-

Digital Banks' Adventure in Türkiye in the Last 3 Years

-

Dijital Banka Kuruluşunda Temel Bileşenler

-

Challenges Faced by Digital Banks in Türkiye

-

Architectural Approach in Banking: Microservice or Monolithic?

-

International Perspective on Digital Banking

-

The 8 Components Successful Digital Banks Need

-

The Circular Future Journey of Digital Banking

A. Digital Banks' Adventure in Türkiye in the Last 3 Years

2022 was the year in which digital banking was institutionalized in Türkiye and a new era began. With the “Regulation on the Operating Principles of Digital Banks and Banking as a Service Model” published by the Banking Regulation and Supervision Agency (BRSA), the digital banking license process was officially launched, paving the way for new generation banks that can offer services entirely through digital channels without opening physical branches. These regulations have enabled the development of innovative business models, especially in digital banking and finance. Digital banks that started operating after 2022 aim to increase financial inclusion in both retail and corporate customer segments. In this article, we will discuss the processes that digital banks have gone through in the last three years since the regulation was published, the stories of their establishment, the challenges they faced and what kind of change and transformation awaits us in the future, as well as the perspective of digital banking internationally.

The following list contains the digital banks established in Türkiye.

Table 1. Digital banks established in Türkiye

B. Key Components in the Establishment of a Digital Bank

In a previous article, we discussed the 5 most important topics in the establishment of a bank. We can state that these 5 topics are of critical importance for digital banks.

Sıddık Kaman Blog Post 👉 Technological Infrastructure Selection in Bank Setup

In addition in this article, we will evaluate the choice of microservice or monolithic architecture, which is an important decision point in technology selection, under a separate heading in the following sections.

C. Challenges Faced by Digital Banks

-

Target Audience Selection: Digital banks may lose focus in selecting their target audience at the initial stage of their establishment. Individual or legal customer preferences can affect many topics such as product range, customer experience focus, digital channel preferences, technological investment processes and intensity, capital utilization, and time it takes to turn profitable. Here, the short, medium and long term expectations and visioning processes of bank management become critical. Unclear target audience choices cause confusion in internal bank structures, technological investments and the solution partner ecosystem. At this point, it is worth remembering that according to the digital banking regulation, the loan customers of digital banks can only consist of financial consumers and SMEs.

-

Conflict of Different Views: In business life, the ability to express different views and to look at things from different perspectives is generally accepted as a competency. In the establishment processes of digital banks, the melting of such different approaches into a common pot contributes to positive outputs to the extent that it serves the common vision set by the bank management. However, in a context where the bank's vision remains in gray areas, different perspectives can lead to conflict and lack of coordination between business units and technology units. This can lead to lost time and high costs until common ground is discovered.

-

Creating Short and Medium Term Visions: In order to prevent the problems mentioned in point 2, it is important for the bank to determine its short and medium-term strategies for the first year and three years, to communicate these strategies to all stakeholders participating in the team, and to disseminate and adopt them throughout the organization. Since all of the Bank's business and IT processes are shaped according to this vision, any complexities that may arise along the way can be overcome by adopting the strategies established at the beginning by all parties and acting on common ground.

-

Profitability: Newly opened digital participation banks may have to act with the promise of a high profit share on deposits due to competition, and on the other hand, they may follow a low-cost loan policy in loan disbursements. Profitability problems may arise in the early years due to technology and infrastructure investments, new personnel employment, the inverse scissors position in deposit and loan rates, advertising, marketing and launch costs. Although it is thought that digital banks will operate with lower (!) costs because they are relatively branchless, in practice this is not very realistic. This is an issue that challenges digital banks globally as well as in Türkiye.

According to a report by WhiteSight, only 27 out of 272 digital banks worldwide are profitable.

Table 2: Profitability Outlook in Digital Banks

To be a successful and profitable digital bank, it is not enough to focus only on Technology and Customer Experience. Paying due attention to revenue-generating products, innovation and cost efficiency plays a critical role in this process. (3)

-

Capital Situation: There may be situations in which the bank needs to bolster its initial capital after the first few years due to unfavorable outlooks in terms of profitability and efficiency, as well as exposure to an inflationary environment.

