“Next-Generation Banking” continues to be one of the most talked-about topics in the financial sector, with its content evolving slightly each year. Initially limited to a few simple features designed to make life easier through banks’ digital channels, this concept has now become deeply integrated into our daily lives.

In recent years, banking and other financial services have emerged as the leading sectors where digital transformation is most visible. Innovations such as QR code transactions, voice response systems, and mobile payment solutions are among the most prominent examples. While digital banking first entered our lives through the internet and mobile branches, today it enables not only branchless transactions but also the ability to meet financial needs through various channels. This is precisely where Banking-as-a-Service (BaaS) comes into play. So, what is BaaS exactly, and why is it so important?

Banking-as-a-Service is an innovative model that enables financial services to be delivered to end users via different platforms and third parties. Also referred to as the “service banking model” in the literature, it extends the financial convenience offered by banks into various areas of daily life. This model benefits not only individual end users but also banks and their partner companies. Banks can reach a broader customer base and expand their sales and marketing activities, while partner companies can enhance customer loyalty by offering financial advantages.

With the advancement of API-based technologies, financial solutions have become significantly more flexible and accessible compared to traditional banking services. In countries like the UK and Germany, regulatory frameworks have enabled banks and fintech companies to collaborate and rapidly implement open banking and BaaS applications. The European Union’s PSD2 (Payment Services Directive 2) regulation has played a critical role in this transformation, fostering an innovative and competitive financial ecosystem. In Turkey, the Banking Regulation and Supervision Agency (BDDK) established a legal framework for BaaS with the regulation published in 2022. Today, banks can offer their infrastructure as a service to technology companies and fintechs, enabling solutions such as:

-

Digital wallets

-

Microcredit solutions

-

Instant payment systems

-

Personalized financial products

One of the most impactful areas for individual users is microcredit offerings on e-commerce platforms. With various bank loan options presented at checkout, customers can now finance, split their payments into installments, or defer them instantly.

How Does Banking-as-a-Service Work?

