What is Central Bank Digital Currency (CBDC)?

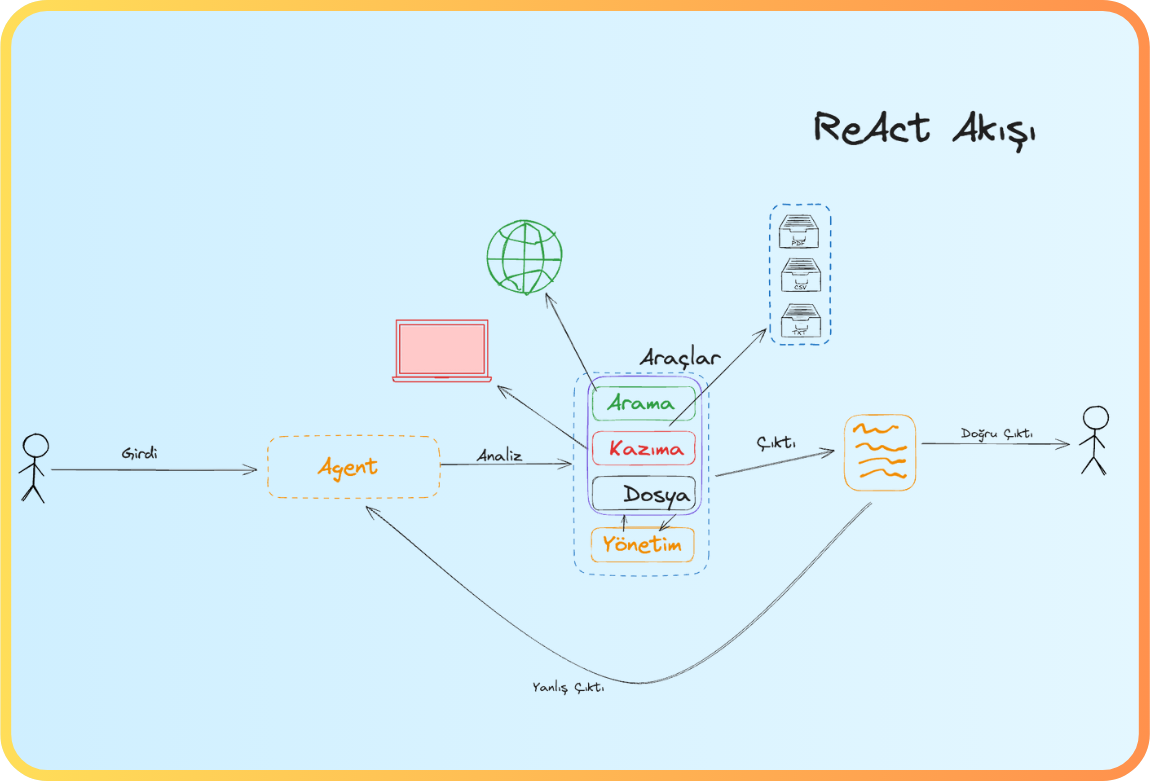

Central bank digital currency refers to the digital currency created and operated by central banks. CDBC operates through a system managed by the central bank and is generally made available to users through a mobile application through an electronic wallet infrastructure operated by the central bank. In addition, thanks to the service infrastructures offered by the central bank, transactions can be made and wallet information can be viewed from applications belonging to banks, payment institutions or e-money institutions. (This part will become clear with the framework of the regulations.)

Storing citizens' digital currencies within central banks will strengthen the hand of financial regulators in terms of taxation. In addition to spreading taxation to a broader base, the opportunity to easily monitor the economic activities of individuals and legal entities will also emerge. In this respect, a more fair and widespread taxation system can directly contribute to economic growth. On the other hand, tracking the money can be done more powerfully; Financing of terrorism, money laundering, illegal activities, smuggling or many other irregular transactions can be prevented. In addition to providing administrative cost advantages in general,

CBDC will provide serious benefits to economies with its benefits in terms of taxation and trace of money. In addition to these benefits, it can also open the door to serious changes on the banks front. Citizens who will make transactions through central bank digital wallets will interact with banks on less operational issues. In addition, citizens who cannot easily access physical channels such as bank branches and ATMs will be able to easily participate in payment systems ecosystems through the electronic wallets that central banks will offer them.

