Have you been paying attention to our daily conversations? There is not a moment where we don't talk about artificial intelligence anymore. Every new development definitely comes up in conversations during coffee break, after a meeting or over dinner. Now a new title is being added to these conversations: Agentic AI.

The long-awaited transformation in the financial world is upon us. A wide range of areas ranging from customer experience to risk management, from collection to investment recommendations are being reshaped with Agentic AI. The real issue now is how the transition from bots to digital workers will occur, where the line between human and digital workers will be drawn, and which business models will come to the fore in this new era. I invite you to read my article to look for the answers to all these questions that will shape the near future. Let's start exploring together...

The Mind Beyond Bots

Bots that appear in call centers or mobile applications of the banks have now turned into ordinary helpers. They remember frequently used transactions and quickly answer basic questions. However, in the recent period, a completely different approach stands out: Agentic AI.

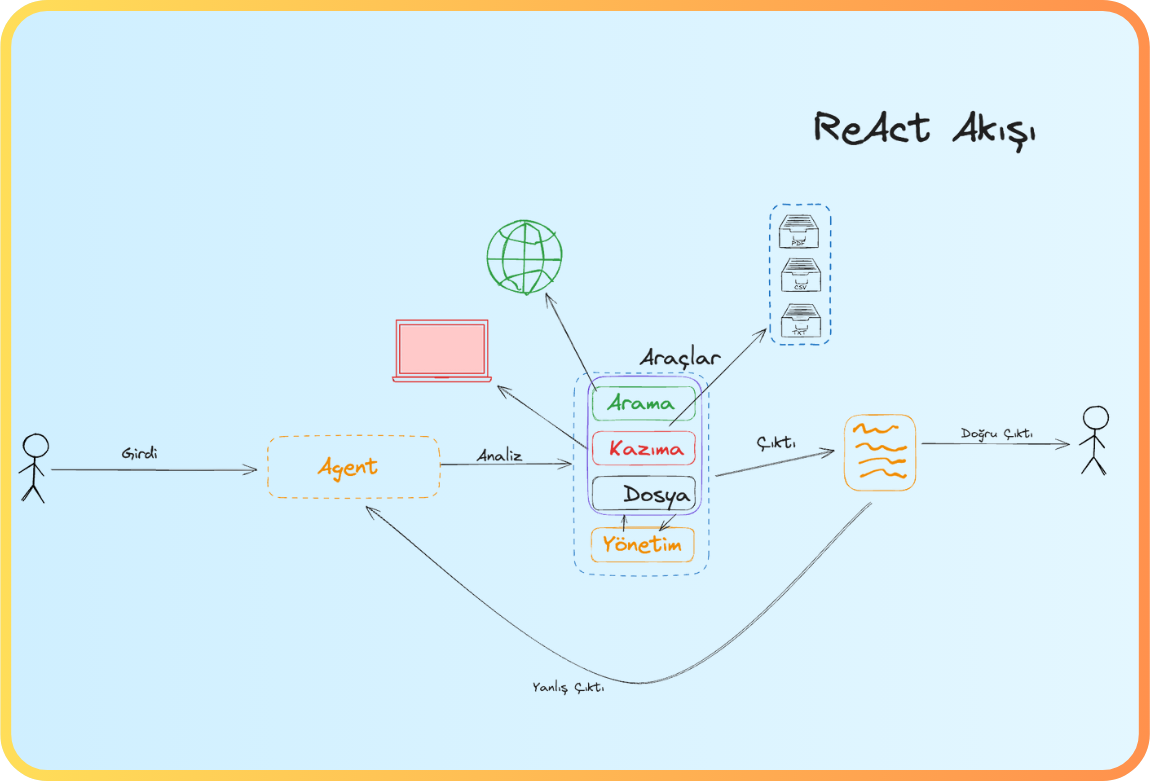

We are no longer talking about tools that simply execute commands, but about digital workers who can make decisions and coordinate processes on their own. This structure, which comes into play in areas such as loan applications, risk analysis, customer support flow or investment recommendations, becomes an active player in the financial ecosystem.

