In an era defined by personalization, speed, and data-driven decision-making, banks are no longer expected to merely provide financial services. They are expected to understand users, guide them, learn from their behavior, and act proactively.

As a result, banks are inevitably transforming into intelligent digital applications.

Why Open Banking and Artificial Intelligence Can No Longer Be Considered Separately

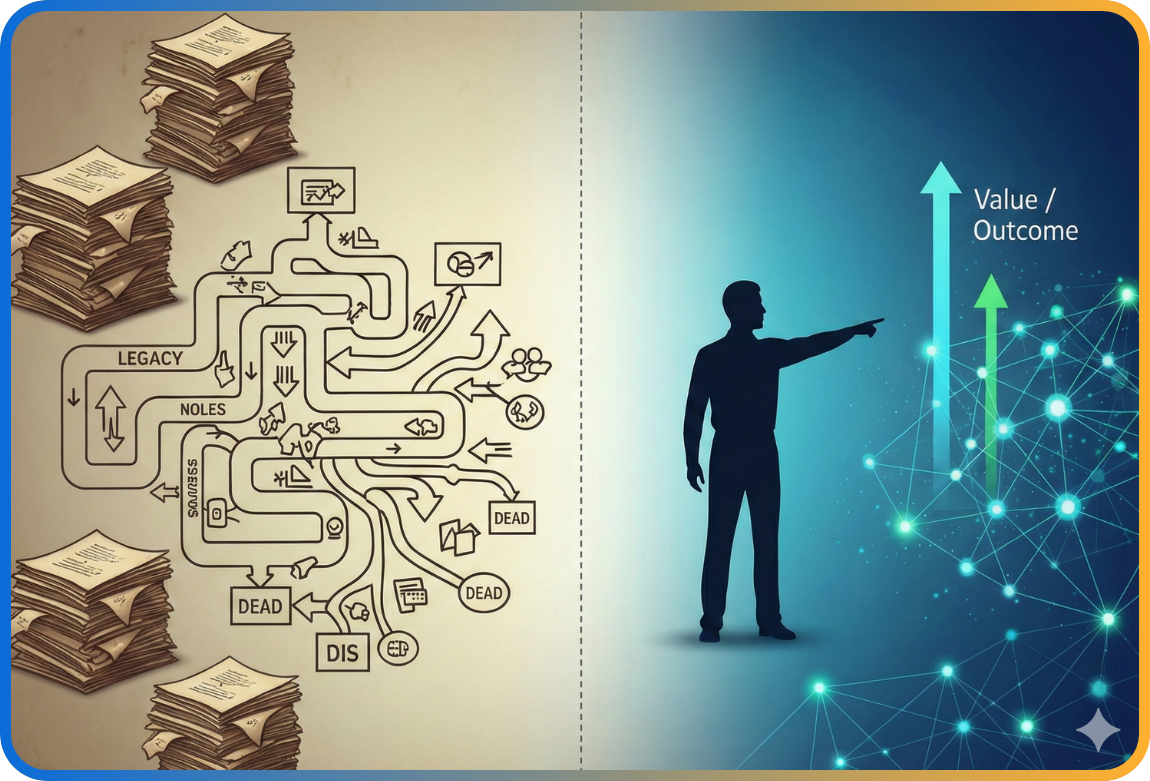

As digital transformation accelerates, open banking and artificial intelligence (AI) are redefining the entire operating model of the financial sector.

Banks are no longer transaction-centric institutions; they are becoming data-driven digital platforms capable of analyzing user behavior, generating insights, and predicting future actions.

This transformation is not merely a technological investment—it is a prerequisite for the survival of next-generation banking. User expectations have fundamentally changed, and traditional banking models are no longer sufficient.

Today’s users expect their bank to act not only as a payment provider, but simultaneously as:

• a personal assistant,

• a financial advisor, and

• a risk manager.

The only structure capable of meeting these expectations is the integration of open banking and artificial intelligence.

Open Banking: A Secure Gateway to Financial Data

Open banking enables users to securely share their financial data with third-party applications through API-based architectures. This model unlocks innovation, speed, and personalized user experiences.