Digital money is a payment method that exists only electronically and is intangible, unlike banknotes and coins. Digital money can be transferred between entities or users with the help of technologies such as computers, smartphones and the internet. Although similar to physical currencies, digital money allows unlimited transfer of ownership as well as instant transactions. Digital currencies can be used to purchase goods and services, serve as a means of accumulating wealth, and therefore can fulfill the traditional functions of money (Tüysüz, 2022: 17,18).

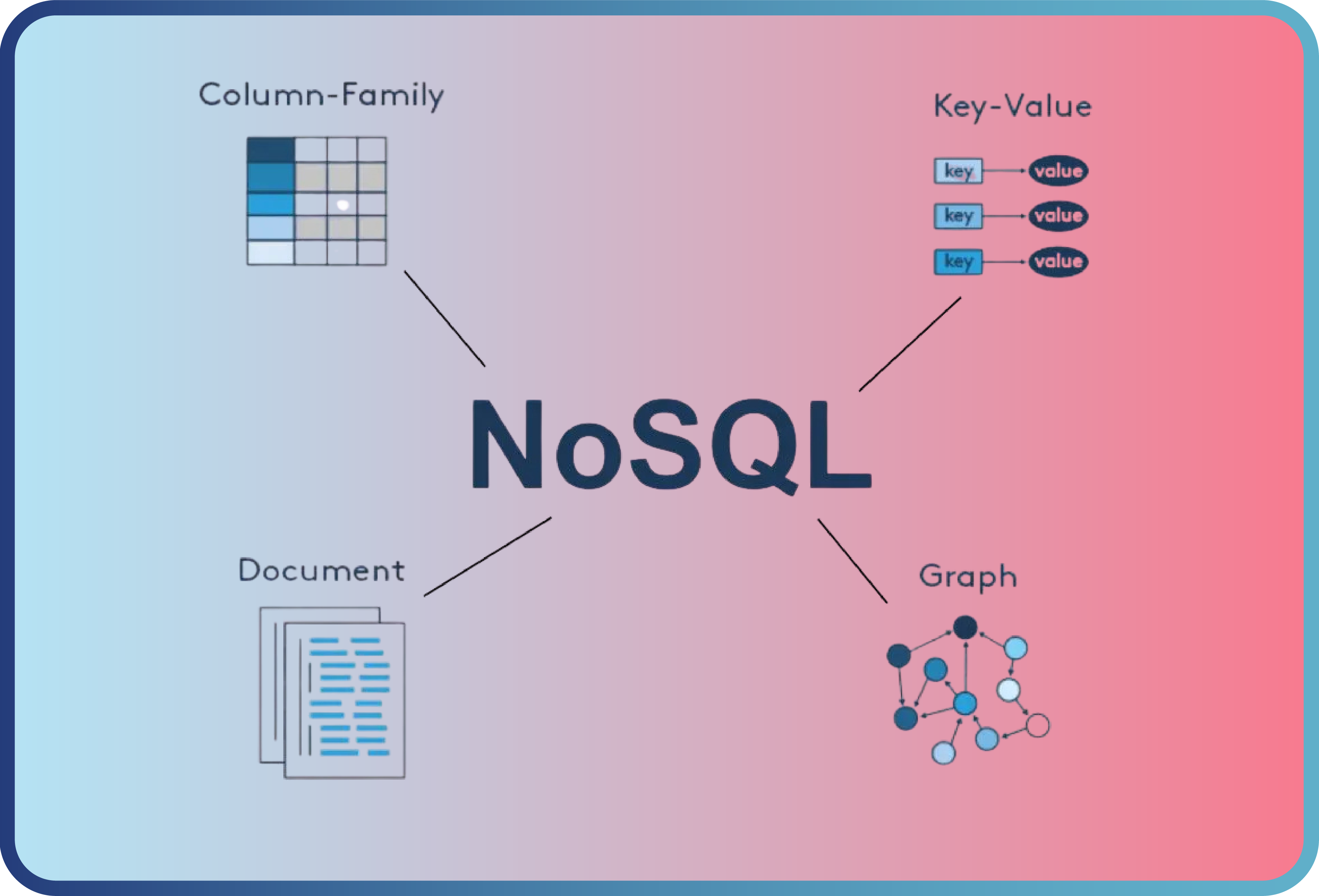

Differences of Central Bank Digital Currency from Cryptocurrencies

CBDC, unlike cryptocurrencies, is managed by a centralized structure. It is a digital currency managed by a central bank or government and is usually based on a country's official currency. For example, in Turkey, the Central Bank Digital Currency is called Turkish Lira (TRY) and is a digital version of the Turkish Lira.

CBDC is generally valued and used similarly to a country's fiat currency, but can also operate similarly to cryptocurrencies through the operation of their wallet structure. Cryptocurrencies have blockchain and distributed ledger technology infrastructure. Cryptocurrencies can enable the transfer and use of currencies whose main source is unknown. CBDC, on the other hand, makes it almost impossible to launder money under the control of central banks.

Are there any CBDC studies in Turkey?

In 2020, CBDC studies will be implemented in Turkey in cooperation with the CBRT and TÜBİTAK; It was announced that the design, development and testing phases of the instant payment system will begin.

In September 2021, while it was announced that the "Digital Turkish Lira Cooperation Platform" was established by reaching an agreement with the The Central Bank of the Republic of Turkey (CBRT) , ASELSAN, HAVELSAN and TÜBİTAK-BİLGEM, the following statements were included in the official announcement: "CBRT announced that the circulation of the digital Turkish lira, which will complement the existing payments infrastructure, continues to investigate its potential contributions. "The process, which started with the completion of the proof of concept study within the scope of the Central Bank Digital Turkish Lira Research and Development (R&D) project, is taken to the next stage with the participation of technology stakeholders."