Transition from Bots to Digital Workers

Classic chatbots have been in our lives for a long time. They fasten the process and take on repetitive tasks. However, when the issue becomes complicated, the process is often transferred to humans. Agentic AI, on the other hand, eliminates this issue.

For example, when working with a customer applying for a loan, it not only fills out forms but also collects documents, runs risk models, and provides guidance when additional documentation is required. At decision thresholds, it determines the time to hand over the task to the human expert. Therefore, flow becomes not only automated, but also intelligent from end to end.

This transformation shortens transaction times for banks and fintechs, reduces error rates, and makes the customer experience much more consistent.

Human and Digital Workers in the Same Team

The success of Agentic AI projects depends on the clear definition of the line between human and digital workers. The critical question here is: When should the task be handed over?

While it is considered natural for the digital worker to proceed alone in low-risk flows, human supervision becomes mandatory in scenarios such as high-amount credit limit increases. Institutions that define the balance of risk, speed, and experience with numerical rules increase trust and strengthen regulatory compliance.

The following thresholds achieve this balance while also shortening discussions between teams:

Complexity: Transferring to a human when the flow reaches more than three logical branches.

Time: Redirection when the standby time exceeds 120 seconds.

Financial Risk: Human consent in situations involving loss of money, legal liability or reputational impact.

Fragile Moments: Transferring due to empathy as a priority in objections, complaints, loss or damage notifications.

Identity and Security: Transferring to a human in case of KYC/AML suspicion, unusual behavior score or masking inability.

This framework not only reduces the risk of errors but also provides transparency and predictability on the customer side.

Gateway to New Business Models

Agentic AI opens a whole new gateway to new revenue models and cost advantages. The significant applications, especially in the fintech field, can be summarized as follows:

Agentic Onboarding and KYC: It collects documents, performs risk assessment, and transfers to a human in a suspicious situation.

Intelligent Field in Credit Processes: It conducts pre-approval, asset verification and security deposit monitoring from a single channel.

Agentic Collection: It chooses the most appropriate contact according to customer behavior, and makes soft reminders when necessary.

Payment Orchestration: It determines the real-time route between card, account, wallet, and instant payment options.

Portfolio Companion: It provides personalized investment recommendations based on goals.

Fraud Defense: It performs fast verification with transaction tracking and device fingerprint.

All these areas of use actually mark only the first steps of a much larger transformation. However, these examples are just the beginning of the intelligent era that Agent AI will usher in the financial world.

