The history of card payment systems is quite interesting and has shown rapid evolution. The first credit card was introduced by Diners Club in 1950, and this card was initially only valid at certain restaurants. However, card payments became widespread with the launch of Bank of America's BankAmericard (later renamed Visa) and Master Charge (later renamed MasterCard) in the 1960s.

The introduction of magnetic stripe technology in the 1970s made cards physically readable. In the 1990s and 2000s, security measures such as chip-based cards and PIN usage increased. During this period, virtual cards used for online shopping also gained popularity.

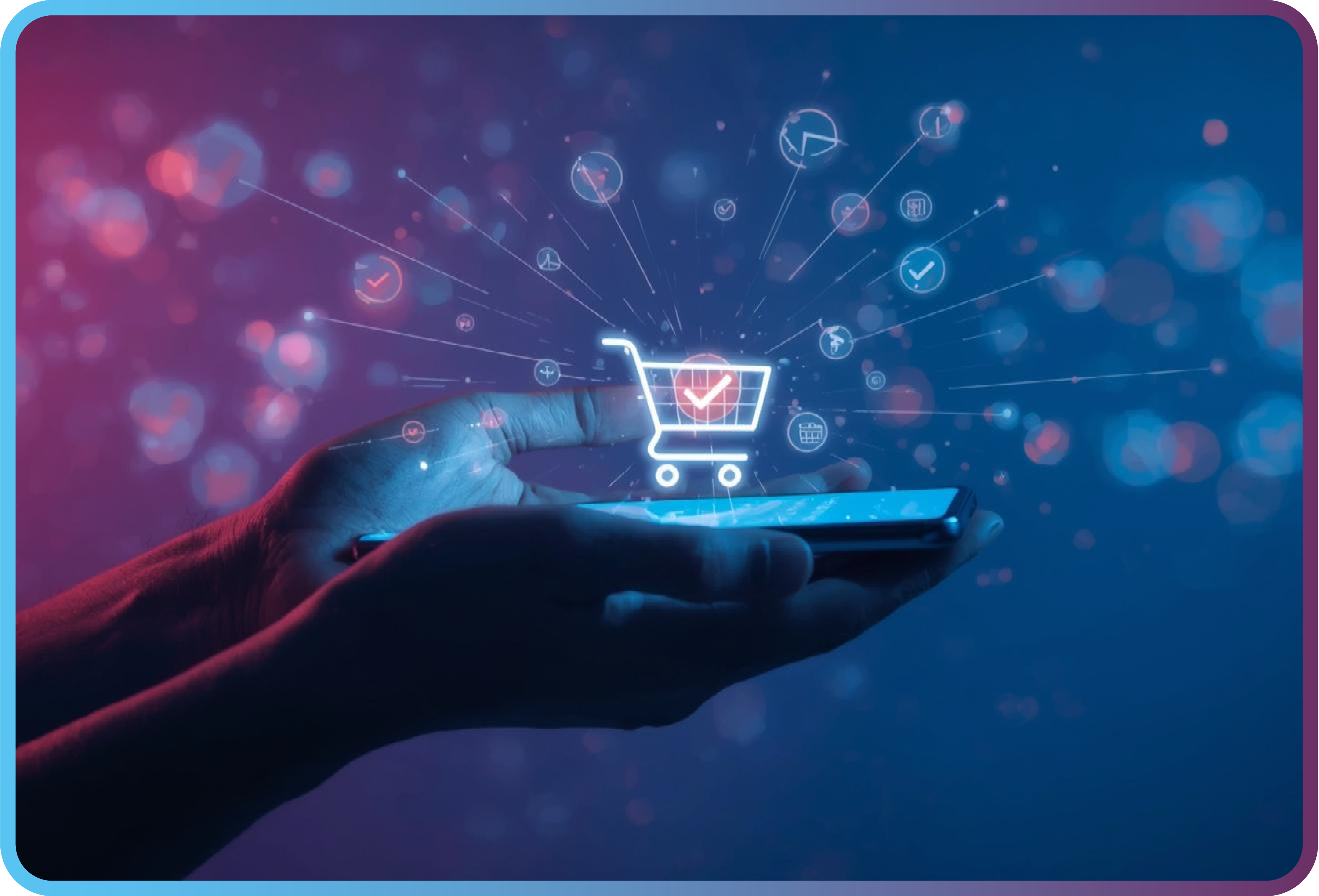

In recent years, the widespread adoption of contactless payments and the emergence of digital wallets (such as Apple Pay, Google Pay) have accelerated card payment systems even further. NFC (Near Field Communication) technology played a significant role in this process. Today, card payments have become an integral part of daily life worldwide. We are likely to hear much more about digital wallets in the future, so let's explore the concept of digital wallets together.

What is a Digital Wallet?

A digital wallet is an electronic system used to store, send, and receive your digital assets, typically through mobile applications or online platforms. These assets can include cryptocurrencies, digital cards, payment information, or other virtual items. Digital wallets can be used as an alternative to traditional physical wallets. They securely store our bank, credit, or prepaid cards in an electronic environment. Digital wallets allow for easy and secure shopping and money transfer transactions.

What are the Advantages of Digital Wallets?

Digital wallets offer many advantages:

-

They significantly reduce the need for users to carry physical wallets and cards.

-

Digital wallets typically include security measures such as encryption and authentication. They may also have features to block remote access in case of loss or theft.

-

Digital wallets can support various payment methods such as credit cards, bank cards, virtual cards, and even cryptocurrencies, providing flexibility to users.

-

Digital wallets can increase the participation of developing countries in the global financial market.

-

Digital wallets allow users to transfer money to friends and family residing in different countries.

-

Digital wallet providers often organize various discounts and campaigns to incentivize users.

-