Picture: Signing an agreement on the Digital Turkish Lira R&D Project platform

It was announced that, within the scope of the first phase studies of the Digital Turkish Lira Project, which is being carried out under the leadership of the CBRT in December 2022, the first payment transactions on the Digital Turkish Lira Network were successfully completed.

The narrow-scope and closed-loop pilot application tests carried out by the CBRT together with technology stakeholders continued in 2023.

The Medium-Term Program (2024-2026) report prepared by the Ministry of Treasury and Finance and the Strategy and Budget Directorate included targets for the Digital Turkish Lira. The Digital Turkish Lira legal regulation is aimed to be implemented in the 4th quarter of 2024. Until this date, studies will be carried out to disseminate the Digital Turkish Lira in line with the results obtained from the second phase pilot studies.

How is CBDC progressing in countries around the world?

CBDC has been around as a concept for a very long time in many countries around the world. The United States central bank, the FED, is currently being cautious on this issue. Countries such as England and Norway are keener on the issue. Meanwhile, in China it is called “Digital Yuan (e-CNY)”, in Sweden it is called “e-Krona”, in Nigeria it is called “eNaira”, in the Bahamas it is called “Sand Dollar” and in Jamaica it is called “Jam-Dex”. There are examples available for use.

The Digital Currency project called Ice Breaker, which will be jointly carried out by Norway, Sweden and Israel under the coordination of the Bank for International Settlements (BIS), was announced in 2022. In the Ice Breaker project, a joint research has begun to be carried out on how digital money can be used in end-user transactions, international trade and money transfer transactions.