Step by Step to the Intelligent Era

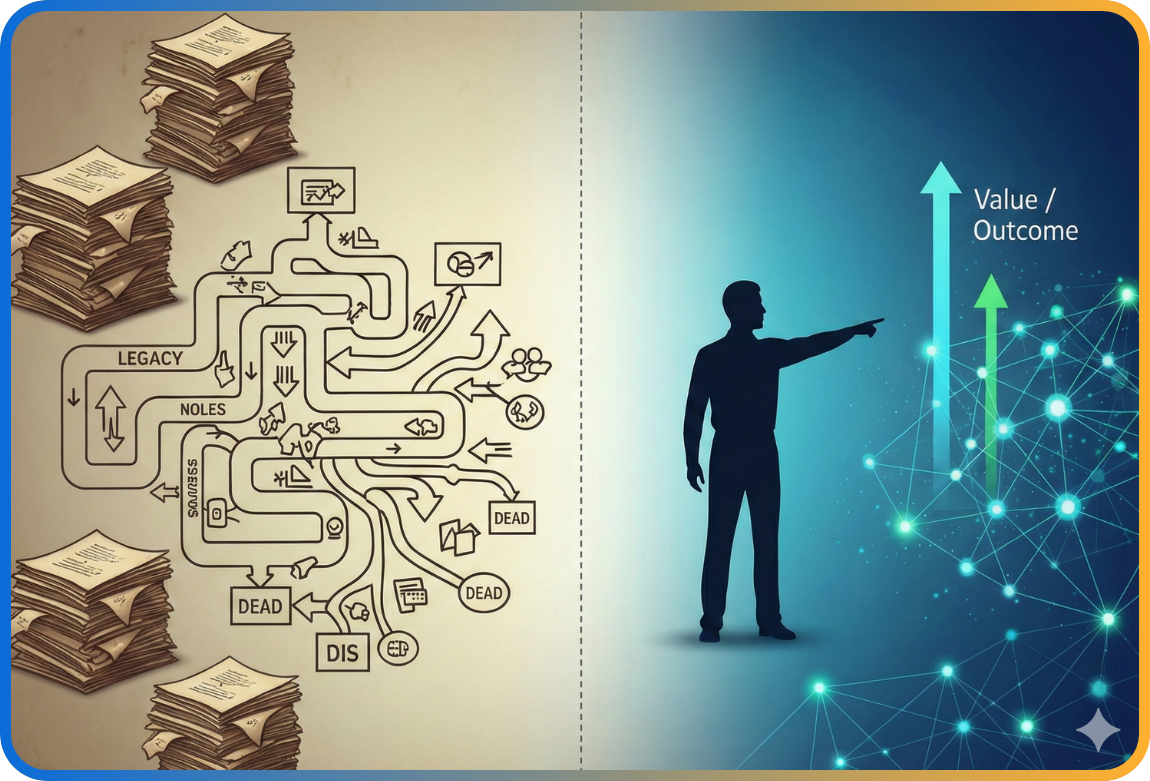

Financial technologies have created their own transformation at every stage. The mainframe era has increased productivity, and digitalization has reduced branch dependence. Now the interactions are gaining intelligence one by one with Agentic AI.

This leap is not just a technological step, but a threshold that transforms corporate culture, team competencies and process design simultaneously. Organizational structures, recruitment policies, and customer communication must be restructured according to the needs of this new era.