-

Service Quality: Since digital banks cannot be physically structured due to regulations, customer experience and overall service quality in the digital channels where they interact with the customer become very important. In terms of service quality, although the 99.8% continuity requirement imposed by the regulation is stated as a certain criterion for digital banks, it is important to keep in mind that the focus on service quality consists of many parameters other than the continuity requirement.

We can list some of these parameters as follows:

-

User Experience (UX) and Interface Design (UI)

-

Application Performance and Continuity

-

Customer Support Services

-

Personalization and Segmentation

-

Error and Interruption Management

-

Security and Privacy Perception

-

Multi-Channel Experience (An integrated and consistent experience across channels such as Mobile, Web, Call Center, ATM)

-

Customer Feedback and Customer Satisfaction Measurements

-

Processing Speed and Ease

-

Inclusiveness

-

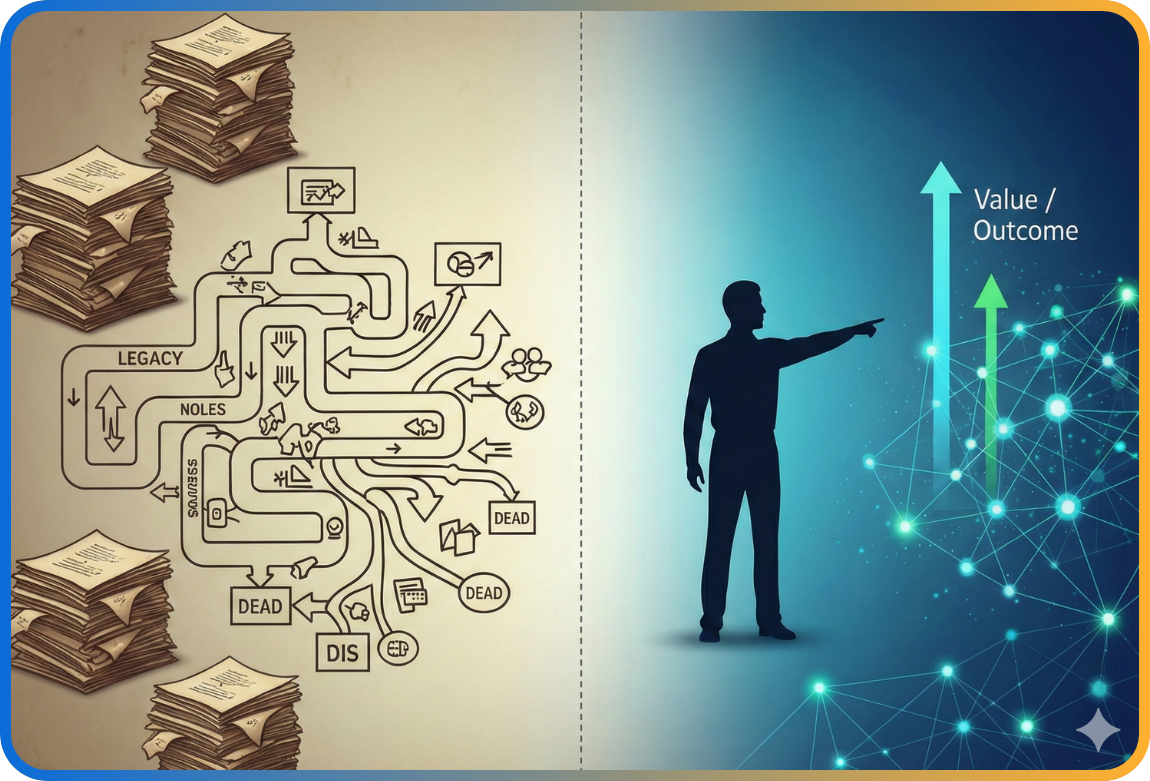

Existing (As-is) Structure or New Developments?: Digital banks may experience uncertainty both during the process of obtaining an operating license and after obtaining an operating license, as to whether they will use the existing core banking application or prioritize new developments with the technology provider IT solution partner company. Here, the first basic task to be completed is to get the existing structure up and running and to make the integrations work, both in terms of speeding up the process of obtaining an operating permit and getting the staff coming from different organizations used to the new system. When new development processes are to be carried out together with the existing structure called “as-is”, it is observed that it is a basic requirement that new development requests are carried out by teams that have a deep understanding of the relevant subject matter for a clear goal.