The Bahamas currency, the Sand Dollar, has not yet reached the desired usage numbers due to the lack of necessary incentives within the country and the insufficient PR efforts. Analysis and research studies have been concentrated in the UK since 2022, and they aim to launch CBDC by 2025.

Jamaica is one of the countries that managed to implement CBDC money in 2022. As in the Bahamas, the use of wallets and new money is at very low levels due to the lack of incentive mechanisms.

In May 2021, the Digital Dollar Project planned to launch five pilot programs to test the potential of CBDC for use in the United States.

Starting from 2014, China's central bank started working on the "digital yuan". Developments in China are progressing rapidly, it is very exciting and serious progress has been made.

Digital Currency Pioneer Country: China

2020

In April 2020, testing began in four cities around China (Shenzhen, Suzhou, Chengdu, and Xiong'an) to improve the currency's functionality. Testing areas include currency reliability, stability, ease of use, and regulatory issues such as preventing money laundering, tax evasion, and terrorist financing.

The currency can be transferred to bank accounts or used directly at select merchants and controlled through apps on one's smartphone.

As of April 2021, more than 100,000 users were using such applications developed by banks, including six state-owned banks.

The digital currency can be spent at stores like Starbucks and McDonald's in China, as well as online shopping platforms like JD.com.

2021

By April 2021, digital currency tests were expanded to 6 more provinces: (Shanghai, Hainan, Changsha, Xi'an, Qingdao and Dalian.)

By the end of 2021, transactions worth $13.8 billion were carried out, while there were 261 million users in the system.

2022

On March 31, 2022, the People's Bank of China announced that the tests were expanded to 6 more provinces: Tianjin, Chongqing, Guangzhou, Fuzhou, Xiamen and Zhejiang provinces, which host the 2022 Asian Games, launched digital currency.

2023

Starting in May 2023, Changshu in Jiangsu province began implementing salary payments in e-CNY for public employees as well as staff in state-owned enterprises and public institutions.

On July 11, 2023, Bank of China, China Telecom, and China Unicom jointly announced SIM card-based e-CNY wallets that allow offline payments using the SIM's NFC feature.

Effects of the Central Bank Digital Money System on the Banking Sector

CBDC will have serious impacts on banking systems. First of all, when using CBDC, the need for citizens to open bank accounts may be eliminated. Because, thanks to the wallet that the Central Banks will give to citizens, citizens/customers will be able to view their accounts through this application. They will be able to transfer money and make payments to other people's wallets. The most basic transactions can be made through central bank wallets. However, it is possible for citizens to return to banks for the advantage’s banks will offer due to needs such as financing needs, use of checks/promissory notes, and collections. With this aspect, the way banks work may change with the widespread use of digital currencies.

Thanks to digital currencies and wallets, the speed of transactions can increase while their costs can decrease. As a result of the competition that will arise, banks will tend to reduce their own costs. This situation will force banks to work much more efficiently. In addition, thanks to digital currencies, the working areas of banks can also expand. For example, thanks to digital currencies, banks can provide services worldwide and even operate without the need for a physical branch. Thanks to digital currencies, fintech companies that offer new financial services may emerge and these companies can serve as competitors to traditional banks.

Digital money system could be the money system of the future. Especially during the Covid-19 epidemic, the use of digital payment methods increased and people started to use digital channels more. Therefore, the digital money system may be more preferred in the future and may have the potential to be the monetary system of the future. In order for the digital money system to be a reliable system in the future, having central banks behind it is an assurance to rule-making institutions and customers. Central banks can produce and operate digital currencies.

Will paper money disappear?

Only if the digital money system is 100% accepted within a country's borders can paper money disappear completely. Digital money does not exist in a physical medium like paper money and is only traded electronically. Therefore, in the digital money system, the use of paper money can be completely eliminated and all transactions can be carried out digitally. However, for this to happen, all countries must switch to a digital money system and all users must agree to use this system.