A Scenario for the Near Future

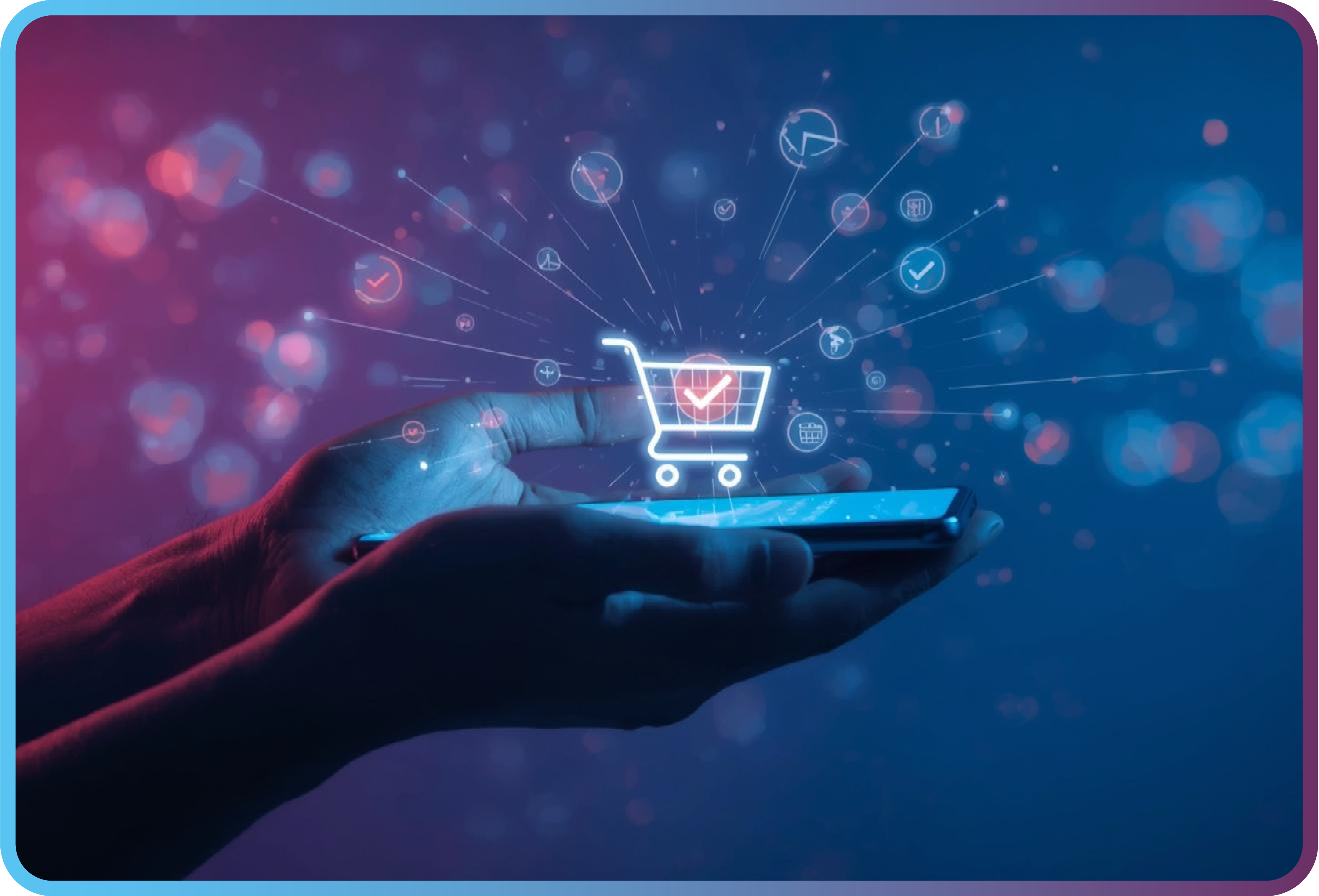

The first notification that comes to your phone in the morning reminds you that your balance is insufficient for your home loan installment and offers a solution. If a login attempt from a foreign device is detected around noon, the system immediately warns you and temporarily limits your card. In the evening, currency exchange purchase and insurance package suitable for your travel plan are presented to you. A human advisor is always active at critical thresholds throughout the day.

On The Threshold of the Future

Agentic AI is not just a tool that speeds up operations; it is a milestone that redefines the future of finance. A new digital workforce is emerging that works side by side with humans at every step, from customer experience to risk management, from portfolio consulting to security processes.

The flows we describe as a scenario today will become a regular part of daily life in a very short time. The real issue is what role the institutions, employees and customers at the center of this transformation will play.

Agentic AI offers us the opportunity to build not only smarter systems, but a more accountable, more transparent and more secure financial ecosystem. The future has already begun; now the question is: Which role will you be in on this journey?

A Mini Guide for Those Who Want to Scratch Their Curiosity

Writing always requires more reading. For those who, like me, are interested in this topic, I have prepared a list of resources that will always keep their curiosity alive:

Sources

- Deloitte Insights – Agentic AI in Banking (https://www.deloitte.com/us/en/insights/industry/financial-services/agentic-ai-banking.html )

- McKinsey – Seizing the Agentic AI Advantage (https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage)

- Bain – State of the Art of Agentic AI Transformation (https://www.bain.com/insights/state-of-the-art-of-agentic-ai-transformation-technology-report-2025/)

- McKinsey – One year in: Lessons learned in scaling up generative AI for financial services (https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/one-year-in-lessons-learned-in-scaling-up-generative-ai-for-financial-services)

- Stanford HAI – AI Index 2025 (https://hai.stanford.edu/ai-index/2025-ai-index-report)

- NIST – AI Risk Management Framework (https://nvlpubs.nist.gov/nistpubs/ai/nist.ai.100-1.pdf)

- BIS – Intelligent Financial System: How AI is Transforming Finance (https://www.bis.org/publ/work1194.htm)

Back

Back