Not a day goes by without a conversation about artificial intelligence.

Although it may still feel foreign to many of us, AI has already settled at the heart of our lives often without us even realizing it. We can’t stop asking questions, and we can’t resist trying it out.

So, what role will we play in this transformation? Will we view technology merely as consumers? Or, as stated in our mission, can we go beyond just using technology and become producers and trailblazers?

Today, we are faced with the reality that artificial intelligence is transforming not only the tech sector, but all sectors. Creating technology is no longer the sole domain of the tech sector; it has become a collaborative ecosystem shaped by multiple disciplines.

If we want to be active players in AI, we must begin by asking the right questions and move forward with determination:

• “Should we develop our own LLM, or move forward with open-source models?”

• “Do we have the necessary hardware? Can we produce it? Should we?”

• “Can our GPU and data center infrastructure handle the load?”

• “Is our telecom infrastructure strong enough? How advanced is our fiber network?”

Each of these questions is important. But an even more critical question remains:

Is it possible or necessary to compete in the same league as the global tech giants?

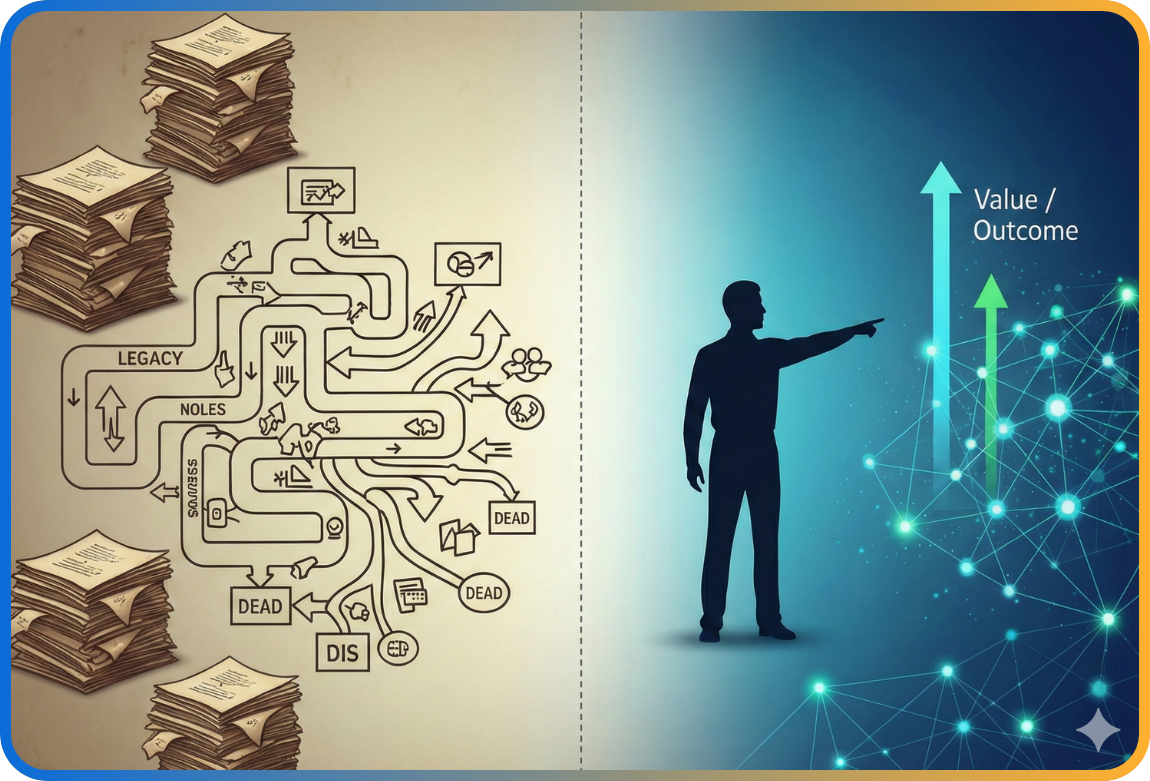

While AI giants have millions of paying subscribers and billions in investment backing, Türkiye’s entire ICT (Information and Communication Technologies) market is still smaller than a single company’s investment volume. So the real question becomes:

Where and how should we run this race?

Perhaps the answer is: “To step onto the field as a regional power in vertical areas of expertise.”

In sectors where we have deep expertise—such as banking, which is data-driven and heavily regulated—we can make a difference by combining hyperautomation with artificial intelligence.

