While technology is creating new winners and losers, another topic has started to come forward recently: Agentic AI...

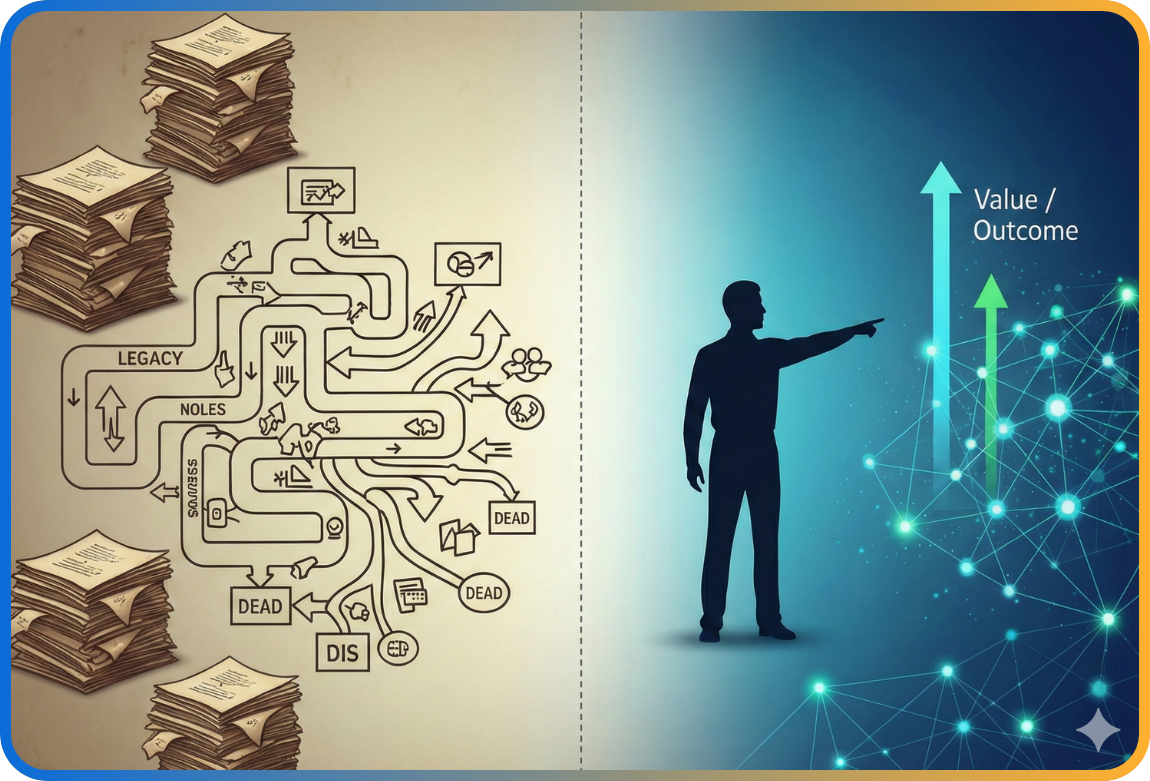

While technology is evolving at a dazzling speed and the efficiency is increasing, it is creating new winners and losers. While the emergence of DeepSeek, a low-cost artificial intelligence model, has surprised Western tech giants and chip makers, another big topic on the agenda is Agentic AI.

What is Agentic AI?