Companies that need to collect consumer data for marketing purposes can greatly benefit from digital wallets. They can learn about consumers' purchasing habits and enhance the effectiveness of their product marketing strategies. However, this may lead to a loss of privacy for consumers.

What are the Legal Regulations for Digital Wallets?

Legal regulations for digital wallets vary from country to country. In Turkey, digital wallets and similar payment services are generally regulated by institutions such as the Banking Regulation and Supervision Agency (BDDK) and the Central Bank of the Republic of Turkey (TCMB).

The legal framework for digital wallets and payment services in Turkey is shaped by Law No. 6493 and related regulations.

-

Licensing: Companies wishing to offer digital wallet services must obtain a license from BDDK or other relevant regulatory authorities.

-

User Authentication: Digital wallet providers must follow certain procedures to verify users' identities, as part of anti-money laundering (AML) and know your customer (KYC) policies.

-

Privacy and Data Protection: The protection of user data is a crucial issue that digital wallet providers must comply with. In Turkey, this is regulated under the Personal Data Protection Law (KVKK).

Additionally, the European Union's payment services directives (such as PSD2) and other international regulations may also be considered and enforced by local regulators.

Are Digital Wallets Secure Enough?

Trust in the system is crucial for users to adopt new technologies. Security is even more important in critical infrastructures like payment systems.

Digital wallets store tokens created from sensitive card information instead of the actual card details. This ensures that sensitive card data is not used openly during transactions and is not stored in databases, preventing access by unauthorized individuals.

However, digital wallets can be attractive targets for cyber attacks if adequate security measures are not taken. Some examples of common security attack types experienced today in digital wallets include:

-

Phishing Attacks: Cybercriminals may use phishing emails or messages to direct users to fake websites or applications, attempting to steal login information to access wallets.

-

Malware Attacks: Malicious software can infiltrate users' devices to steal digital wallet information. Such software can spread through downloaded files or visited websites, especially when users are not cautious.

-

SIM Swapping Attacks: Attackers can take control of a user's phone number to intercept two-factor authentication (2FA) messages and gain access to the wallet.