-

Personnel Structure and Turnover Rate: The establishment process of digital banks is not only limited to technological infrastructure, but is also directly related to the healthy construction of the organizational structure and the effective management of human resources. Digital banks, which are in a new formation, are usually formed by bringing together personnel from different sectors, traditional banking and participation banking, fintech, technology companies and consulting firms. While this diversity offers advantages in terms of rich perspectives and innovative ideas, it can also pose challenges in terms of cultural cohesion and establishing collaborative dynamics.

During the establishment phase, there are likely to be ambiguities in role definitions, incompatibilities in ways of doing business, and communication breakdowns due to the unestablished structure of the organization. This can lead to some areas of conflict, especially in the early years. The development of a common corporate culture needs time and deliberate management strategies.

At this point, the adaptation of employees, especially those in critical positions, to the organization and their commitment to the organization are of great importance. The ability of a digital bank to achieve its strategic goals and achieve sustainable growth is directly related to the knowledge, leadership skills and long-term contributions of these individuals. However, high employee turnover in these key positions can negatively affect the success of the organization by leading to incomplete projects, loss of information and operational inefficiencies.

Therefore, it is of utmost importance that human resources policies are strategically addressed during the establishment phase of a digital bank, and that systems focused on talent acquisition, retention, development and motivation are designed. Working with staff experienced in change management who can lead the process of building the corporate culture will secure not only the establishment period of the digital bank but also its long-term stability.

-

Alignment of Business and Technology Teams: Effective alignment of business and technology teams is essential for the successful establishment and sustainable operation of a digital bank. Business teams' understanding of the digital banking concept and technical operation enables them to define needs more accurately and to accurately identify missing or adaptable points in the processes. These teams make requests to technology teams in line with the bank's strategic goals, which plays a critical role in the efficient use of resources, correctly ranking priorities and strengthening the customer experience.

Similarly, it is vital that the software development and technology teams work in harmony with the business unit teams to ensure that the needs communicated are correctly understood and transformed into fast, quality solutions. This process requires a clear definition of requirements, a balance between technical capacity and business expectations, and a working environment based on mutual understanding.

Developing a common language between business and technology teams, establishing effective communication channels and co-designing processes provide significant benefits in terms of both time and cost. These two fundamental building blocks, working in harmony, enable the digital bank to quickly adapt to its dynamic structure, offer customer-oriented products and services without interruption, and integrate the technological infrastructure with strategic goals. Therefore, it is indispensable for the success of the digital bank that business unit and technology teams act in a structure that learns and produces together.