Through open banking:

• Financial data becomes centralized around the user

• Banks can offer third-party services

• Mobile and web applications become smarter

• User experience becomes deeply personalized

However, the true value of this data only emerges when it is processed with artificial intelligence.

This is why open banking and AI are not optional complements—they are inseparable components.

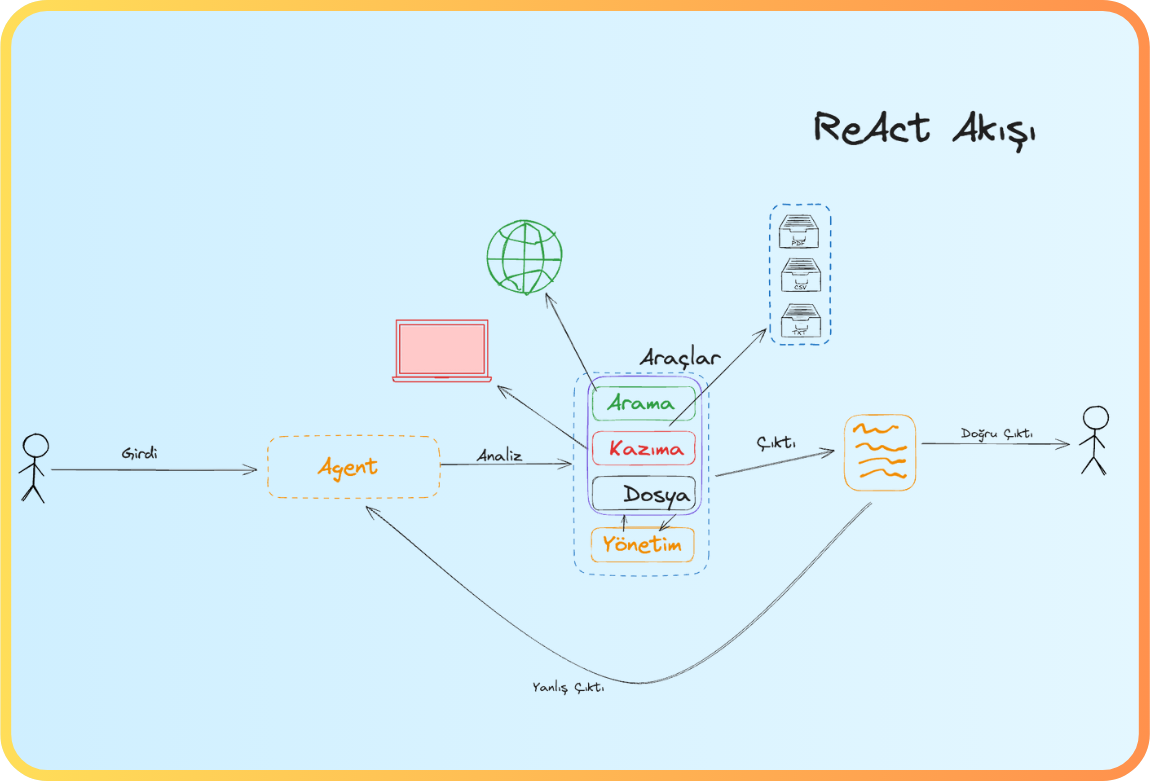

How Artificial Intelligence Is Transforming the Financial Experience

AI-powered banking applications are now capable of:

• Learning spending behaviors

• Forecasting budgets and cash flow

• Generating personalized saving recommendations

• Analyzing credit and risk profiles

• Detecting suspicious and fraudulent activities

• Delivering personalized offers based on behavioral patterns

The foundational structure enabling all of this remains the same:

Open Banking + Artificial Intelligence

Banks are no longer systems that understand only what a user did, but also why they did it—and what they are likely to do next.

