Introduction: The Transformation of Banking and the Role of Artificial Intelligence

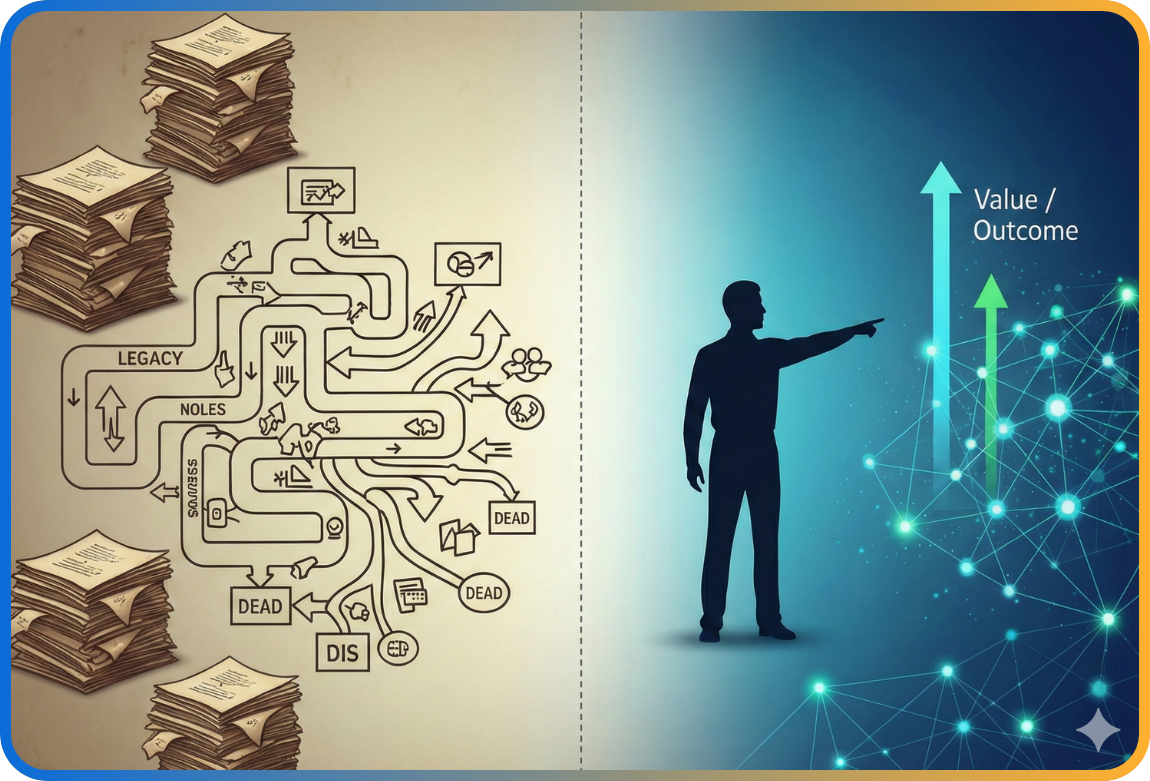

Although banking has been one of the cornerstones of the social order for centuries, it is a field that has still not completed its structural transformation. While traditional banking consisted of deposits, credits, risk management, customer relations and operational processes, digital technologies and especially artificial intelligence-based approaches have begun to radically redefine this framework in the last 10 years.

Today, banking is not only a financial intermediation activity, but also a laboratory of the interaction between technology and people at the same time. In this period, which we can call “Banking 4.0” or “artificial intelligence supported banking,” we observe technical limits and opportunities, while at the same time we have the opportunity to think about mind-opening scenarios for the future.

Where is Artificial Intelligence in Banking?

The transformation that occurred with the advent of computers is now being experienced with artificial intelligence. We no longer have the option of going back to banking done with pen and paper before computers entered our lives. The transformation brought about by the advent of computers and digitalization is now being experienced with artificial intelligence. Artificial intelligence has permeated every layer of banking today. In front office applications, smart chatbots, voice assistants, and natural language processing-based systems used in customer service are coming to the fore. These technologies not only respond to customers but also provide personalized recommendations. Mobile application assistants in Türkiye can be considered among the most current examples that have entered our lives the fastest.