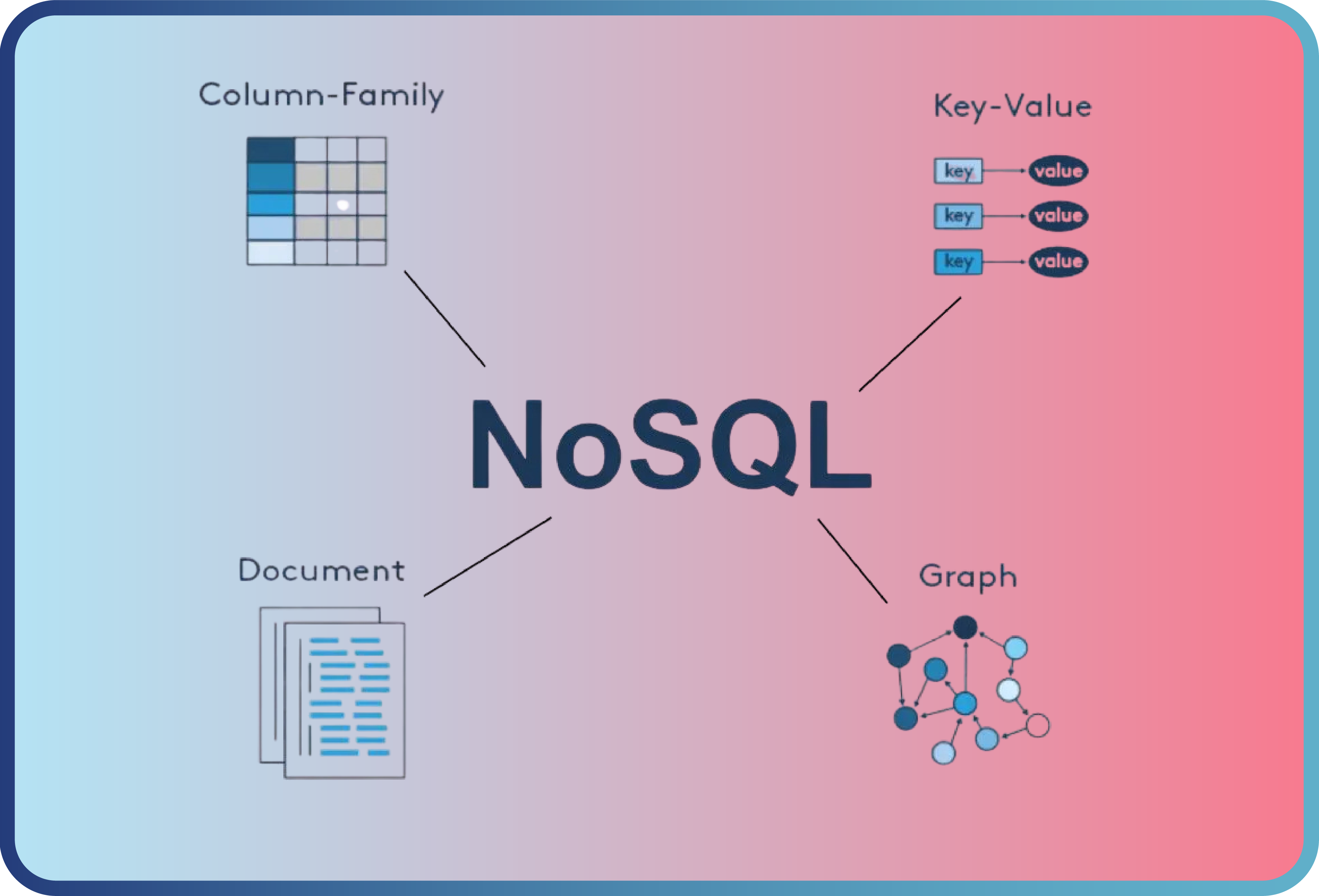

D. Architectural Approach in Banking: Microservice or Monolithic?

For many years, monolithic architectural approaches have been preferred in the development of core applications in the banking sector. However, in recent years, microservice architecture has emerged as an important alternative. Both architectural models have their own advantages and challenges and produce different results according to the needs of organizations. As Architecht, we offer solutions in both architectures. In the evaluation we made with our architect colleagues working in both technical approaches, we tried to summarize the 2 approaches under 6 headings in a comparative way.

-

Microservices Architecture in Banking: Between Theory and Reality

The microservices approach offers many advantages such as flexibility, scalability and independent development that it offers in the software development world in general, also in the banking and finance sectors. However, in practice, this architecture seems to pose some intractable problems. One of the most critical challenges for financial systems is data consistency. Inconsistencies that are tolerable in many other sectors can have serious consequences in banking.

-

The Use of Microservices in Banking: Advantages and Challenges

Designing all components of the core banking system as microservices offers many benefits in theory. Each service can be independently developed, updated and optimized with different technologies. However, the fragmentation in this structure can pose serious challenges for ensuring transaction integrity, error management and maintaining consistency across systems.