-

Security Vulnerabilities: Security vulnerabilities in digital wallet software can allow attackers to infiltrate systems. These vulnerabilities pose serious risks if not addressed through regular updates.

-

Social Engineering: Attackers may manipulate users into sharing personal or login information, often through phone calls or social media messages.

-

Key Theft in Crypto Wallets: In cryptocurrency wallets, the theft of private keys can provide direct access to users' funds, typically occurring when users do not securely store their keys.

To protect against such attacks, various encryption methods such as fingerprint, facial recognition, and two-factor authentication can be used to enhance the security of digital wallets. Thus, even if your device is compromised, your financial information remains protected.

Additionally, the reliability of wallet providers is also important. Choosing reliable and updated software reduces potential security vulnerabilities. It's important to review the provider's privacy policy and understand how they handle user data. Researching the provider's past performance can provide insights into their reliability.

Types of Digital Wallets

Pass-Through Digital Wallets:

These wallets store physical card information or a tokenized representation of the card, allowing users to make payments in stores or online channels. Although typically used via mobile phones, they can also integrate with wearable technology. Examples include Apple Pay, Chase Pay, Android Pay, and Samsung Pay. Turkey's first digital wallet, BKM Express, also operates with this model.

Staged Digital Wallets:

In this type of wallet, transactions are conducted in two stages: funding and payment. Card information is not shared with anyone. The wallet acts as an intermediary between the customer and the merchant. Transactions can only be conducted within the proprietary network of the staged digital wallet. Popular examples include PayPal and Square Cash.

Stored Value Digital Wallets:

These wallets operate like prepaid cards. Users need to pre-load funds into a separate account assigned to them using traditional methods.

Other Uses of Digital Wallets

Digital wallets, in addition to simplifying payment transactions, can be used to keep other important documents organized and easily accessible. In a digital wallet, you can store boarding passes, concert tickets, health cards, loyalty reward cards, gift cards, and identification documents alongside credit and debit cards.

Many applications, especially those offering loyalty programs, provide their own digital wallets, offering various advantages. For instance, digital wallets allow customers to track loyalty points or rewards digitally. This enables a better customer experience and more effective reward management.

Additionally, digital wallets can be integrated into loyalty programs, offering incentives like earning points or taking advantage of special discounts during purchases. Customers can easily participate in loyalty programs and quickly benefit from advantages through digital wallets, increasing customer satisfaction and strengthening brand loyalty.

Digital wallets are also used to store and transact cryptocurrency balances.

With the discovery of new solutions, digital wallets have started to be used in various solution areas such as verifying identity information.

The Future of Digital Wallets

In recent years, we have seen a decline in cash usage and an increase in the use of digital payment systems.

Digital wallet solutions, which have been popular in Asian countries, especially China, for many years, have become widely used in our country and worldwide in recent years.

In particular, digital wallets used in e-commerce payments accounted for 48.6% (2.6 trillion dollars) of global e-commerce payments in 2021. In the coming years, this share is expected to increase to 52.5% by 2025.

The popularity of digital wallets and competition in this field are increasing every day as banks, GSM operators, payment institutions, meal card companies, and loyalty programs offer their own digital wallet solutions.

References:

- Payment system - by Alex Xu - ByteByteGo Newsletter

- Dijital Cüzdanlar. Dijital cüzdanlar kullanıcısının ödeme… | by mustafa aktaş | Bankalararası Kart Merkezi | Medium

- What Is A Staged Digital Wallet? | GoCardless

- Digital Wallet - Overview, Significance, Examples, Types (corporatefinanceinstitute.com)

- Digital Wallet Guide November 2020 (visa.com)

- E-ticaret ödemelerindeki dijital cüzdan payının, 2025 yılında yüzde 52,5'e çıkması bekleniyor - Webrazzi

- Dijital Mobil Ödemelerin Yükselişi ve Mevcut Regülasyonlar | Fintechtime

Back

Back