Artificial intelligence is being deployed in critical functions such as credit scoring, fraud detection, anti-money laundering controls, and customer complaint analysis in the middle office. The models used in this field must operate under the constraints of both regulatory pressures and transparency requirements. In the back office, applications such as process automation, document processing, intelligent OCR, and customer identity verification are now largely AI-powered. In fact, in banking applications in Türkiye, reducing the model development time from days to minutes demonstrates the power of this transformation and the Turkish banking sector's pioneering role in this area. For example, today a bank's annual targets are broken down at the minute level based on the performance of all operations, branches, and employees at the bank, and target tracking can be carried out in real time.

The banking sector in Türkiye has quickly embraced these developments. Research shows that almost all large-scale banks use artificial intelligence in areas such as fraud detection, QR payments, and chatbot applications. For example, a bank can scan 40 million transactions per day, flag approximately 500 potentially suspicious transactions, and reduce fraud losses by over 98%. As another example, we can see that speech-enabled artificial intelligence systems are used in collection processes, significantly reducing the workload of customer representatives.

All these developments are also having a noticeable impact on the financial performance of banks, taking it to a new level. Empirical studies show that artificial intelligence innovations increase banks' return on assets. Leading consulting firms emphasize that banks need to develop not only individual models but also an infrastructure encompassing end-to-end artificial intelligence capabilities to sustain this value growth.