The management of a financial transaction by different microservices can cause irreparable damage if an error in one of the transaction steps is not communicated to the others. Especially in financial systems where transactions are irreversible, it is vital to ensure full coordination between microservices.

-

External System Dependency and Real Life Constraints

Financial institutions are in constant communication with external systems such as government agencies and third-party integrations. These external dependencies further complicate efforts to ensure consistency across microservices. In addition, the fact that many channels such as mobile banking, web channels, credit card POS devices transact through the same system increases the need for a centralized and consistent structure. At this point, monolithic architecture, which is often criticized, can actually bring many advantages.

-

Monolithic Architecture: Data Integrity and Consistency

While monolithic applications are often seen as large, difficult to manage and update, they offer significant advantages in areas such as banking where consistency and security are paramount. In monolithic structures, all components operate under the same data integrity and the overall consistency of the system is more easily ensured.

Although frequent and fast updates can be made in a microservice architecture, the potential impact of these updates needs to be carefully analyzed. Even a small mistake can cause huge financial losses. Furthermore, the independent testing capabilities offered by microservice architecture are not always applicable to large and complex modules in banking applications. For example, process-based testing of a loan module is very difficult to decompose and test in isolation.

-

Microservice Compatibility: Not Applicable for All Sectors

In areas such as e-commerce, microservice architecture can work very efficiently. For example, it is easy and secure to distribute a list of products between different services. However, in banking, this data is much more sensitive and requires integrity, such as customer, account and balance information. Therefore, even the best data sharing models may not provide the desired level of consistency in banking.

-

Conclusion: Hybrid Architecture Approach

Microservices architecture is ultimately a new system, but it may not be suitable for every sector and company. Monolithic structures can ensure consistency, manage high user numbers, and ensure smooth updates with experienced teams. This does not mean that microservices should be completely abandoned. Rather, it is necessary to correctly analyze which modules are suitable for microservicing and which should remain monolithic.

Considering that trust is at the forefront in financial systems, a hybrid architectural model can be created by combining the speed, scaling and innovation of microservices with the strengths of monolithic architecture such as data integrity and consistency.

E. International Perspective on Digital Banking

Since digital banking is very new in Türkiye, it will be useful to examine and closely follow global experiences and stages in this field in order to understand the present and future of the sector.

-

Pioneering Digital Banks – Early 2010s

-

The first modern examples of digital banks began to appear in the early 2010s. These banks were often fully online organizations with no physical branches.

-

One of the most notable examples during this period was Simple (US, founded in 2009, fully operational in 2012). It was later acquired by BBVA.

-

Fidor Bank (Germany, 2009) also attracted attention as one of the first digital banks in Europe.

-

New Generation of Digital Banks - After 2015

-

After 2015, a serious digital bank movement started in Europe and other developed markets.

-

Players such as Revolut (UK, 2015), Monzo (UK, 2015), N26 (Germany, 2015), Starling Bank (UK, 2014) were established during this period.

-

The proliferation of digital banks in Europe has been accelerated by regulations such as PSD2 (Payment Services Directive 2).

-

Compliance with Regulations - After 2018

-

As of 2018, many countries have started to develop specific regulations for the establishment and licensing of digital banks.