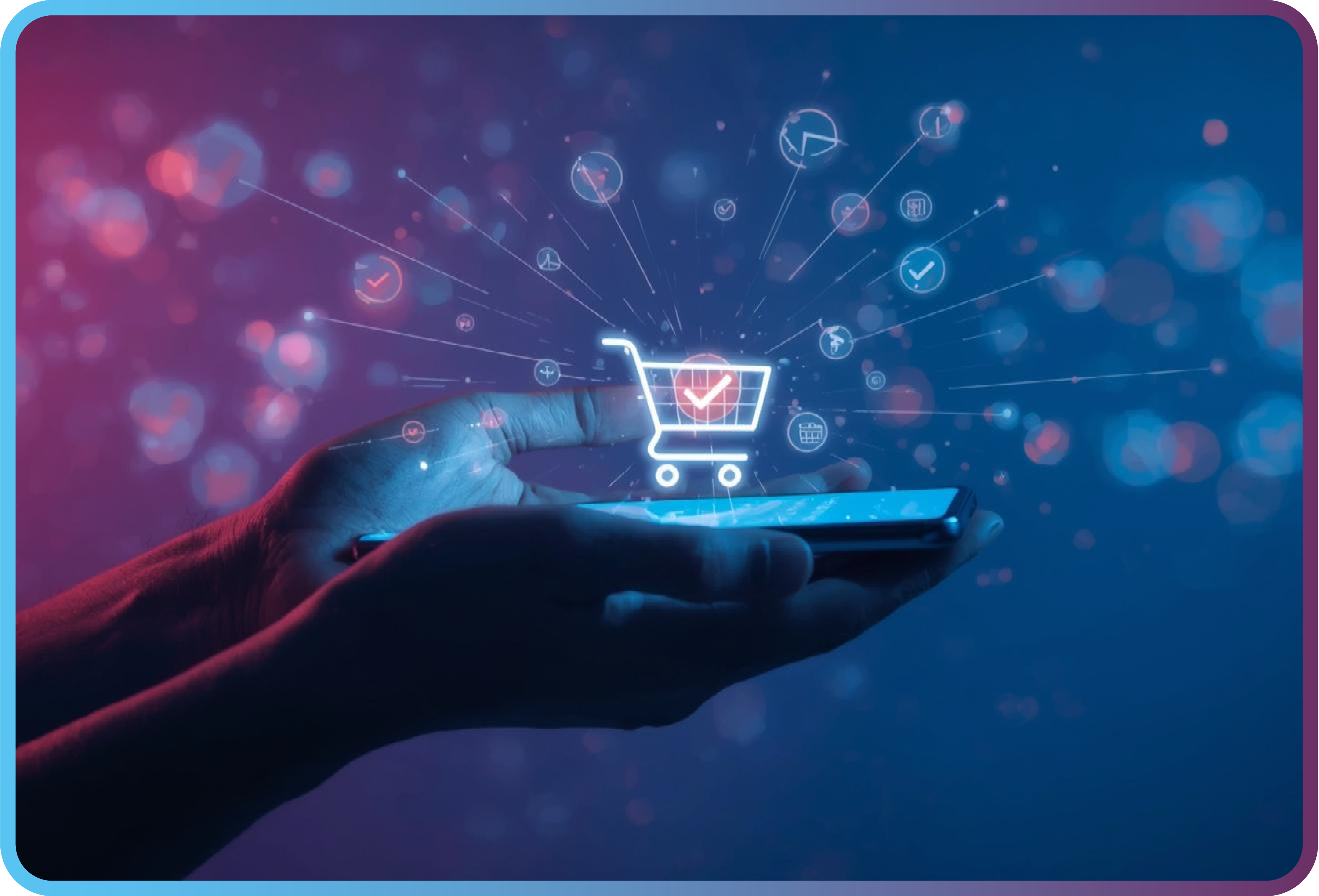

Why Banks Must Become Applications

FinTech companies have elevated banking to an application-level experience. For users today, what matters is no longer:

• Branches → but experience

• Call centers → but speed

• Products → but solutions

To survive, banks must evolve into the following structure:

Platform + Application + Artificial Intelligence + Open Banking

Traditional banks must transform from physical buildings into living digital products.

And this transformation is only possible through open banking and AI.