Today, Türkiye’s banking ecosystem has the capabilities to deliver both in-house and outsourced solutions. However, in order to make this competence globally competitive, we must now unite our resources and go global with joint products and services in specific verticals. Because this transformation is no longer a luxury, but a necessity.

Shall we start with hyperautomation vertical in banking?

Now is the right time to empower the future through hyperautomation and AI in the banking sector. Whether we develop in-house or outsourced solutions within our financial ecosystem, we are now faced with the imperative to unite our resources and act collectively. If we can integrate our products and capabilities through an outsourced strategy in targeted verticals, we can increase our chances of entering global markets with competitive solutions and achieving sustainable growth. Because if we want a share of the global stage, scaling together is the only way forward.

The transformative power of AI makes hyperautomation a critical tool in a sector like banking, which is data-intensive, highly regulated, and characterized by rapidly changing customer expectations. It is no longer just about speeding up processes; it is becoming possible to build smarter, predictable and customer-focused systems.

This transformation in the financial sector is especially evident in five areas:

-

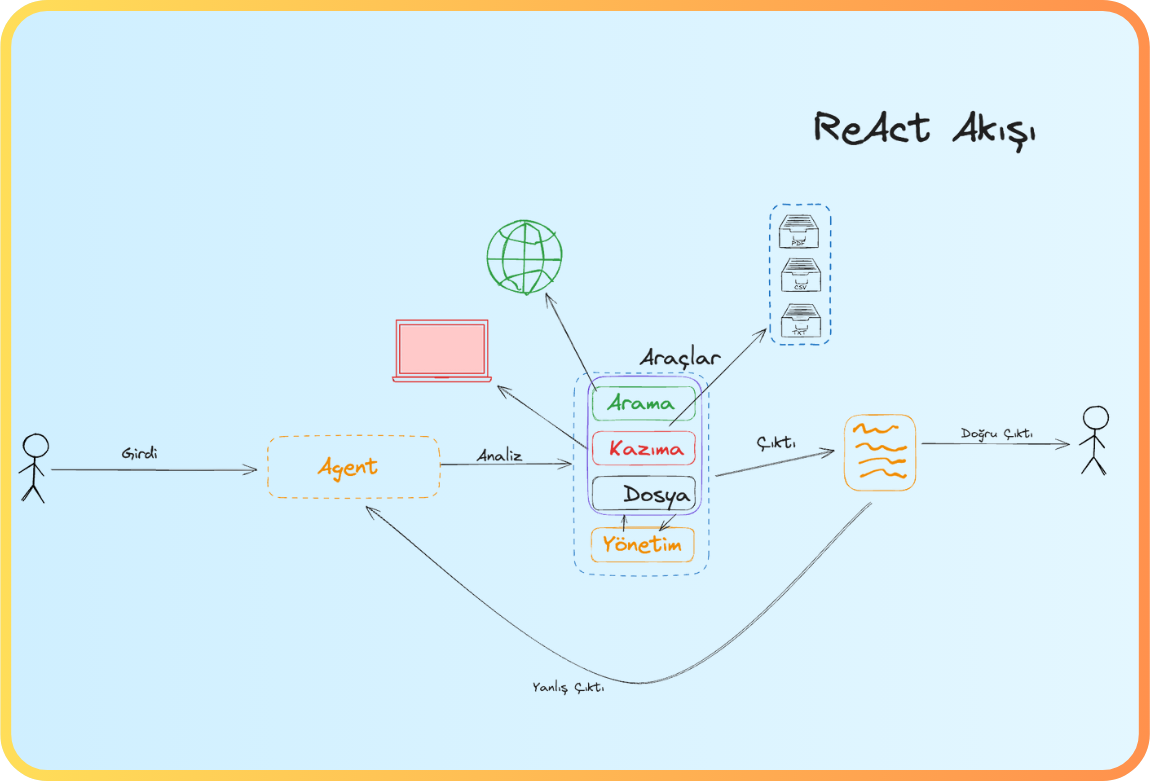

AI enables more accurate decision-making through data analysis.

-

It simplifies processes by making sense of unstructured data.

-

It predicts risks in advance, making systems more proactive.

-

It continuously improves processes through self-learning algorithms.

-

It enhances decision-support mechanisms through human-machine collaboration.

As a result, hyperautomation in banking not only accelerates processes, but also makes them more accurate and improves customer satisfaction. AI has become one of the most critical building blocks of this transformation. It is now possible not only to increase operational efficiency, but also to build smarter, predictable and customer-focused systems. This transformation is not optional for the banking sector; it’s a prerequisite for sustainable growth and global competitiveness.

So why not start building the future with banking?

Back

Back