-

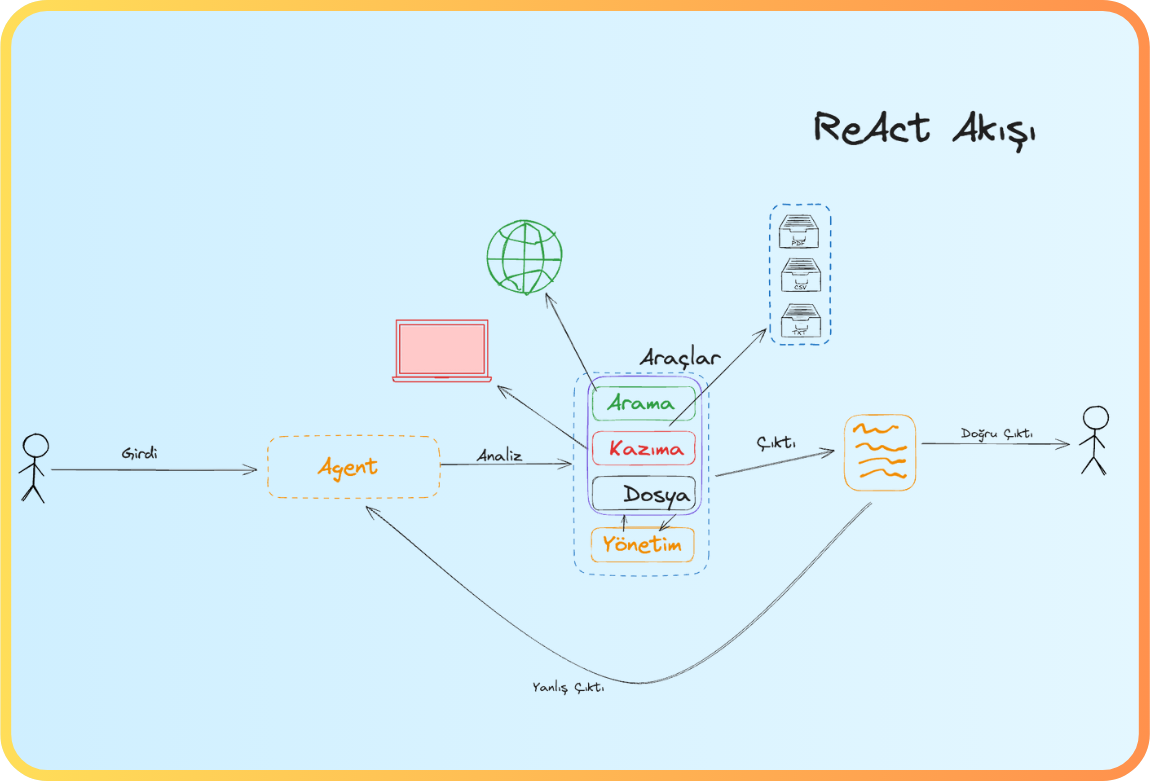

New Direction of Digital Banking with Artificial Intelligence Revolution - Post 2025

-

After 2025, digital banking will evolve from being just a service channel with artificial intelligence to a structure that proactively manages the financial lives of users. Thanks to hyper-personalization, autonomous financial assistants, real-time risk analysis and smart regulatory compliance (RegTech), digital banks are transforming into systems that anticipate needs, not just respond to them. This transformation makes banking less of a technological experience and more of a digital financial companion for individuals and businesses. As the artificial intelligence revolution shapes the future of digital banking, speed, trust, insight and personalization are becoming the new competitive axes.

F. The 8 Components Successful Digital Banks Need

Table 3. The 8 Components Successful Digital Banks Need

-

Business Model Flexibility: Digital banks should develop flexible business models that can quickly adapt to changing market conditions. Bank managements must also restructure the way they generate revenue so that the bank can maximize the value of its digital investments.

-

Operational Flexibility and Resilience: Successful digital banks become more resilient to external shocks by making their processes flexible. Cloud technologies, composable architectures and hyper-automation play an important role in increasing the agility of banks.

-

Cultural Alignment and Maturity: Lack of cultural maturity is cited as the primary reason why many digital transformation strategies fail, according to Gartner reports. Changing the culture or creating a culture in any organization requires patience and time.

-

Innovation Competence: Digital banks that focus on innovation instead of traditional structures that generate high costs and low returns will gain competitive advantage. Innovation is still a vague concept in many digital banks. The strict control standards of the banking sector limit banks' innovative growth, leading to low ROI results at high cost.

-

Ecosystem and Partnership Development: Embedded finance is becoming the new standard in banking. Digital banks should seek to create value by developing integrated service models with fintechs and other digital players.

One of the key determinants of success in digital banking in the future will be the ability of banks to access and manage different digital ecosystems and develop integrated service models with fintech companies and other business partners. As these competencies become the key to creating long-term and sustainable value from technology investments, the role of cloud service providers in enabling such collaborations will become increasingly critical.