Technical Limitations, Challenges, and Problem Areas

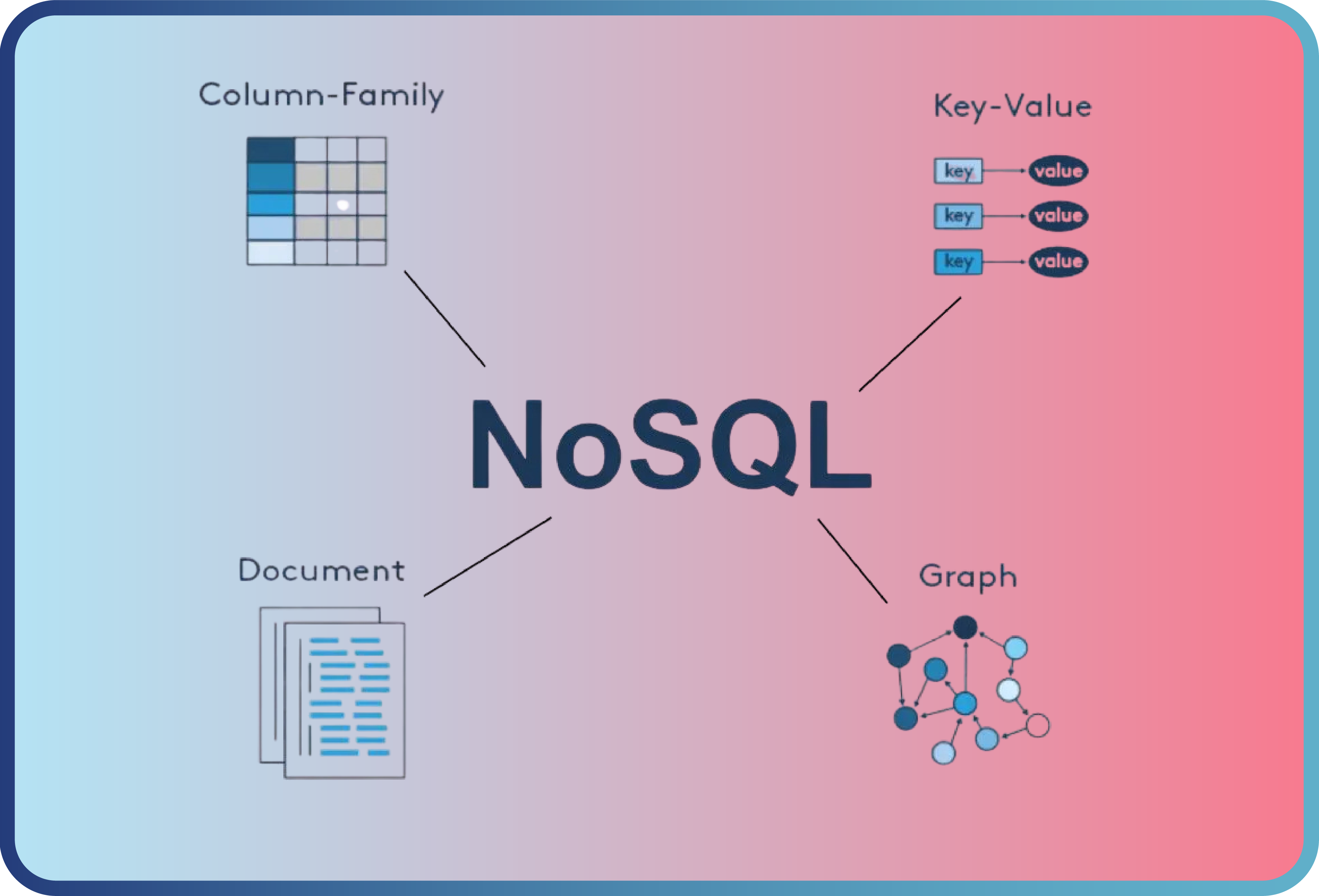

The most important and primary factor limiting the use of artificial intelligence in banking has emerged in data quality. The data held by banks often comes from a wide variety of sources, may be incomplete or inaccurate, and exists in different formats. Therefore, cleaning, labeling, and converting the data into the appropriate format is a critical process. Additionally, these data may contain hidden social biases. For example, income data can reproduce socioeconomic inequalities. This situation highlights the importance of a responsible approach to artificial intelligence.

Security is another critical area. Artificial intelligence systems may become vulnerable to cyberattacks. Poisoning training data, misleading the model with counterexamples, or reverse engineering the model pose serious threats to banks. Therefore, robustness and security must be an integral part of artificial intelligence systems.

In addition, regulations and legal frameworks also pose a significant barrier to artificial intelligence. Explaining the reasons behind decisions such as credit rejections, protecting personal data, and ensuring models are auditable are now becoming legal requirements. Banks must develop artificial intelligence systems in a manner consistent with these frameworks.

Beyond all these technical challenges, organizational barriers also pose a significant obstacle. Artificial intelligence projects often remain in the pilot phase and cannot be scaled up. The reason for this is not only technical, but also cultural. Employees' fear of job loss, management's lack of readiness for change, or low artificial intelligence literacy can be prominent reasons for projects slowing down.

Future Trends and Opportunities for Türkiye

We can foresee that banking will become even more integrated with artificial intelligence in the future. Generative artificial intelligence and large language models will make customer interactions much more natural and provide support in areas such as interpreting legal texts, preparing reports, and managing internal communications. However, it can be predicted that human oversight will be mandatory to counter the risk of faulty production with these technologies.