While central banks' digital currencies can perform some functions of money, they do not have the power to perform all functions. For example, central banks can use digital currencies to control the money supply and thus prevent inflation. On the other hand, since the factors that determine the value of digital currencies may be beyond the control of central banks, central banks may not be able to determine the exact value of their digital currencies.

Thanks to the digital money system, customers' trips to and from bank branches can be reduced. With the digital money system, customers will have the opportunity to make payment transactions requiring digital money through the balances loaded into digital wallets belonging to payment institutions other than the central bank or banks. In this way, citizens will be able to act more democratically in basic transactions such as account transactions, transfers and payments without the need for bank mobile applications. These situations will not only require less operations for banks, but may also mean that they will waive commissions on basic transactions. Banks' operation centers and operational structures in branches will be able to provide service to customers with a more minimized organization.

How is employment affected?

If the Central Bank digital money system completely replaces the existing physical money and a large part of banking transactions are carried out with digital currencies through digital wallets, then employment capacity in the banking sector may decrease. On the other hand, if the Central Bank digital money system is implemented in addition to the existing banking system and some of the banking transactions are still carried out in the physical environment, then there may be no decrease in employment capacity. New business sectors and areas of expertise may emerge as new business areas and earning opportunities arise for fintech and payment institutions. The change and rapid transformation in the sector will offer more diverse job opportunities to information technologies and human resources. Opportunities in business models will trigger more activity in the startup world, allowing entrepreneurial individuals to quickly get involved in business life.

Is digital money more hygienic?

CBDC is thought to be more hygienic than the paper money system. Paper money used in the paper money system must be disinfected periodically to be hygienic. In this respect, physical money has a hygiene problem. On the other hand, in the digital money system, the devices used during money transfer (especially mobile phones and computers) have the potential to become extremely dirty and collect bacteria. For this reason, we cannot say that the digital money system is hygienically advantageous compared to the paper money system

How does the pandemic affect processes?

Covid-like outbreaks around the world may accelerate central banks' transition to the digital money system. In particular, efforts to reduce the use of cash may increasingly turn towards digital money systems. Additionally, due to the pandemic process, measures can be taken such as reducing or even banning the use of cash in various places. This may lead to increased use of digital money. It was specifically designed to reduce the use of physical money and increase the use of digital money as a safer payment method. During the COVID-19 pandemic, many people have preferred to use banks' self-service channels instead of physical money. Additionally, during the COVID-19 pandemic, most people stayed at home and preferred to shop online. This situation can be considered as a factor to accelerate the transition to the digital money system.

The impact of financial innovations on platforms

To define the concept of financial innovation, it can be expressed as "a product or a process that emerges to benefit from profit opportunities arising from the incompleteness of financial markets and/or the ineffectiveness of financial intermediation". The digital platform tools put into service in this process are cash machines (ATMs) and electronic fund transfer (EFT). After the frequent use of electronic payment methods in daily life, the newest phenomenon that emerged was the concept of e-money. Electronic money causes the circulation of money to increase significantly. Digital currencies began to be used as payments and money transfers were made entirely over the internet (Özbaş, 2019: 87).

In the central bank digital money system, ATM devices may not be completely disabled in the first place. In economies where digital money usage is intense, physical transactions on ATMs will decrease. However, the way digital money systems work may be different, and therefore how ATM devices will transform or whether they will survive will be shaped by the strategic decisions of the operating banks and customer demands. For example, by covering all payment methods of citizens with wallet-like applications, customers' need for cash will be minimized. This situation can be inferred that ATM services will be minimized.

The impact of digital money on costs

In the central bank digital money system, transaction costs are reduced. First of all, digital money systems use electronic money instead of physical money, which eliminates physical transactions such as carrying, storing and counting money. In addition, in digital money systems, transactions are generally carried out quickly and directly, which helps to carry out transactions quickly and therefore reduce transaction costs. Additionally, because digital money systems have no intermediaries between banks and other financial institutions, no additional fees are required to transfer money between transactions, reducing transaction costs.