-

Innovative Value Measurement: It is often not easy to accurately measure the value of investments in digital technologies. If the investment is directly targeted at a specific process improvement or product development, it may be possible to identify tangible results, such as cost savings or revenue generated. In most cases, however, the relationship between such investments and direct income is ambiguous and difficult to measure.

Measuring innovative value focuses not only on monetary indicators, but also on non-monetary indicators such as user experience, customer loyalty and increased transaction speed.

-

Data Focus and Harvesting: The key to growth is the effective use of customer-generated data. With open banking and the increasing diversity of data, banks should create new sources of revenue by analyzing data such as location, visual and behavioral data.

-

Autonomous Business Models and Programmable Economies: The rise of autonomous businesses assisted by AI, sensors and machines is transforming banking. Banking services are moving towards a structure where decisions are made by autonomous systems and embedded in consumer experiences. Digital banks need to be positioned in accordance with this new economic structure.

G. The Circular Future Journey of Digital Banking: 2024 Analysis

Table 4. Circular Chart for Digital Banking Transformation

-

Light blue dots: Technologies expected to mature in 2 - 5 years

-

Black dots: The ones that will become widespread in 5 - 10 years

-

Yellow triangle: Technologies that need more than 10 years (e.g. Quantum Computing)

Digital banking is constantly evolving with technological developments. Gartner's 2024 “Hype Cycle for Digital Banking Transformation” chart helps us understand the maturation process of technologies by categorizing the different stages of this transformation into five phases:

-

Innovation Trigger:

This is the stage when new technologies first emerge and begin to attract attention. Although not yet commercially mature, they create high expectations.

The concepts involved at this stage are:

-

Programmable Money

-

Real-Time Cross-Border Payments

-

Digital Twin of a Customer

-

Intelligent Industrial Assets

-

Homomorphic Encryption

-

Peak of Inflated Expectations:

This is the period when interest in technologies reaches its peak and exaggerated expectations are formed. However, widespread applications are not yet seen at this stage.

The featured titles at this peak are:

-

Sustainable Finance

-

Financial Data APIs

-

Synthetic Data

-

Generative AI in Banking

-

Trough of Disillusionment:

When initial expectations are not met, interest begins to wane. The shortcomings and limitations of technologies become apparent. However, some come out of this stage stronger.

Those involved in this stage are:

-

Composable Core Banking

-

Hyperautomation Tools

-

Decentralized Identity

-

Retail/Wholesale CBDC

-

Tokenization

-

Slope of Enlightenment:

Technologies have been tested and value propositions have become clear. More and more institutions start to adopt these solutions.

Those involved here are:

-

Embedded Finance

-

Transaction Data Monetization

-

Real-Time Payments

-

FS Industry Superapps

-

Core Banking on the Public Cloud

-

Plateau of Productivity:

Technologies mature, become widely deployed and generate tangible business value. Technologies that reach this point become standard in the sector.

The technology that has fully reached this plateau is limited, but Core Banking on the Public Cloud is the closest to this goal.

Hayat Finans and TOM Bank, Türkiye's first licensed digital banks, chose Architecht as their technology partner and started their operations after obtaining their legal permits using our BOA Digital Banking Platform.

If you want to examine the BOA Digital Banking Platform in detail, you can visit our product page.

References:

- Cracking the profitability code of successful digital banks — WhiteSight

- https://whitesight.net/digital-banks-profitability-2023/

- https://medium.com/t%C3%BCrkiye/dijital-bankalarda-kar-problemi-halen-s%C3%BCr%C3%BCyor-f360f7fbc26c

- Core Capabilities for Digital Banks: Gartner’s Digital Banking Taxonomy 5.0

- https://www.gartner.com/document-reader/document/5182263?ref=solrAll&refval=464296132

- Hype Cycle for Digital Banking Transformation, 2024

- https://www.gartner.com/interactive/hc/5589059?ref=solrAll&refval=464689935

Back

Back