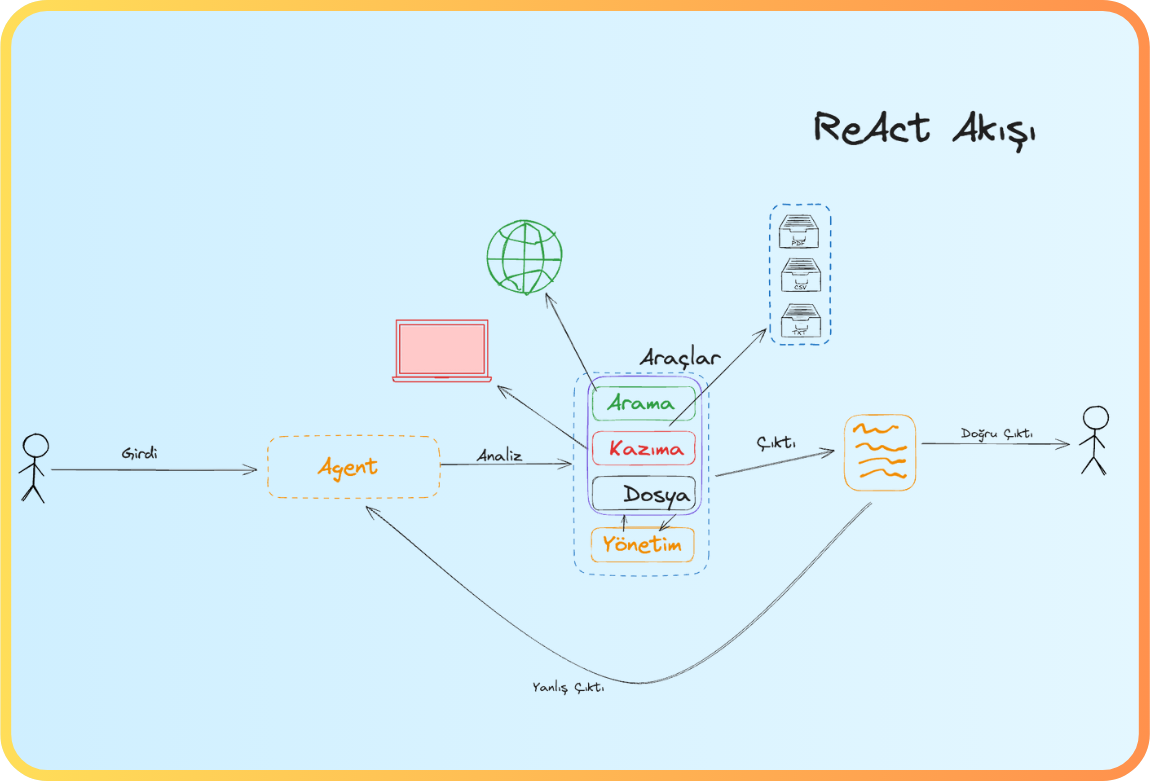

In the future, agent-based systems, namely autonomous software agents, will become an indispensable part of the banking ecosystem. For example, it can be said that agents who handle and evaluate a loan application from start to finish, approve it, or rebalance the customer portfolio according to risk tolerance will become mandatory in daily operations.

Continuing with the same example, today the credit application process is multi-stage, multi-actor, and requires numerous documents and information. For example, creating an agent that, upon a company's “apply for credit” command, explains credit alternatives and handles all the background work without requesting a single piece of information or document based on preference, and advances the process by preparing all the processes and documents from public institutions, the company's data sources, or previously recorded information at the bank, is no longer a dream. The integration projects of the 90s resulted in applications such as e-Government, and the impact of these integrations continues today. Applications such as open banking can perhaps be seen as a reflection of the technologies of the 90s. Today's change, however, is enabling systems where integrated systems at the artificial intelligence level emerge, and all institutions are connected not only at the data level via APIs, but also at the artificial intelligence level, through processes, context, flow, and shared purpose. These integrations will enter our lives much more quickly, but we will see together how long it will take.

In parallel with all these developments, privacy-friendly learning methods such as “federated learning” will offer opportunities to overcome data privacy barriers in countries like Türkiye. Banks will be able to train shared models without centralizing their data, which will provide both a competitive advantage and innovation.

In a world where ESG (Environmental, Social, and Governance) criteria are becoming increasingly important, artificial intelligence will become a powerful tool for analyzing environmental and social impacts. Turkish banks can differentiate themselves at this point by producing multidimensional reports that draw not only on financial statements but also on social media, news feeds, and global data sets.