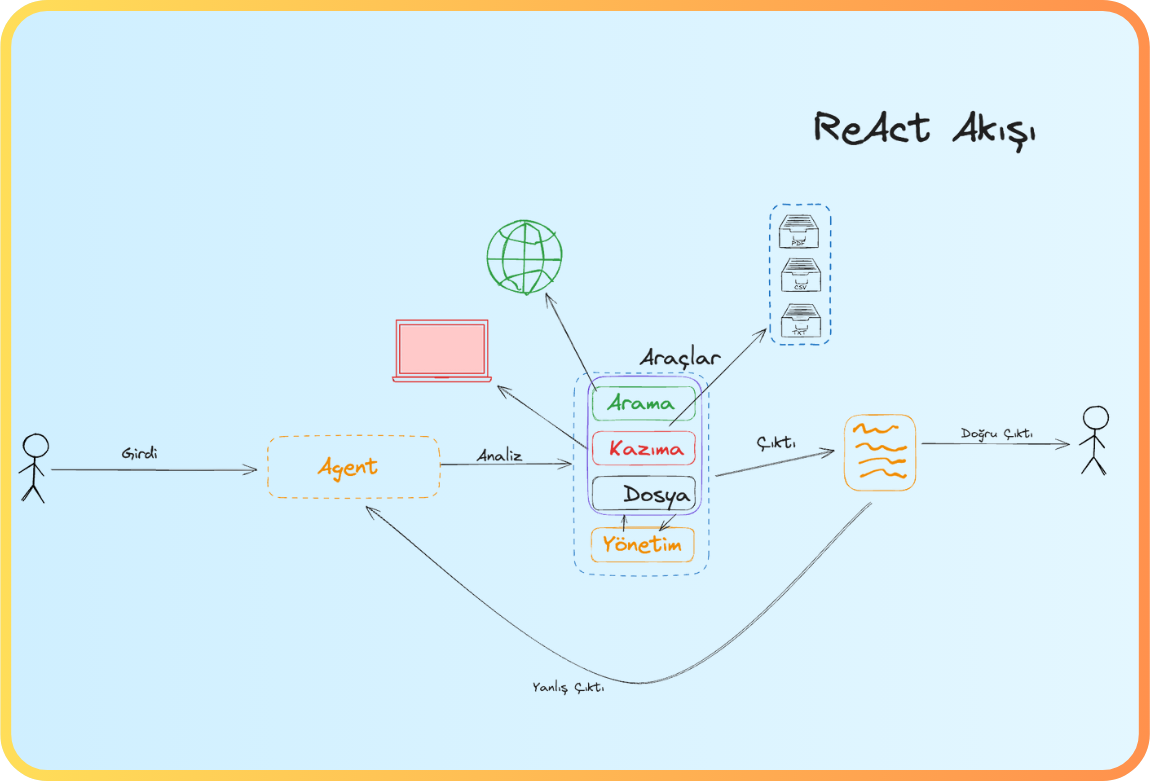

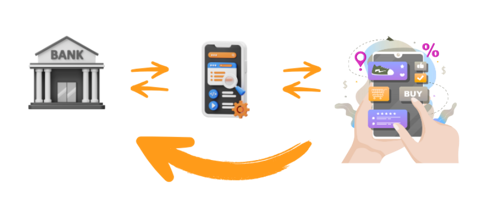

The foundation of BaaS was laid with the emergence of Open Banking. This modern banking model allows customers to securely share their financial data with authorized third parties, providing easier access to a wide range of digital banking services. This data sharing is facilitated through APIs, and many users first encountered it through the “One bank, all accounts” feature.

BaaS builds upon Open Banking. While Open Banking focuses on data sharing, BaaS takes it a step further by opening up banking infrastructure to third parties. For example, a fintech company can use a partner bank’s APIs to develop its own mobile payment solution. This allows users to make secure and fast payments using the bank’s infrastructure. At the same time, banks can reach new customers and create additional revenue streams through such partnerships.

Here’s a more technical breakdown of how it works:

-

The bank exposes functions like credit, payments, and account management via RESTful APIs or SOAP-based services.

-

These APIs are secured using authentication protocols such as OAuth 2.0.

-

Third-party platforms (e.g., e-commerce sites, fintech apps) trigger banking operations through their own user interfaces.

-

Before completing a transaction, the user is redirected to the bank’s verification screen (redirect flow). Security is ensured through multi-factor authentication (MFA) and token-based access.

-

The financial transaction initiated by the user (e.g., selecting a loan at checkout) sends a request to the bank’s API.

-

The bank performs identity verification and risk checks, and upon approval, the transaction is completed.

Is Banking-as-a-Service Secure?

BaaS solutions can only be offered by licensed banks or regulated financial institutions. These entities must comply with both national and international regulations. In Turkey, the BDDK, along with European authorities such as the EBA, ensures the protection of customer data and transaction security.

Personal and financial data are stored and transmitted within the secure infrastructure of banks. Technologies such as data encryption (SSL, TLS), multi-factor authentication (MFA/2FA), and identity management are used to minimize risk.

On the other hand, fintechs and other companies using bank infrastructure must also ensure the security of their own systems. Strong partnership agreements, regular audits, and comprehensive security testing help keep these systems under constant control. This not only protects user trust but also ensures the sustainability of the financial ecosystem.

The Future of Banking-as-a-Service

With the evolution of technology and changing customer expectations, BaaS is undergoing a significant transformation. Globally and in Turkey, BaaS is expected to gain even more importance in the coming years. Increased collaboration between banks, fintechs, and technology companies will significantly enhance the diversity and accessibility of financial products and services. As regulations mature and technological infrastructure advances, traditional banking services will transform into more personalized and integrated solutions. Additionally, the use of artificial intelligence in this space will enable smarter, faster, and more secure financial transactions.

In Turkey, the future of BaaS will be shaped by supportive regulations from the BDDK and a young, tech-savvy fintech ecosystem. Turkish banks are continuing to launch new business models that extend banking services to broader audiences through the BaaS model. This enables SMEs, startups, and other ventures to rapidly develop their own innovative financial products on top of a secure banking infrastructure.

One of the key players in this transformation is Architecht, which has long supported banks’ digital transformation through its pioneering open banking product, Airapi. On the BaaS front, Architecht’s low-code digital platform AppWys simplifies the implementation of the BaaS model for banks. AppWys enables banks to open their financial infrastructure to partners from various sectors, allowing end-to-end financial services to be delivered through e-commerce, mobile apps, and other digital channels. Services such as microcredit solutions, digital wallet integrations, and instant payment systems can be deployed quickly and securely with AppWys.

Back

Back