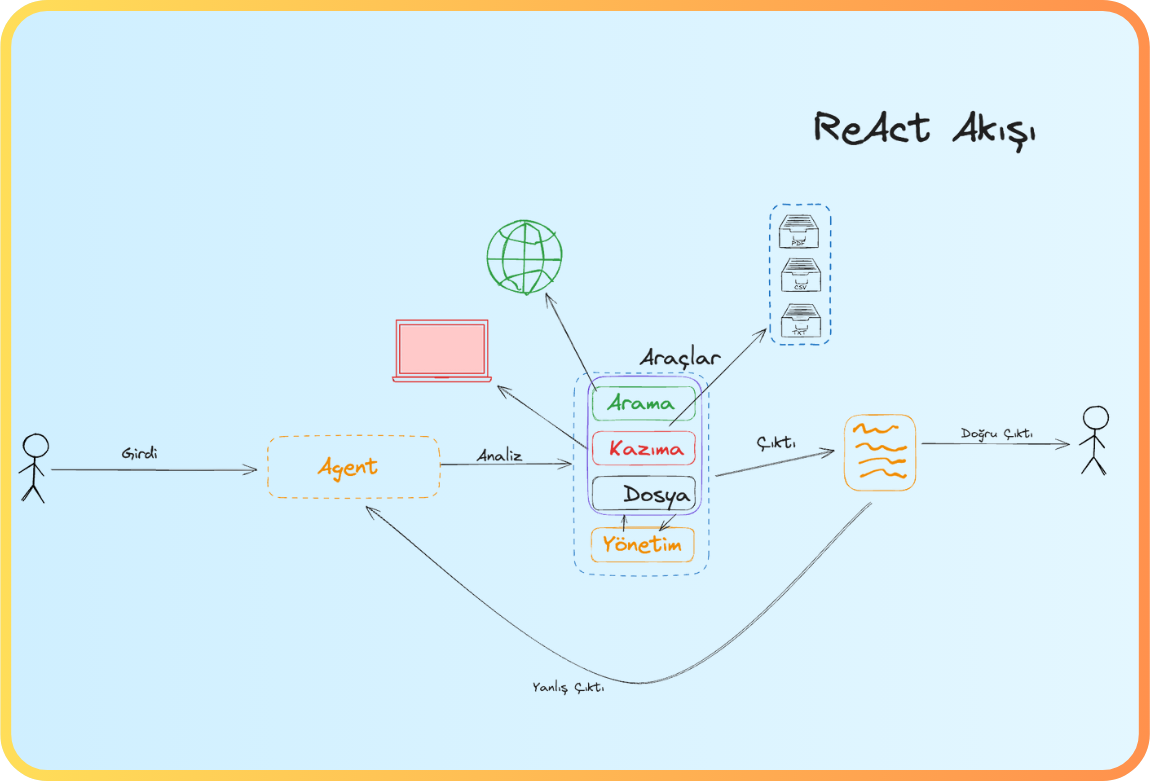

Figure 2: Decision making with data mining.

Let's take a brief look at the potential uses of data mining in the banking sector and the benefits it can bring.

1. Customer Segmentation and Targeting

Data mining is used to create different customer groups based on customer behaviour. This enables banks to better understand the needs of their customers and offer more tailored financial products and services. In some applications, personalised campaigns have resulted in a 20% increase in customer conversion rates and a 15% improvement in the Net Promoter Score (NPS), which measures customer satisfaction.

2. Customer Satisfaction and Personalised Services

By analysing feedback from customers who rate the products or services they receive, data mining can be used to measure customer satisfaction. This data can lead banks to improve customer service.

3. Credit Risk Assessment

With data mining, a customer's credit risk can be determined through past credit applications, credit card usage and other financial activities. This enables banks to make more sensitive and reliable credit assessments of their customers. By implementing data mining applications in credit risk analysis, we have achieved efficient results, reducing credit risk by 30% and accelerating the approval time of credit applications by 40%.

4. Marketing and Campaign Management

Banks can develop more effective marketing strategies by using data mining techniques to analyse their customers' preferences and shopping habits. This enables them to satisfy existing customers and attract new ones with special campaigns and offers. Segmentation-based campaign management increased marketing campaign conversion rates by 35% and reduced campaign costs by 20%.

5. Detection of Fraud

Banks can benefit from data mining to quickly identify abnormal activity and suspicious movements on customer accounts. Fraud attempts can be detected. This enables rapid intervention and security measures to be taken. Fraud detection systems supported by data mining have been reported to reduce fraud cases by 85% and average losses by 60%.

As a result, the place and use of data mining in the banking sector is becoming more important every day. Data mining technologies help banks to make strategic decisions by analysing the large amounts of data generated in the banking sector. It also enables them to improve customer experience and gain competitive advantage. As we conclude our article, we cannot help but draw attention to the following point; it should always be remembered that we have a responsibility to use this technology within moral and legal boundaries.

References

- Bhambri, V., 2011. Application of data mining in banking sector. Internat. J. Comput. Sci. Technol., 2: 199-201.

- Pulakkazhy, A. and Balan, R. V. S, 2013. Data mining in banking and its applications. Journal of Computer Sciences, 9(10): 1252-1259.

- Web 1, https://www.gtech.com.tr/fintech-finansal-teknoloji-nedir-ne-ise-yarar/

- Web 2, https://vizyonergenc.com/icerik/5-temel-soruda-veri-madenciligi-data-mining-nedir

- Doğuç, Ö, 2022. Data mining applications in banking sector while preserving customer privacy. Emerging Science Journal, 6: 1444-1454.

Back

Back