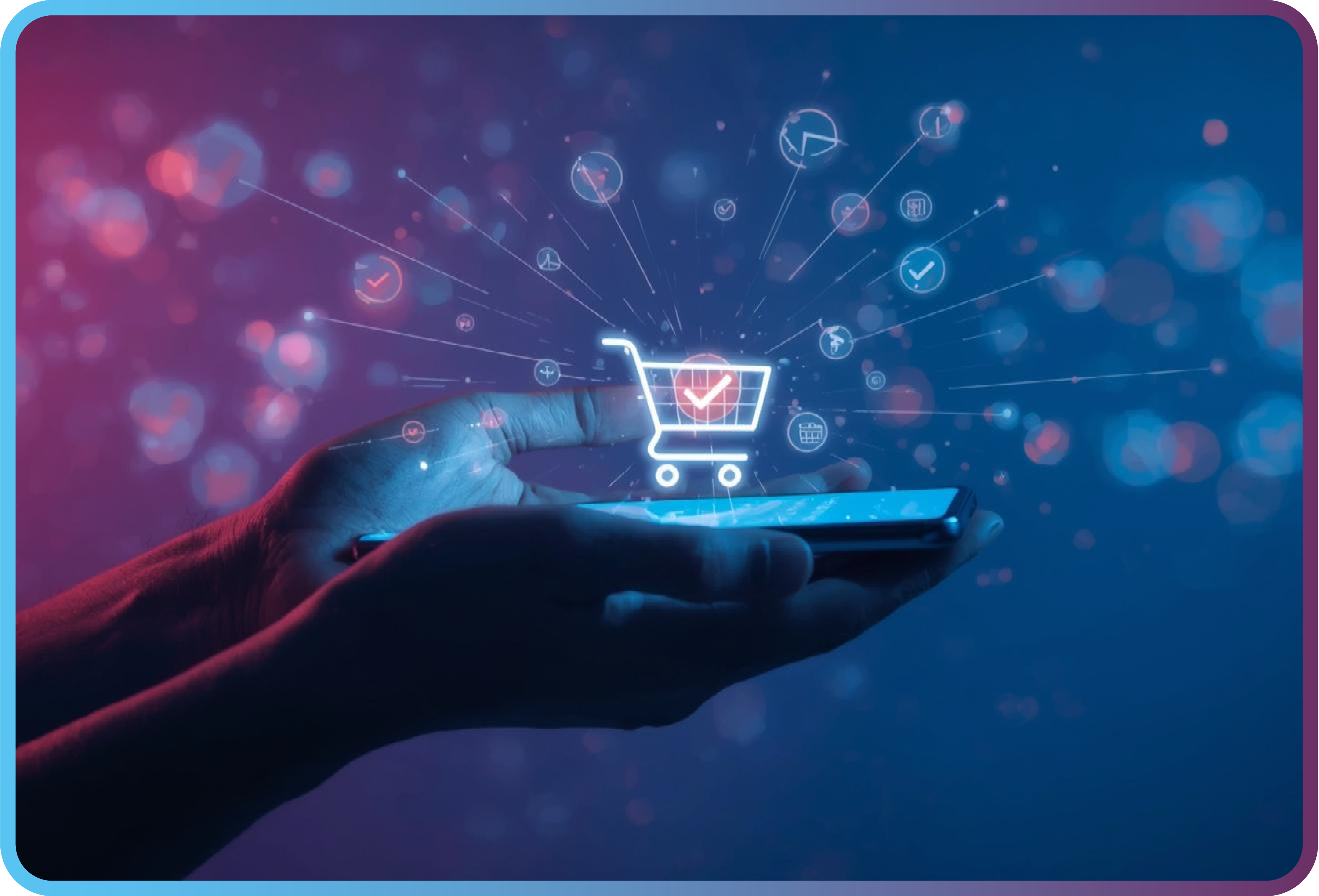

Super apps can transform the financial ecosystem in countries with high digitalization rates, such as Türkiye. Super apps that offer banking, insurance, investment, and payment services under one roof can completely transform the customer experience when combined with artificial intelligence. The rapid spread of these applications in countries such as China and the management of all related financial structures through a single application are causing significant transformations in the banking sector, and similar transformations are considered imminent developments for countries such as Türkiye.