The effectiveness and role of central banks in macroeconomic management is very great. Central banks carry out this activity by using monetary policy. In order for these applications to catch up with the developing financial technology, the benefits that digital money will bring to the economy and the costs to be incurred must be taken into account (Coeure, 2018).

The cost of operating a central bank digital money system may be lower than managing physical money. For example, in physical money management, expenses are required for operations such as printing, distribution and management of money. In addition, taking and managing security measures for a physical monetary system can also be costly. In the digital money system, money is stored digitally and transactions are carried out over the internet, which reduces operating costs. However, since security measures must be taken and managed in the digital money system, extra security software costs will arise.

In the central bank digital currency system, seigniorage earnings are the way the central bank earns profits by holding digital currencies in various financial instruments. The central bank can earn interest/dividend earnings by holding digital currencies in fixed-term securities. Additionally, the central bank can also generate foreign exchange earnings by using digital currencies in trade transactions. These seigniorage gains are made for the purpose of providing liquidity in the central bank's digital money system and preserving the value of currencies.

In the central bank digital money system, the money circulation rate is generally high. This means money transfers can happen quickly and payments can be made instantly. When a customer purchases a product, payment can be processed instantly and money is credited to the seller immediately. This indicates that the money circulation rate is high in the digital money system. Therefore, the central bank digital money system is a practical and fast payment method for use in daily life.

In the digital currency system, the central bank can use the following methods to control the money supply:

1) The central bank may change the digital money supply at regular intervals. With this method, if the money supply is reduced, prices usually fall, and if the money supply is increased, prices usually rise.

2) In the central bank digital currency system, the central bank can control the issuance or withdrawal of digital currencies. With this method, if the central bank issues a large amount of digital money, the money supply increases and prices rise, if the digital money is withdrawn, the money supply decreases and prices fall.

3) In the central bank digital currency system, the central bank can control the issuance or withdrawal of digital currency checks. With this method, if the central bank issues a large amount of digital money checks, the money supply increases and prices rise, if the digital money checks are withdrawn, the money supply decreases and prices fall.

4) In the central bank digital currency system, the central bank can control digital currency reserves. With this method, if the central bank holds excess digital currency reserves, the money supply increases and prices rise, if the digital currency reserves decrease, the money supply decreases and prices fall.

Source

- TÜYSÜZ, N. (2022). Merkez Bankası Dijital Para Tedavülünün Modellenmesi Ve Türkiye’de Bankacılık Sektörüne Ve Katılım Bankacılığına Olası Etkilerinin Değerlendirilmesi

- ÖZBAŞ, M. Y. (2019). Elektronik Para ve Dijital Para: Bitcoin Geleceğin Para Birimi Olabilir mi?. İşletme Ekonomi ve Yönetim Araştırmaları Dergisi, 2(1), 85-104.

- AKBULAK, Y. (2022) Merkez Bankası Dijital Para Birimi Finansal Kapsayıcılığı Genişletmek İçin Doğru Bir Araç mıdır? https://legal.com.tr/blog/genel/merkez-bankasi-dijital-para-birimi-finansal-kapsayiciligi-genisletmek-icin-dogru-bir-arac-midir/

- Coeure, B. (2018). The future of central bank money. Member of the Executive Board of the ECB, at the International Center for Monetary and Banking Studies. Cenevre.

- Merkez Bankası Dijital Parası (CBDC) Modelleri • Başlangıç Noktası (baslangicnoktasi.org)

- Ünlü Ekonomist, CBDC'lerin İnsan Özgürlüğüne Karşı Bir Tehdit Olduğunu Söylüyor • Coinkolik

- CBDC Vs Crypto, IMF Plans To Create A Global Digital Currency System (voi.id)

- Central Bank Digital Currency (CBDC) vs Cryptocurrency. (ccoingossip.com)

Back

Back