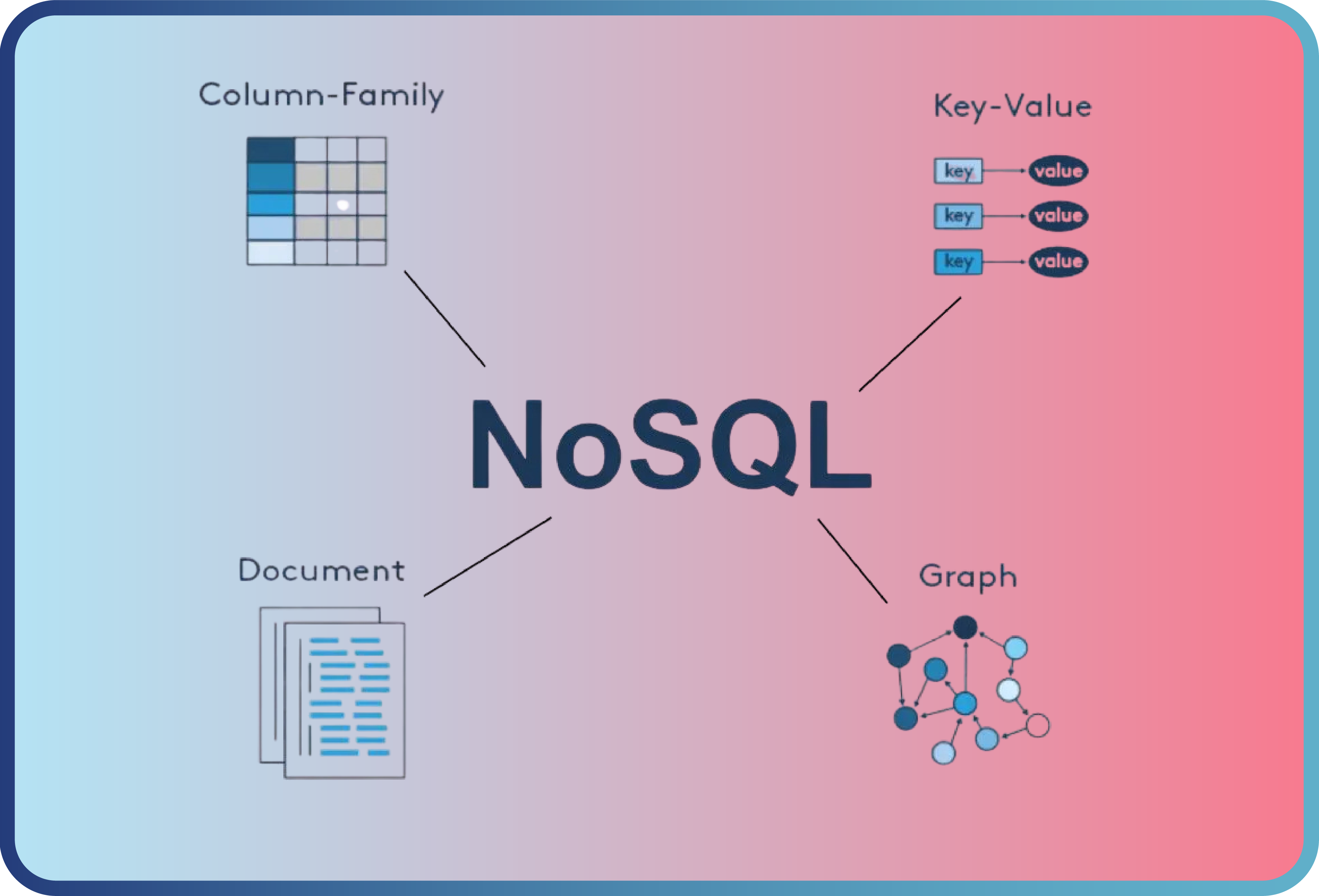

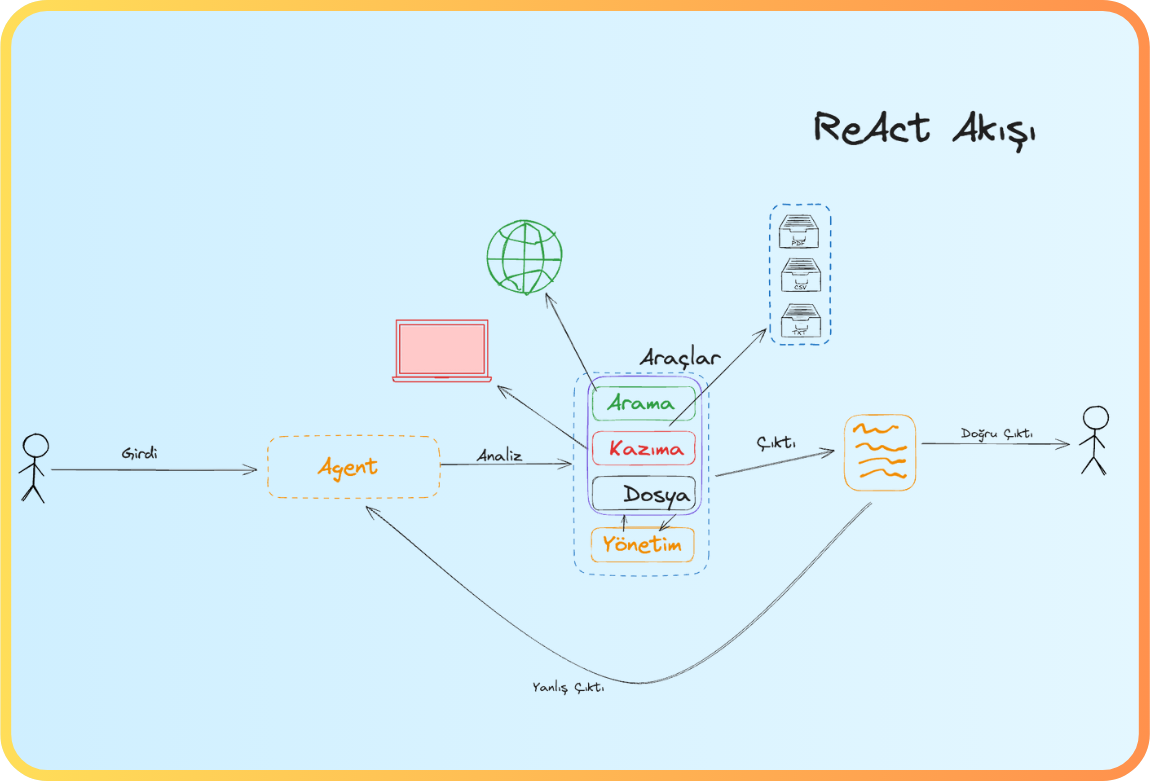

Agentic AI systems combine machine learning, large language models and enterprise-wide automation. These systems are completely autonomous and can adapt to new data easily. It can be considered as a human brain. It analyzes large amounts of data, generates insights, develops strategy, makes independent decisions and learns from experience in complex functions such as risk management and trading.

What is the difference between "Agentic AI" and "AI Agents"?

Agent systems are often mixed up with AI Agents. AI Agents are just subsystems that perform only defined / specific tasks. For instance, a customer service chatbot or an automatic system that checks a suspicious account is an AI Agent.

-

Agentic AI: Manages results and makes decisions.

-

AI Agents: Performs predefined tasks.

Why is this differentiation important? Because while AI Agents repetitively perform limited responsible tasks defined by users, Agentic AI collects data, analyzes it, takes initiative and makes decisions. This is a much more active assignment. It can bring unlimited opportunities and also unpredictable risks.

How will Agentic AI impact the financial sector?

Agentic AI promises transformation in two fields:

1. Automation of in-house operations

-

Data entry and regulatory compliance checks

-

E-mail and report summarization

-

Developing predictive models for risk management

2. Proactive customer engagement

-

Chatbot supported customer services

-

Personalized investment portfolios and financial counseling