The acceleration of CBDC (Central Bank Digital Currency) studies is also opening up a new field. Alongside the digital Turkish lira, artificial intelligence is expected to play an active role in fraud prevention, smart contracts, and automated payment mechanisms. In the longer term, quantum computing will multiply the power of artificial intelligence in portfolio optimization and financial simulations.

The Importance of Being Human

Despite all these technological advances, the role of humans is not diminishing. Although qualities such as empathy, value judgment, ethical evaluation, and understanding social context are unique to humans, artificial intelligences' ethical codes are causing a rapid shift from virtue ethics to utilitarian ethics. Artificial intelligence can learn from data but cannot make sense of it; it can recognize patterns but cannot grasp social context, it has no virtues, physical pain and suffering are just numerical data, and it cannot understand the difference between the two. We are building systems that can only read the impact of decisions on people through digital data, and it is impossible to fully understand their impact on people. Therefore, as with all the systems we have built so far, it becomes clear that people must be involved in these systems as well.

We are entering a phase where we will question what it means to be human more in the coming years. The systems will operate, but they will be different from all other systems; a person will be required to work integrated into the system, something that does not exist in any other system. The concept of “human,” which we have robotized and turned into a cog in the system, now seems to be redefined in a very different way, as something that is only human and separate from the system, and contrary to its years of working in harmony with the system, now with a role that criticizes the system.

The applications in the field can be handled much more simply. For example, customers will want to feel that there is a human being behind financial decisions, but at the same time, they will want a system free from human error; it appears that we will see a hybrid structure where human intuition and decisions are intertwined with their algorithmic reflection, with artificial intelligence and humans complementing each other. Ultimately, banking is not just about transferring money, extending credit, or collecting deposits; it is also the institutionalization of abstract concepts such as trust, time, and risk management.

A bank is essentially the embodiment of trust in society, expectations for the future, and the management of uncertainty. In this sense, as I mentioned at the beginning of this article, banking will once again serve as a laboratory for the integration of humans and artificial intelligence, and it seems that it will give us the opportunity to re-examine these relationships in every culture, every legal and social structure.

Future Outlook for Banking and Software Employees

For those working in banking software, this transformation represents both an opportunity and a risk. Simply coding will no longer be sufficient; there will be an increasing need for experts who can design end-to-end artificial intelligence systems, process data, make models explainable, and ensure security.

The good news is that it's now much easier for people to do all of these things. In the past, a person who saw, analyzed, and generated ideas for a system might have needed 100 people to keep that system alive and make it possible. With advancing technological capabilities, that person now has the ability to manage the process alone, gain end-to-end control, and bring it to life much more quickly and efficiently.

In the long term, we can say that we may transition to a platform where very few people design, critique, or establish rules for the system, where new systems are implemented very quickly, and where errors, critiques, and all threats are processed very quickly to improve the system. For example, a one-person bank is still a fantasy today, but using current technologies, we can see that a one-person bank with only one employee is now possible.

Of course, the impact of artificial intelligence is not limited to the banking sector. Today, the concepts of money, economy, and finance upon which the banking system is built are being questioned again. For example, in the digital world, we have access to unlimited resources (for example, an app can be downloaded by an unlimited number of people from the App Store, and the cost for copies made after the app is created is quite low). In the physical world, developing technologies are rapidly digitizing, and digital transformation is taking place in almost every field, including manufacturing (Industry 4.0), agriculture, livestock, transportation, and communication, bringing us closer to unlimited resources every day. Actually, we don't need unlimited resources; it's enough that we can supply more than humanity can demand. In such a future scenario, if there were no limited resources, what would happen to the existence of money? And we must question what banking, finance, and economic systems based on the concept of money will become.

But let's focus on the near future. In the near future, data engineering, model monitoring, ethical audit modules, agent-based architectures, and continuous learning mechanisms are likely to become new areas of responsibility for software developers in banking applications. It is foreseeable that professionals who combine financial knowledge with artificial intelligence expertise will come to the fore during this period.