A Real-World Usage Scenario

A user aggregates all financial data from different banks into a single application.

Artificial intelligence analyzes the data and provides insights such as:

• “You made 18% unnecessary spending this month.”

• “Your potential savings amount is 3,200 TRY.”

• “The most suitable investment option for you is Fund X.”

At this point, the user is no longer just a bank customer—they are using a personal financial intelligence system.

This experience is called:

Open Banking + Artificial Intelligence

Open Banking and Artificial Intelligence in Türkiye

In Türkiye, the open banking infrastructure led by BKM and regulations defined by the Central Bank of the Republic of Türkiye (CBRT) have significantly accelerated this transformation.

Key initiatives include:

• Account Information Service Providers (AISP / ÖHVPS)

• Payment Request systems

• Open API ecosystems

• AI-powered fraud detection systems

For banks, staying out of this transformation is no longer an option—it is an existential risk.

Leading Digital Banks Using Open Banking and AI Globally

The most successful implementations of open banking and AI are seen in branchless digital banks (neobanks). These institutions are designed entirely as software products, with architectures built around APIs, data, and AI.

Revolut – API-First and AI-Driven Global Neobank

Profile

• Founded: 2015 – United Kingdom

• Customers: 40+ million (2024)

• Countries served: 40+

Key Technologies

• API-first architecture

• ML-based spending categorization

• Real-time fraud detection

• Personalized recommendation engines

• Cloud-native microservices

AI Capabilities

• Automated budgeting insights

• Anomaly detection

• Dynamic risk and limit scoring

• Behavioral product recommendations

Revolut represents the clearest example of banking evolving into a financial super-app.

N26 – Real-Time Data and AI-Focused Banking

Profile

• Founded: 2013 – Germany

• Customers: 8+ million

Technologies

• Event-driven architecture

• Real-time data streaming

• ML-based credit risk analysis

• Behavioral analytics

N26 exemplifies instant insight and mobile-first banking in Europe.

Monzo – A Bank That Learns User Behavior

Profile

• Founded: 2015 – United Kingdom

• Customers: 9+ million

AI Applications

• Predictive cash-flow forecasting

• Behavioral alerts

• Automated saving strategies

Monzo positions banking as a personal financial coach.

Nubank – AI at Massive Scale

Profile

• Founded: 2013 – Brazil

• Customers: 90+ million

Technologies

• Big data-driven ML credit scoring

• AI-powered customer support

• Fully cloud-native infrastructure

Nubank demonstrates how AI can drive financial inclusion at scale.