While it might seem that the mutual purpose of both of these fields is to increase productivity and reduce costs, the increase in customer satisfaction will be more crucial. According to some experts, Agentic AI could have an unprecedented impact on the financial sector. We will see that all together.

What are the Risks and Difficulties?

Some risks that this technology brings:

-

Lack of transparency: Agentic AI mostly works as a "black" box" and it can be difficult to explain the decisions it makes.

-

Regulative risks: Incorrect automatic decisions may violate consumer rights and other sectoral regulations.

-

Financial stability risk: Decisions made from incorrect data or assumptions may lead to serious losses and systemic risks.

For example, what happens if an Agentic AI of a bank tells an AI Agent to make a transaction and that transaction causes loss? Or if an account is opened that should not have been opened with incorrect data, if wrong lending decisions are made? Because of these risks, this new technology is in trial phase and its uses are being tested. In this phase human supervision is crucial. Agentic AI systems should be constantly monitored and the risk evaluation processes should be carried out meticulously.

Conclusion

Agentic AI is a new technology that has a potential to reshape the financial sector. however, along with the great benefits, there are also serious risks. Human supervision and regulation mechanisms are the greatest need for new technologies to mature and be deployed. And to achieve this, we need previously undefined task definitions and the skills.

- This article by Soner Canko, who has carried out important work in the field of financial technologies in Türkiye, was first published on BloombergHT website on February 10, 2025.

Back

Back