It would not be an exaggeration to predict that nearly half of banking will be conducted by autonomous agents within the next 10 years. The concept of experiential banking will deepen, with artificial intelligence analyzing customers' moods to establish more human-like communication with them. Banks will develop insurance products against artificial intelligence errors, and customers will interact with banks using their own micro-agents.

Artificial intelligence banks tailored for SMEs may emerge in Türkiye. Microcredit models that utilize alternative data sources can increase SMEs' access to the financial system through fast approval processes and low-cost financing. This type of innovation will strengthen banking's social function as well as its economic function. My personal view is that the most significant transformation will occur through AI developments on the SME side, and that this will play a very critical role for Türkiye. Of course, here too, the banks and their transformation, which will once again be the driving force behind Türkiye's transformation, with their pioneering and multiplier effect, and the banks' approach to technology, processes, and most importantly, “people,” are seen as critical.

Conclusion

The integration of banking and artificial intelligence is not merely a technological transformation; it is a revolution with ethical, social, and human dimensions. Türkiye has the potential to play a leading role in this transformation, not merely a follower. However, no matter what technology emerges, human empathy, creativity, ethical compass, and sense of trust must remain indispensable. The banking of the future will be a hybrid system shaped by both humans and artificial intelligence. Banks will be the driving force behind this transformation, and their approach to technology, processes, and most importantly, people, will be critical to their own transformation.

References

- Al-Naami, K. M., Şeker, S. E., & Khan, L. (2014). GISQF: An efficient spatial query processing system. Proceedings of IEEE CLOUD 2014, 681–688.

- Arner, D. W., Barberis, J., & Buckley, R. P. (2017). FinTech, RegTech, and the reconceptualization of financial regulation. Northwestern Journal of International Law & Business, 37(3), 371–413.

- Brynjolfsson, E., & McAfee, A. (2017). Machine, platform, crowd: Harnessing our digital future. W. W. Norton & Company.

- Castelnovo, A. (2024). Towards Responsible AI in Banking: Addressing Bias for Fair Decision-Making. arXiv preprint arXiv:2401.08691.

- Frost, J. (2020). The economic forces driving fintech adoption across countries. Bank for International Settlements Quarterly Review, March 2020, 15–26.

- Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265.

- I. Met, A. Erkol and S. E. Seker, Performance, Efficiency, and Target Setting for Bank Branches: Time Series with Automated Machine Learning, in IEEE Access, vol 11, pp. 1000–1011, 2023, doi: 10.1109/ACCESS.2022.3233529.

- I. Met, A. Erkol and S. E. Seker, M. A. Erturk, B. Ulug, Product Recommendation System With Machine Learning Algorithms for SME Banking in International Journal of Intelligent Systems, 2024, https://doi.org/10.1155/2024/5585575

- Kovacevic, A., Radenkovic, S. D., & Nikolic, D. (2024). Artificial intelligence and cybersecurity in banking sector: opportunities and risks. arXiv preprint arXiv:2412.04495.

- McKinsey & Company. (2024). Extracting value from AI in banking: Rewiring the enterprise.

- Narang, A., Vashisht, P., & Bajaj, S. B. (2024). Artificial Intelligence in Banking and Finance. Innovative Research Publication.

- Şeker, S. E. (2015). Computerized Argument Delphi Technique. IEEE Access, 3, 368–380.

- Şeker, S. E. (2024). Editorial: Large language models in work and business. Frontiers in Artificial Intelligence, https://doi.org/10.3389/frai.2024.1516832

- Şeker, S. E., Mert, C., Al-Naami, K., Ayan, U., & Özalp, N. (2013). Ensemble classification over stock market time series and economy news. Proceedings of IEEE ISI (Intelligence and Security Informatics), 272–273.

- Şeker, S. E., Mert, C., Al-Naami, K., Özalp, N., & Ayan, U. (2013). Correlation between the economy news and stock market in Turkey. International Journal of Business Intelligence Research, 4(4), 1–21.

- Xu, J. (2024). AI in ESG for Financial Institutions: An Industrial Survey. arXiv preprint arXiv:2403.05541.

Back

Back