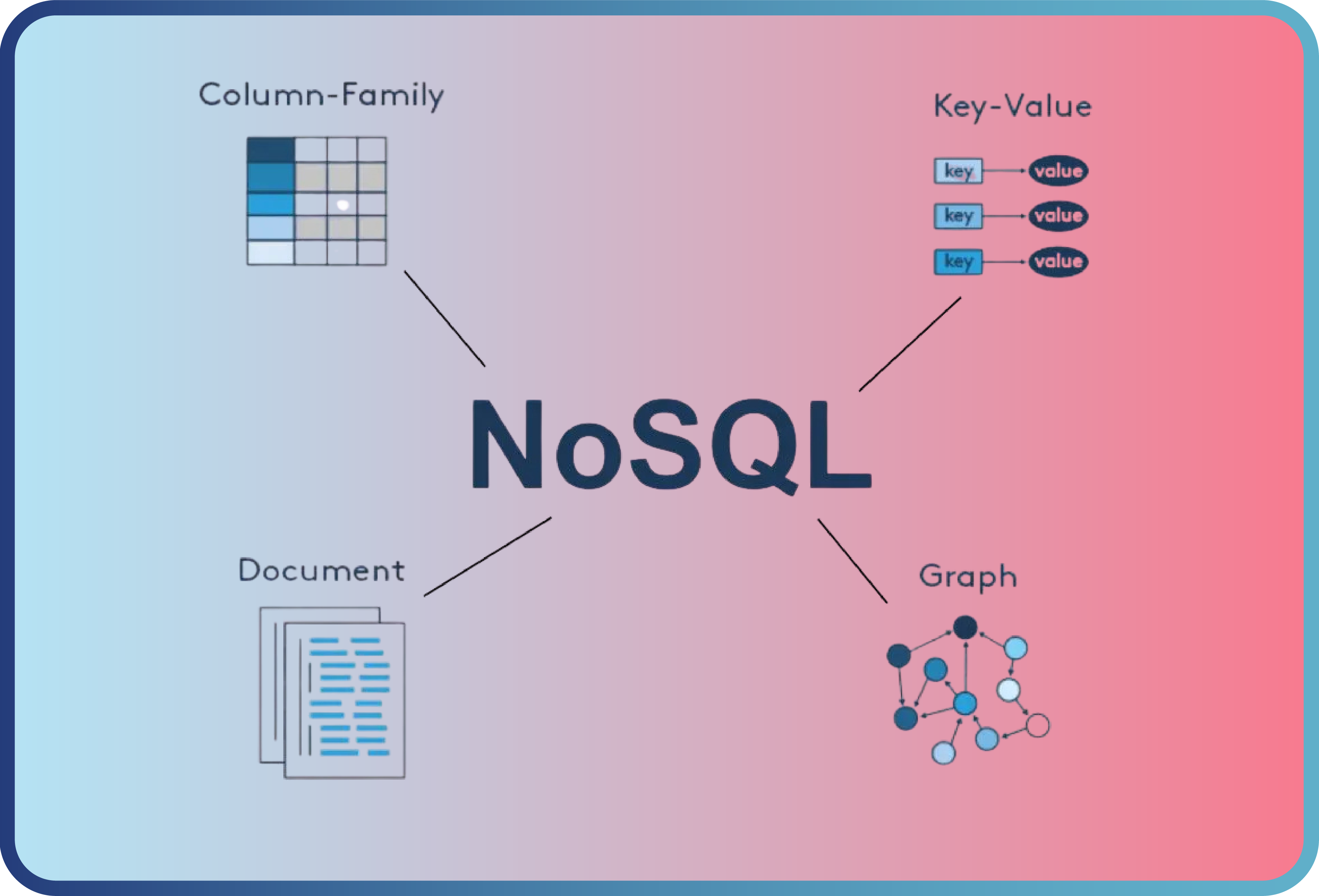

Core Banking Technologies Used

|

Technology |

Use Case |

|

Machine Learning |

Fraud detection, credit scoring |

|

NLP / LLMs Chatbots |

Voice assistants |

|

OCR & Computer Vision |

KYC and document processing |

|

APIs & Microservices |

Open banking and modular services |

|

Real-Time Analytics |

Personalized offers |

|

DevOps & Cloud |

Scalability and resilience |

Shared Technical Architecture

Across these digital banks, common architectural principles emerge:

Technical Stack

• API-first design

• Microservices architecture

• Cloud infrastructure (AWS, GCP, Azure)

• Real-time data processing

• MLOps pipelines

• Event-driven systems

AI Layers

• Fraud and anomaly detection

• Credit and risk scoring

• Personal finance recommendation engines

• NLP-based assistants

• Behavioral prediction models

This enables banks to answer not only:

“What happened?”

but also:

“Why did it happen, and what will happen next?”

Conclusion: The Future Belongs to Intelligent Banks

The winners of the next era will be banks that:

• Build open banking infrastructure

• Invest heavily in artificial intelligence

• Put the user at the center

• Think and act like application companies

In short:

Banks must now think like software companies.

Because the future of finance follows this formula:

Open Banking + Artificial Intelligence + Application Experience = Next-Generation Finance

References

• European Banking Authority – Open Banking Framework

• BKM – Open Banking Standards & API Documentation

• World Economic Forum – AI in Financial Services

• McKinsey – Global Banking AI Transformation

• Accenture – The Future of Open Banking

• Revolut Annual Report & Engineering Blog

• N26 Engineering Blog

• Monzo Tech Blog

• Nubank Engineering & Investor Reports

Back

Back